Last Update 23 Dec 25

Fair value Increased 1.43%532539: Future Margin Gains And EV Investment Will Drive Bullish Repricing

Analysts have nudged their price target on Uno Minda slightly higher from ₹1,472 to ₹1,493. This reflects expectations of improved profit margins and a marginally richer future valuation multiple, even as they temper revenue growth assumptions and apply a higher discount rate.

What's in the News

- The board will consider acquiring the remaining 49.90 percent equity stake from Buehler Motor GmbH in Uno Minda Buehler Motor Private Limited at the December 1, 2025 meeting, which would make it a wholly owned subsidiary (Board Meeting agenda).

- A proposal to terminate the existing joint venture agreement with Buehler Motor GmbH will be taken up as part of the same December 1, 2025 board deliberations (Board Meeting agenda).

- A plan is under review to invest up to INR 40 crore, in one or more tranches, into UnoMinda EV Systems Pvt. Ltd., the company’s wholly owned EV subsidiary (Board Meeting agenda).

- A board meeting is scheduled for November 7, 2025 to consider and approve unaudited standalone and consolidated financial results for the quarter and half year ended September 30, 2025 (Board Meeting agenda).

Valuation Changes

- Fair Value: Risen slightly from ₹1,472 to ₹1,493, reflecting a modest upward revision in the estimated intrinsic value per share.

- Discount Rate: Increased slightly from 14.38 percent to 14.80 percent, implying a marginally higher required rate of return and risk assumption.

- Revenue Growth: Reduced meaningfully from 26.14 percent to 22.30 percent, indicating more conservative expectations for top line expansion.

- Net Profit Margin: Improved moderately from 7.20 percent to 7.83 percent, signaling expectations of better profitability.

- Future P/E: Edged up marginally from 50.39x to 50.80x, suggesting a slightly richer valuation multiple applied to future earnings.

Key Takeaways

- Capacity expansions and rapid product innovation, driven by strong customer commitments, position Uno Minda for above-industry growth, margin gains, and increased market share.

- Strategic moves in electrification, technology acquisitions, and global branding underpin sustained earnings stability, diversified revenue streams, and industry leadership.

- Slow EV transition, margin strain from high investment, commoditization, client concentration, and global headwinds threaten Uno Minda's growth, profitability, and earnings stability.

Catalysts

About Uno Minda- Manufactures and supplies auto components and systems in India and internationally.

- Analyst consensus expects Uno Minda's capacity expansions and new plants will drive steady growth, but this may understate the upside: management commentary makes clear these expansions are all backed by customer orders and purchase commitments, positioning the company to capture surges in demand and achieve market share gains far above industry rates, leading to greater top-line growth than forecast.

- Analysts broadly agree exports and premiumization trends support Uno Minda's revenue, but the acceleration of localization (e.g., in-house camera module production for ADAS) and rapid new product launches mean margin expansion and market penetration could progress much faster, driving faster-than-expected operating leverage and sustainable improvements in net margins.

- Uno Minda is uniquely exposed to India's rapid vehicle electrification and tightening regulatory environment through aggressive innovation in high-value electronic systems such as controllers, battery management systems, ADAS and sensor modules, substantially increasing content per vehicle and supporting both long-term revenue and EBITDA margin expansion.

- The company's ongoing transformation into a solutions provider-backed by recent full acquisition of Friwo's technology, technical capabilities from Germany and Vietnam, and expanded JV control-places Uno Minda in a leadership position to set technological standards, accelerating product development cycles and securing outsized wallet share with global and local OEMs, with a meaningful impact on long-term earnings stability and resilience.

- Aftermarket and international revenues are showing signs of structural acceleration thanks to intensified branding, expanded distribution, and India's emergence as a global sourcing hub, which, when combined with rising OEM-linked spares demand, positions Uno Minda for diversified, recurring foreign currency revenue streams that de-risk earnings and improve both return on capital and cash flow visibility.

