Key Takeaways

- TVS faces significant disruption risks from electrification trends, evolving mobility preferences, and regulatory pressures that can erode core revenue streams and compress margins.

- International expansion exposes TVS to currency and geopolitical risks, while ESG and compliance challenges threaten access to capital and long-term profitability.

- Strong growth in EVs, premium products, and financing, along with cost discipline and innovation, position TVS Motor for sustained profitability and market expansion.

Catalysts

About TVS Motor- Engages in the manufacture and sale of automotive vehicles and components, spare parts, and accessories in India.

- TVS Motor is heavily exposed to the risk that accelerating electrification in key markets will disrupt its core internal combustion engine (ICE) business faster than the company can pivot, especially given recent supply chain setbacks in critical EV components like rare earth magnets. This could cause a material decline in future ICE revenues before EV growth can compensate, putting both top-line momentum and earnings at risk.

- As urban and rural consumers increasingly shift to new mobility alternatives such as ride-hailing and public transport-potentially spurred by favorable regulation-there is a threat that two-wheeler demand will erode, capping TVS's volume growth and permanently reducing its total addressable market and long-term consolidated revenues.

- TVS's ambitious international expansion into volatile markets like Africa and Latin America exposes it to severe foreign exchange fluctuations and ongoing geopolitical instability. This persistent risk could result in significant operating margin compression, unpredictable earnings, and heightened exposure to sudden shocks in export revenues.

- Increasing ESG scrutiny and global capital reallocation towards sustainability leaders may disadvantage TVS if it is perceived as slow in its transition or not best-in-class in compliance. This could lead to restricted access to capital, a higher cost of debt, and sustained pressure on valuation multiples, ultimately impacting future net profit growth.

- Intensifying competition from both established rivals and technologically agile entrants, coupled with persistent industry regulatory tightening (including higher safety and emission norms), is likely to drive up compliance costs and dilute pricing power. This scenario can materially compress sector-wide and company-specific net margins for TVS over the long term.

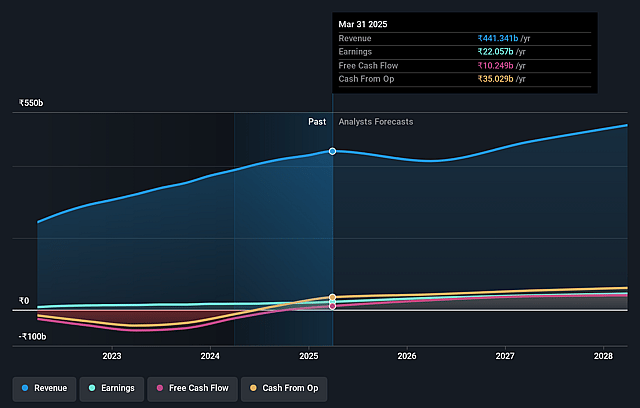

TVS Motor Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on TVS Motor compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming TVS Motor's revenue will grow by 1.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 5.1% today to 8.6% in 3 years time.

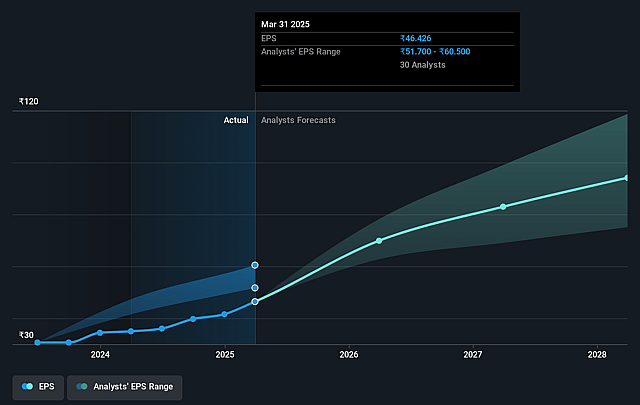

- The bearish analysts expect earnings to reach ₹41.1 billion (and earnings per share of ₹86.51) by about September 2028, up from ₹23.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 42.0x on those 2028 earnings, down from 70.3x today. This future PE is greater than the current PE for the IN Auto industry at 34.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.69%, as per the Simply Wall St company report.

TVS Motor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained leadership and rapid growth in both domestic and international two-wheeler markets, alongside strong expansion in electric vehicle sales and premium product launches, could support higher revenues and margin expansion in the medium to long term.

- Aggressive product pipeline and continued investments in EVs, premium motorcycles, and international markets-especially with the Norton launch and an expanded EV portfolio-are likely to drive revenue diversification and support consolidated profitability as these segments scale.

- Ongoing expansion of TVS Credit, with rapidly growing consumer financing and digital transformation, can increase vehicle affordability and widen TVS Motor's addressable market, potentially boosting future sales volumes and overall group earnings.

- Improving geopolitical and economic stability in key export markets such as Africa and Latin America, coupled with infrastructure development and rising scooterization in rural India, could deliver upside to both volume growth and operating margins.

- TVS's proven ability to execute sustained cost reductions, invest in technology, and maintain robust product innovation positions it well to benefit from long-term trends like electrification and premiumization, supporting further improvement in EBITDA margins and overall net profit.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for TVS Motor is ₹2117.09, which represents two standard deviations below the consensus price target of ₹3136.43. This valuation is based on what can be assumed as the expectations of TVS Motor's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹4250.0, and the most bearish reporting a price target of just ₹2020.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹477.0 billion, earnings will come to ₹41.1 billion, and it would be trading on a PE ratio of 42.0x, assuming you use a discount rate of 19.7%.

- Given the current share price of ₹3495.5, the bearish analyst price target of ₹2117.09 is 65.1% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.