Last Update 09 Dec 25

532539: Future Returns Will Reflect EV Investment And Full Control Of Joint Venture

Analysts have nudged their price target for Uno Minda slightly higher to ₹1,303.74, reflecting marginally lower perceived risk and steady expectations for robust revenue growth, stable profit margins, and a rich future P E multiple.

What's in the News

- The board will meet on December 1, 2025 to consider acquiring the remaining 49.90 percent equity stake of joint venture partner Buehler Motor GmbH in Uno Minda Buehler Motor Private Limited, which would make it a fully controlled subsidiary (Key Developments).

- The same December 1, 2025 board meeting will also review the termination of the existing joint venture agreement with Buehler Motor GmbH, with the aim of streamlining ownership and governance of the joint venture business (Key Developments).

- The board will evaluate an additional investment of up to INR 40 crore in UnoMinda EV Systems Pvt. Ltd., its wholly owned EV-focused subsidiary, in one or more tranches (Key Developments).

- A board meeting is scheduled for November 7, 2025 to consider and approve the unaudited standalone and consolidated financial results for the quarter and half year ended September 30, 2025 (Key Developments).

Valuation Changes

- Fair Value: Unchanged at approximately ₹1,303.74 per share, indicating no revision to the intrinsic value estimate.

- Discount Rate: Fallen slightly from about 14.85 percent to 14.76 percent, reflecting a marginal reduction in perceived risk.

- Revenue Growth: Essentially unchanged at around 20.43 percent, suggesting stable expectations for top line expansion.

- Net Profit Margin: Stable at roughly 7.71 percent, indicating no meaningful change in profitability assumptions.

- Future P E: Edged down slightly from about 47.22x to 47.11x, pointing to a marginally lower valuation multiple applied to future earnings.

Key Takeaways

- Focus on EV and smart vehicle technologies, along with localization and strategic acquisitions, boosts innovation, margins, and reduces reliance on external partners.

- Capacity expansion, premiumization, and compliance with evolving safety standards support long-term revenue growth and operating leverage above industry averages.

- Aggressive expansion, overseas challenges, start-up costs, partnership risks, and weak export demand may constrain margins and limit earnings growth despite strong domestic momentum.

Catalysts

About Uno Minda- Manufactures and supplies auto components and systems in India and internationally.

- Substantial ongoing and planned investments in EV-specific components, ADAS, sensors, and smart electronics position Uno Minda for significant growth as regulations and consumer preferences shift towards electric, safer, and smarter vehicles; this is expected to expand revenue and improve margins as product mix becomes more value-accretive.

- The company's localizing of advanced components such as camera modules for ADAS and RPAS-formerly imported-enables cost competitiveness, improves margins, and supports higher content per vehicle as OEMs transition to more feature-rich, regulatory-compliant models.

- Robust order book and capacity expansions-tied to confirmed POs-across alloy wheels, lighting, and emerging EV product lines, coupled with multiple new plants coming online in FY26/27, are likely to support 1.5x or higher top-line growth relative to industry averages, driving future revenue and operating leverage.

- Growing demand driven by premiumisation (higher content per vehicle) and stricter safety norms (e.g. more airbags, LED lighting, ADAS) underpin a structural uplift in average realized revenue per unit and should support higher EBITDA margins as penetration of these technologies rises across segments.

- Strategic acquisition of JV partners' technology and stakes (e.g., Friwo) enables Uno Minda to gain proprietary control over key EV technologies, reducing dependency on external partners and strengthening both innovation capability and margin profile over the long term, as more revenue accrues from differentiated, own-IP products rather than lower-margin, commoditized components.

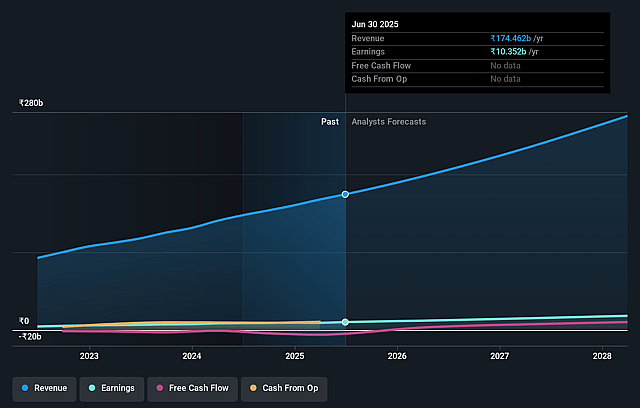

Uno Minda Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Uno Minda's revenue will grow by 19.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.9% today to 7.2% in 3 years time.

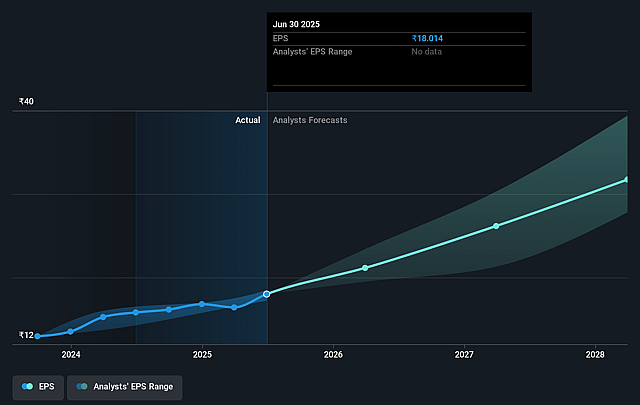

- Analysts expect earnings to reach ₹21.2 billion (and earnings per share of ₹36.97) by about September 2028, up from ₹10.4 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₹23.5 billion in earnings, and the most bearish expecting ₹13.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 48.7x on those 2028 earnings, down from 71.4x today. This future PE is greater than the current PE for the IN Auto Components industry at 29.3x.

- Analysts expect the number of shares outstanding to grow by 0.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.34%, as per the Simply Wall St company report.

Uno Minda Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained high levels of growth CapEx and large numbers of simultaneous expansion projects may strain cash flows and increase net debt; with several new plants and high investment in emerging technologies, delays in achieving target asset turns or slower ramp-up in new businesses could pressure both net margins and earnings in the medium term.

- Continued underperformance and margin pressure in overseas businesses-especially in the European acoustics segment (Clarton Horn), which has faced declining volumes and difficulty achieving profitability at current scale-may weigh on consolidated margins and limit earnings growth if turnaround plans do not succeed.

- The company's margin trajectory is currently diluted by the ramp-up of a large number of new ventures and product lines, where start-up costs are expensed ahead of revenue generation; this structural drag may persist if new lines (e.g., EV powertrain castings, camera modules) take longer than expected to scale, limiting operating leverage and net profit growth over the next few years.

- Heavy investment and strategic reliance on partnerships and joint ventures for access to advanced technology (e.g., Friwo, Buehler, Inovance) could expose Uno Minda to risks if technology licensing agreements prove costly or if partner instability (as seen with Friwo's exit and Buehler's capital constraints) disrupts operations, ultimately compressing long-term margins and technological differentiation.

- Despite strong domestic momentum, declining or stagnating demand in export geographies (such as persistent European weakness and evolving OEM preferences) could hamper revenue diversification; if Indian auto sector growth slows or foreign EV makers mostly use global supply chains, Uno Minda may face headwinds in growing international earnings and market share.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1197.474 for Uno Minda based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1450.0, and the most bearish reporting a price target of just ₹790.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹296.0 billion, earnings will come to ₹21.2 billion, and it would be trading on a PE ratio of 48.7x, assuming you use a discount rate of 14.3%.

- Given the current share price of ₹1283.25, the analyst price target of ₹1197.47 is 7.2% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.