Key Takeaways

- Uno Minda's aggressive expansion and advanced technology focus are driving significant revenue growth and margin improvement well beyond industry expectations.

- Global diversification and strong investment in automotive electronics and R&D uniquely position Uno Minda to benefit from rising demand for connected and autonomous vehicles.

- Lagging transition to EVs, dependency on few OEMs, limited global reach, slow tech adoption, and margin pressures risk Uno Minda's growth and long-term competitiveness.

Catalysts

About Uno Minda- Manufactures and supplies auto components and systems in India and internationally.

- While analyst consensus acknowledges capacity expansion as a growth catalyst, they may be underestimating the impact of Uno Minda's aggressive multi-year CapEx pipeline, which is backed by concrete order visibility and enables outperformance at over twice the broader industry growth rate; this could drive a structural uplift in consolidated revenue and long-term earnings well beyond market expectations.

- Analysts broadly expect margin improvements from operational efficiency, but this outlook likely understates the benefits of Uno Minda's rapid mix shift toward premium, technology-driven products (lighting, sensors, ADAS, smart switches, EV-specific components), which are already demonstrating higher kit values per vehicle and are poised to deliver sustained increases in net margin as adoption accelerates.

- The company's expanding global footprint-including imminent entry into new geographies and global EV/autonomous vehicle supply chains-positions Uno Minda to capture high-value export opportunities, significantly diversify revenue streams, and mitigate domestic demand cyclicality, leading to greater earnings stability and growth.

- Uno Minda's deep investments and leadership in automotive electronics, IoT, and digital systems uniquely align with the industry-wide pivot toward smart, connected, and autonomous vehicles; as OEMs globalize their platforms, Uno Minda stands to achieve higher rates of content per vehicle and premium pricing, accelerating revenue and margin expansion over the medium and long term.

- Momentum in the company's proprietary R&D capabilities, combined with accelerated vertical integration and technological partnerships, sets the stage for a sustained increase in ROCE and long-term free cash flow generation, positioning Uno Minda for market re-rating as a technology leader in the evolving automotive landscape.

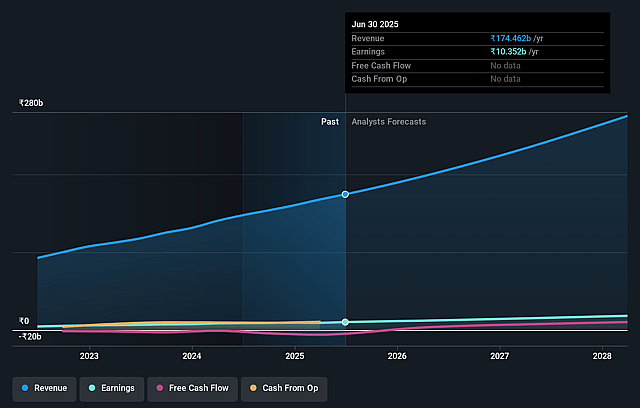

Uno Minda Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Uno Minda compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Uno Minda's revenue will grow by 26.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 5.6% today to 6.8% in 3 years time.

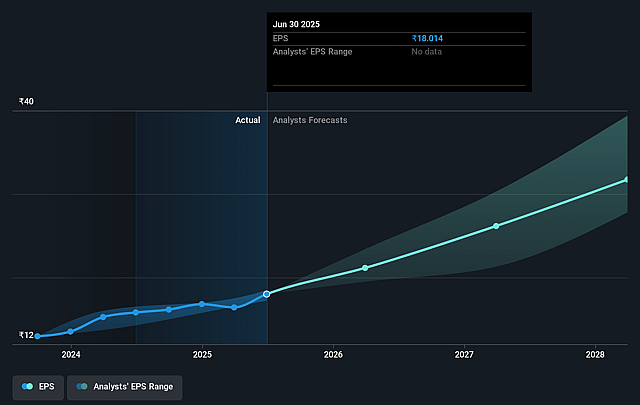

- The bullish analysts expect earnings to reach ₹23.2 billion (and earnings per share of ₹39.93) by about July 2028, up from ₹9.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 49.5x on those 2028 earnings, down from 65.3x today. This future PE is greater than the current PE for the IN Auto Components industry at 31.8x.

- Analysts expect the number of shares outstanding to grow by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.9%, as per the Simply Wall St company report.

Uno Minda Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerating global adoption of electric vehicles may erode demand for Uno Minda's legacy ICE-focused product lines, and while their EV efforts are ramping up, achieving scale and profitability could lag market needs, potentially leading to a loss of market relevance and putting long-term revenues at risk.

- Over-reliance on large OEM customers makes Uno Minda's revenues vulnerable to automakers' sourcing shifts and market share losses, especially as modular platforms and OEM in-sourcing become more prevalent, which may cause significant revenue volatility.

- Rising global protectionism and localization policies, combined with limited current exposure in key export markets like the UK and US, could restrict Uno Minda's international growth ambitions and constrain future revenue diversification.

- Slower pace in scaling next-generation, high-value auto technologies such as advanced sensors, ADAS, and EV powertrain components versus competitors may result in missing out on share in fast-growing segments, hampering medium-term growth and affecting long-term earnings potential.

- Margin compression remains a threat due to aggressive capital expenditures, increased employee and raw material costs, and the potential inability to quickly pass on such cost increases to customers, thus negatively impacting net margins and free cash flow generation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Uno Minda is ₹1350.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Uno Minda's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1350.0, and the most bearish reporting a price target of just ₹770.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹339.1 billion, earnings will come to ₹23.2 billion, and it would be trading on a PE ratio of 49.5x, assuming you use a discount rate of 13.9%.

- Given the current share price of ₹1071.35, the bullish analyst price target of ₹1350.0 is 20.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.