Last Update20 Sep 25Fair value Increased 7.49%

The upward revision in TVS Motor’s price target reflects improved consensus revenue growth forecasts and a lower discount rate, resulting in an increased fair value estimate from ₹2998 to ₹3223.

What's in the News

- TVS Motor and Noise launched India's first EV-smartwatch integration, enhancing connectivity and safety features for the iQube electric scooter, which surpassed 650,000 unit sales.

- TVS Motor introduced the TVS King Deluxe Plus CNG 3 Wheeler in Tanzania, expanding its presence with premium, fuel-efficient features tailored for urban and semi-urban mobility.

- TVS signed an MoU with ALT Mobility to lease and deploy up to 3,000 electric three-wheelers in FY26, supporting clean mobility and livelihoods through integrated asset management.

- Multiple product launches and upgrades: TVS NTORQ 150 hyper sport scooter, TVS Orbiter EV, TVS King Kargo HD EV, updated Apache and Jupiter models, and the HLX 150 5G in Congo, featuring segment-first technologies and safety enhancements.

- Company amended bylaws to increase authorized share capital, including the addition of preference shares, with necessary filings completed.

Valuation Changes

Summary of Valuation Changes for TVS Motor

- The Consensus Analyst Price Target has risen from ₹2998 to ₹3223.

- The Consensus Revenue Growth forecasts for TVS Motor has risen from 7.1% per annum to 7.7% per annum.

- The Discount Rate for TVS Motor has fallen from 20.94% to 19.84%.

Key Takeaways

- Strong growth in two-wheeler sales and electric vehicle adoption, coupled with digital initiatives, underpins TVS Motor's revenue and margin expansion prospects.

- International diversification and premium product launches support stability, while cost efficiency measures drive long-term profitability.

- Persistent high investments and exposure to global risks may pressure margins and earnings if new ventures and international segments underperform expectations.

Catalysts

About TVS Motor- Engages in the manufacture and sale of automotive vehicles and components, spare parts, and accessories in India.

- Rapid urbanization and a growing middle class in India and emerging markets are driving sustained demand for two-wheelers; TVS Motor has consistently outpaced industry sales growth both domestically and internationally, indicating further potential for revenue expansion as these demographic trends accelerate.

- Accelerating adoption of electric vehicles due to favorable government policies and sustainability initiatives is a catalyst for TVS; the company's early investments and expanding portfolio in electric two

- and three-wheelers (including the strong iQube performance and new EV launches) are likely to boost future top-line growth and support higher gross margins as scale improves.

- Expansion of TVS Motor's footprint in Africa, Latin America, and Southeast Asia-with strong momentum in recovering markets-provides diversified and resilient revenue streams, reducing dependence on the Indian market and supporting more stable overall earnings growth.

- Digital transformation (easier financing and online sales via TVS Credit and other digital initiatives) lowers barriers to vehicle ownership and improves customer acquisition and retention, which should accelerate sales volumes and positively impact both revenues and net margins over time.

- Ongoing product premiumization (higher-end scooters/motorcycles and upcoming Norton premium launches) alongside cost efficiency initiatives is contributing to improved product mix and EBITDA margin expansion, positioning the company for stronger long-term profitability growth.

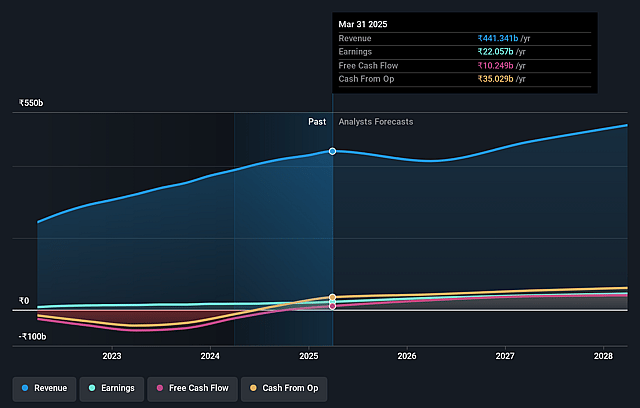

TVS Motor Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming TVS Motor's revenue will grow by 6.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.1% today to 9.0% in 3 years time.

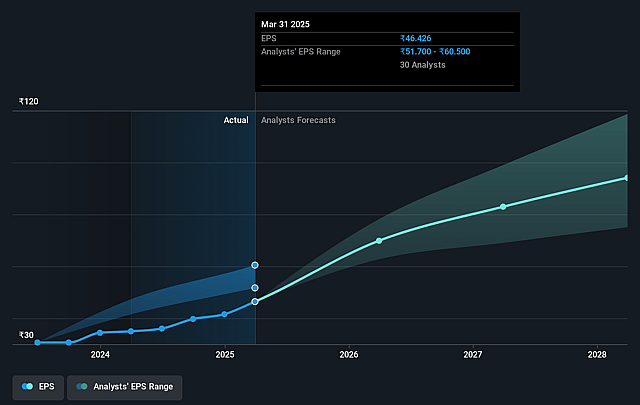

- Analysts expect earnings to reach ₹50.6 billion (and earnings per share of ₹106.35) by about August 2028, up from ₹23.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₹62.0 billion in earnings, and the most bearish expecting ₹35.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 49.2x on those 2028 earnings, down from 65.8x today. This future PE is greater than the current PE for the IN Auto industry at 32.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 21.04%, as per the Simply Wall St company report.

TVS Motor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued high investment requirements for Norton (premium motorcycle brand) and e-bike businesses, with no near-term assurance of breakeven, could suppress free cash flow and reduce net margins in the medium

- to long-term.

- Exposure to rare earth magnet supply chain risks for EVs, without a clear immediate solution, poses a threat to EV production continuity and may adversely impact EV sales volumes, revenues, and market share until alternative sourcing or technology solutions are in place.

- The e-bike segment in Europe remains challenged due to sluggish macroeconomic conditions, resulting in ongoing operating losses in overseas subsidiaries, potentially dragging down consolidated earnings if the recovery is delayed.

- Heavy reliance on international markets like Africa and Latin America for export-led growth exposes the company to currency fluctuations, geopolitical instability, and uneven economic recoveries, increasing volatility in revenues and profit growth from exports.

- Large, sustained CapEx and investment requirements (₹2,000–2,200 crore annually) into new products, global expansion, and digital initiatives may pressure margins and returns if new segments (e.g. premium, EV, international) do not deliver expected growth, thereby risking lower net profit and return on capital employed.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹2950.216 for TVS Motor based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹3500.0, and the most bearish reporting a price target of just ₹1870.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹562.6 billion, earnings will come to ₹50.6 billion, and it would be trading on a PE ratio of 49.2x, assuming you use a discount rate of 21.0%.

- Given the current share price of ₹3271.2, the analyst price target of ₹2950.22 is 10.9% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.