Key Takeaways

- The company faces major revenue threats from electrification, customer concentration, and limited export strategy amid rising input costs and industry consolidation.

- Sustained innovation demands and regulatory compliance risks could compress margins and restrict long-term earnings amidst technological disruption and environmental shifts.

- Diversified product segments, technological investments, and strong financial flexibility position Lumax to capitalize on electrification and premiumization trends while supporting sustained, margin-accretive growth.

Catalysts

About Lumax Auto Technologies- Manufactures and sells automotive components in India.

- The accelerated shift towards electric vehicles globally may reduce demand for traditional auto components, particularly for legacy lighting and mechatronic products, threatening Lumax Auto Technologies' core revenue streams as electrification scales up over the next decade.

- Heavy reliance on a concentrated set of domestic OEM customers, especially Mahindra & Mahindra and Tata Motors, exposes Lumax to significant top-line risk should any key account reduce orders or shift to alternative suppliers, with the risk heightened as OEMs gain greater bargaining power in a consolidating industry.

- Limited mid-term plans for export-led revenues and a focus on the domestic market, despite global localization and onshoring of supply chains, means Lumax risks missing out on export growth opportunities while simultaneously facing higher input costs due to geopolitical trade shifts, negatively impacting both revenue growth and operating margins.

- The rapidly increasing pace of innovation in vehicle electronics, lighting and advanced driver-assistance systems presents a major transition risk; Lumax must sustain high levels of R&D to prevent product obsolescence, which could erode EBITDA margins if investment needs escalate or innovation falls short.

- Stricter global environmental regulations and the threat of carbon taxation pose upward pressure on compliance costs across the value chain, which, when combined with a tight cost structure and high fixed overheads, threaten to compress net margins and restrict future earnings growth.

Lumax Auto Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Lumax Auto Technologies compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Lumax Auto Technologies's revenue will grow by 15.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 4.8% today to 7.1% in 3 years time.

- The bearish analysts expect earnings to reach ₹4.3 billion (and earnings per share of ₹63.61) by about September 2028, up from ₹1.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 18.1x on those 2028 earnings, down from 38.1x today. This future PE is lower than the current PE for the IN Auto Components industry at 30.8x.

- Analysts expect the number of shares outstanding to decline by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.67%, as per the Simply Wall St company report.

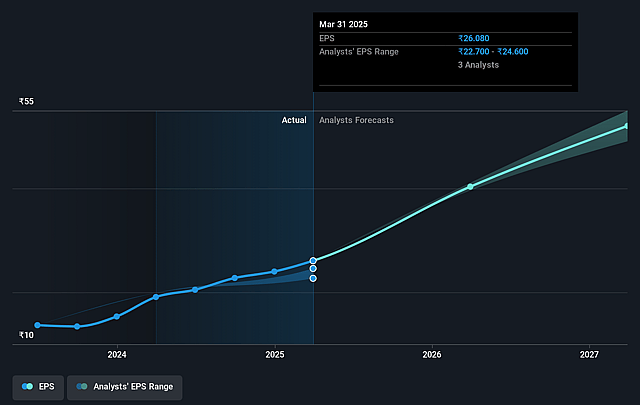

Lumax Auto Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's robust order book of ₹1,500 crores, with 40% allocated to future and clean mobility solutions, suggests that Lumax is well-positioned to benefit from the long-term electrification and technology upgradation trends, providing strong visibility for revenue growth over the next three years.

- Strategic expansion through new subsidiaries, investments in R&D and software integration (like the SHIFT Smart Hub in Bengaluru), as well as localization efforts in China, enhance its capabilities to capture technological shifts and premiumization trends, which should support both revenue growth and margin improvement.

- Diversification across segments-including strong growth in advanced plastics, mechatronics (which doubled year-on-year), green fuel, and a rapidly growing aftermarket business-reduces reliance on any single customer or segment, cushioning revenue and profit growth even in a flat or volatile macro environment.

- The group is experiencing margin uplift from higher-value content per vehicle, increased wallet share with major OEMs, and business mixes shifting toward higher-margin product lines such as green fuel and aftermarket verticals, all of which are expected to drive improvement in consolidated EBITDA margins towards the 16% range by FY '28.

- Financial flexibility is underpinned by strong free cash reserves, conservative gearing, and internal accruals expected to fund future capex for growth, enabling asset-light expansion and supporting sustained earnings growth without significant dilution or strain on profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Lumax Auto Technologies is ₹767.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Lumax Auto Technologies's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1300.0, and the most bearish reporting a price target of just ₹767.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹60.8 billion, earnings will come to ₹4.3 billion, and it would be trading on a PE ratio of 18.1x, assuming you use a discount rate of 14.7%.

- Given the current share price of ₹1048.0, the bearish analyst price target of ₹767.0 is 36.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.