Key Takeaways

- Rapid shifts to electric vehicles and new mobility trends threaten core product demand, requiring transformative investment that could pressure margins and cash flows.

- Heavy dependence on key automakers and expansion risks, combined with trade barriers, expose the company to concentration risk and uncertainty in export-driven growth.

- Strong growth in advanced auto components, technological investments, and rising market share position Uno Minda for sustained revenue, margin, and shareholder value expansion.

Catalysts

About Uno Minda- Manufactures and supplies auto components and systems in India and internationally.

- Uno Minda faces the risk that the rapid proliferation of electric vehicles will significantly reduce demand for its traditional internal combustion engine components and casting products, requiring major investment in retooling and R&D, which could drain cash flows and squeeze EBITDA margins for years to come.

- Growing adoption of shared mobility and the potential long-term shift toward fewer vehicle sales due to autonomous and fleet-based models may shrink Uno Minda's total addressable market, slowing revenue growth and putting pressure on its core OEM-centric business model.

- The company's heavy reliance on a few top automakers for the bulk of its revenue exposes it to concentration risk, where the loss of a major customer or stagnating order volumes from large OEMs could cause a material decline in both top line and earnings, especially as new plants come online with higher start-up costs.

- High CapEx intensity and aggressive expansion into emerging technologies-while necessary-could result in prolonged periods of elevated debt and lower free cash flow generation, particularly if growth in the EV and advanced electronics segments underperforms expectations or faces execution challenges.

- Increasing localization requirements and protectionist trade policies in major global export markets threaten Uno Minda's current and planned export-driven growth, potentially forcing costlier investments in local manufacturing or resulting in missed volume opportunities, which would negatively affect revenue and profitability.

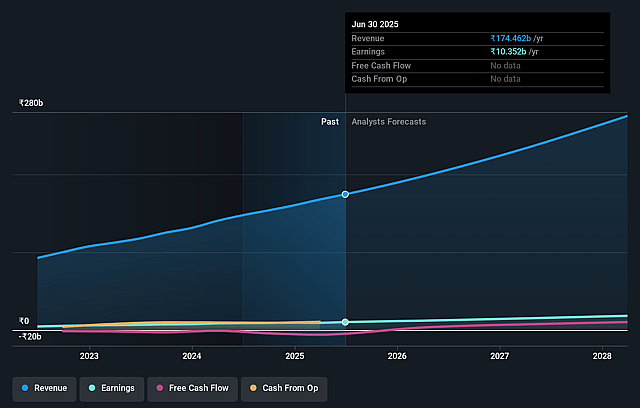

Uno Minda Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Uno Minda compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Uno Minda's revenue will grow by 13.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 5.6% today to 5.5% in 3 years time.

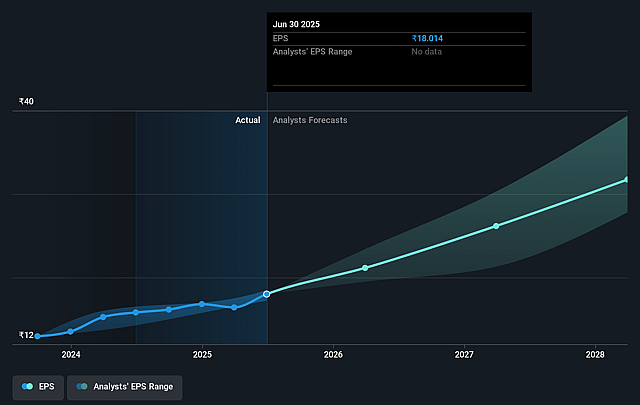

- The bearish analysts expect earnings to reach ₹13.7 billion (and earnings per share of ₹23.96) by about July 2028, up from ₹9.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 52.4x on those 2028 earnings, down from 65.3x today. This future PE is greater than the current PE for the IN Auto Components industry at 31.8x.

- Analysts expect the number of shares outstanding to grow by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.9%, as per the Simply Wall St company report.

Uno Minda Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is rapidly expanding into growth segments like EV components, sensors, controllers, and advanced lighting, which are all aligned with long-term automotive secular trends and are already driving strong revenue growth in these areas, supporting top-line expansion over the coming years.

- Uno Minda continues to outperform auto industry growth by a factor of 1.5x to 2x, consistently gaining market share and benefiting from premiumization trends across both 2-wheeler and 4-wheeler segments, which could lead to sustainable gains in both revenues and earnings.

- The company has secured anchor orders in high-value, next-generation products such as the 4-wheeler e-Axle and advanced lighting systems for autonomous vehicles, ensuring enhanced content per vehicle and greater visibility for future revenue streams and market presence.

- Ongoing investments in R&D and capacity (including the Czech Republic R&D center and new manufacturing facilities), as well as strategic JVs and partnerships, strengthen Uno Minda's technological capabilities and product pipeline, supporting long-term gross margin expansion and competitiveness.

- Management's disciplined financial strategy, healthy balance sheet, strong operating cash flow to fund CapEx, and increasing dividend payouts suggest continued earnings stability and shareholder value creation, which are likely to positively impact profitability and share price over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Uno Minda is ₹845.04, which represents two standard deviations below the consensus price target of ₹1131.71. This valuation is based on what can be assumed as the expectations of Uno Minda's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1350.0, and the most bearish reporting a price target of just ₹770.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹247.8 billion, earnings will come to ₹13.7 billion, and it would be trading on a PE ratio of 52.4x, assuming you use a discount rate of 13.9%.

- Given the current share price of ₹1071.35, the bearish analyst price target of ₹845.04 is 26.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.