Key Takeaways

- Rapid expansion in EVs, luxury models, and digital offerings could drive revenue and margin growth far beyond current analyst expectations.

- Strategic investments and geographic diversification position the company for sustained outperformance and high-margin growth in both domestic and international markets.

- Slower EV growth, heavy investment needs, regulatory pressures, rural market risks, and European losses all threaten margins, cash flow, and future revenue expansion.

Catalysts

About TVS Motor- Engages in the manufacture and sale of automotive vehicles and components, spare parts, and accessories in India.

- While analyst consensus highlights TVS Motor's expansion in the EV segment, this likely underestimates the speed and breadth of adoption given the company's rapidly widening portfolio, ability to mitigate supply chain risks, and aggressive network building; these factors could deliver revenue and margin growth that far outpaces current expectations as EV penetration accelerates nationwide and internationally.

- Analysts broadly agree strategic geographic diversification will drive international growth, but this outlook may not fully capture the exponential revenue potential from TVS's strong execution in recovering and underpenetrated markets like Africa, LatAm, and Southeast Asia, where rising middle class incomes and urbanization are set to trigger surging demand for two

- and three-wheelers.

- The upcoming launch of accessible, super-premium Norton models, supported by a differentiated global retail strategy and multi-model lineup, is poised to catalyze a new high-margin revenue stream; early-mover advantage in the luxury motorcycle segment could lead to both top-line and EBITDA margin expansion beyond consensus.

- TVS's deepening investment in digital technologies, connected vehicles, and premiumization (including unique partnerships like BMW) positions it to unlock high-margin, recurring revenue through after-sales services, fintech, and platform-based business models, structurally lifting net margins and earnings over time.

- The company's embedded advantages in R&D and local sourcing, alongside an accelerated move to alternate (HRE-free and magnet-free) EV components, are set to create a self-reinforcing cycle of cost reduction and innovation, paving the way for sustainable, above-industry margin expansion and long-term outperformance in both ICE and electric platforms.

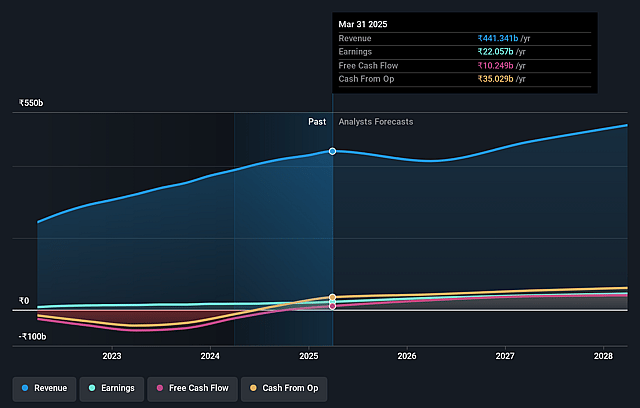

TVS Motor Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on TVS Motor compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming TVS Motor's revenue will grow by 11.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 5.1% today to 10.6% in 3 years time.

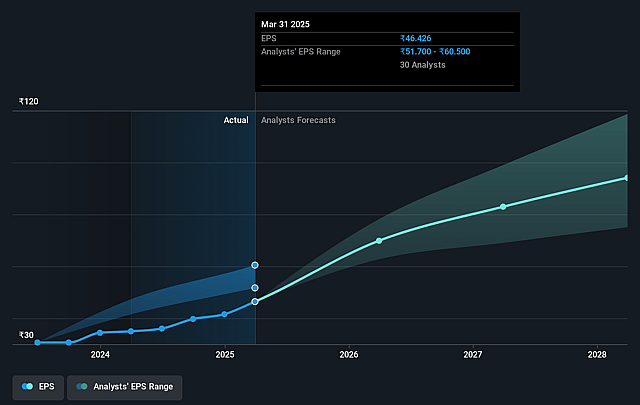

- The bullish analysts expect earnings to reach ₹67.2 billion (and earnings per share of ₹139.73) by about September 2028, up from ₹23.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 50.4x on those 2028 earnings, down from 70.3x today. This future PE is greater than the current PE for the IN Auto industry at 34.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.69%, as per the Simply Wall St company report.

TVS Motor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- TVS Motor's electrification appears to be progressing at a slower pace than some peers, and ongoing short-term supply chain disruptions for key EV inputs like rare earth magnets have already caused EV sales declines, risking a loss of future market share and lower growth in revenue.

- The company continues to make heavy investments in premium brands like Norton, international expansion, and digital initiatives, with guidance for annual investment and capex outlays in the ₹2,000 crore to ₹2,200 crore range, which may pressure free cash flow and net margins if these bets do not generate expected returns in a timely manner.

- Management acknowledges that the e-bike business in Europe is facing headwinds due to economic conditions, and the segment is currently operating at a loss, so continued weakness or slow recovery may result in ongoing negative impact to group earnings and profitability.

- There are increasing regulatory pressures including stricter emission norms (such as upcoming ABS safety regulations), and a shift toward carbon neutrality, which may require further capital expenditure and technological upgrades, elevating compliance costs and squeezing operational margins.

- A significant share of TVS Motor's domestic business is rural and price sensitive, exposing the company to risks from intensified competition, variable input costs, and consumer preference shifts toward shared and micro-mobility, all of which may pressure net margins and slow down revenue growth if rural demand underperforms.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for TVS Motor is ₹4155.78, which represents two standard deviations above the consensus price target of ₹3136.43. This valuation is based on what can be assumed as the expectations of TVS Motor's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹4250.0, and the most bearish reporting a price target of just ₹2020.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹633.7 billion, earnings will come to ₹67.2 billion, and it would be trading on a PE ratio of 50.4x, assuming you use a discount rate of 19.7%.

- Given the current share price of ₹3495.5, the bullish analyst price target of ₹4155.78 is 15.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.