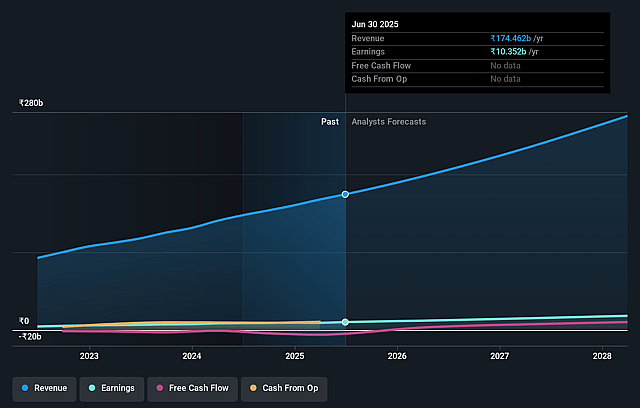

Uno Minda Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Uno Minda compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Uno Minda's revenue will grow by 26.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 5.9% today to 7.2% in 3 years time.

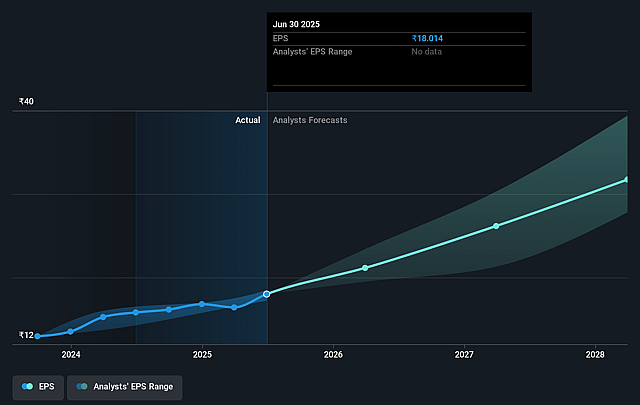

- The bullish analysts expect earnings to reach ₹25.2 billion (and earnings per share of ₹42.4) by about September 2028, up from ₹10.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 50.4x on those 2028 earnings, down from 70.7x today. This future PE is greater than the current PE for the IN Auto Components industry at 31.4x.

- Analysts expect the number of shares outstanding to grow by 0.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.38%, as per the Simply Wall St company report.

Uno Minda Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerated EV adoption could reduce demand for Uno Minda's legacy ICE-centric components such as castings and certain switches, leading to slower revenue growth and potential product obsolescence if the pace of portfolio transition to advanced EV and electronics is insufficient.

- High ongoing R&D and capital expenditures on new projects and technology upgrades-often expensed up front and with a lag until profitability-are suppressing margins and delaying operating leverage, which may result in sustained margin pressure and reduced free cash flow over the medium term.

- Increasing global and domestic competition in next-generation auto technologies and industry shifts towards OEM in-sourcing of critical electronics and EV components risk commoditizing Uno Minda's core product lines, thereby eroding pricing power and shrinking both revenues and net margins.

- Client concentration, notably heavy reliance on key OEMs and dependence on their ordering and industry cycles, exposes Uno Minda to volatile revenues and limited earnings stability if contracts are lost or if key OEMs face slowdowns in production or shift toward in-house manufacturing.

- Expanding international footprint and reliance on cost-competitive domestic production face headwinds from global trade protectionism, raw material cost inflation (such as potential rare earth disruptions), and one-off or lumpy state incentives that if reduced or delayed could compress profit margins and hinder predictable earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Uno Minda is ₹1472.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Uno Minda's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1472.0, and the most bearish reporting a price target of just ₹790.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹350.2 billion, earnings will come to ₹25.2 billion, and it would be trading on a PE ratio of 50.4x, assuming you use a discount rate of 14.4%.

- Given the current share price of ₹1269.2, the bullish analyst price target of ₹1472.0 is 13.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Uno Minda?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.