Key Takeaways

- Cloud infrastructure migration and ecosystem integration drive cost reduction, innovation, and set the stage for superior margin and revenue growth versus competitors.

- Rural expansion, fintech user gains, and major platform partnerships accelerate network effects, boosting engagement and monetization across core payments and commerce segments.

- Persistently fierce competition, regulatory pressures, and integration challenges threaten growth prospects and may continue to constrain profitability despite efficiency and ecosystem synergy efforts.

Catalysts

About GoTo Gojek Tokopedia- Provides and operates on-demand services in Indonesia and internationally.

- While analyst consensus expects margin expansion from product and incentive refinement, the completion of GoTo's massive cloud infrastructure migration immediately cuts technology costs by more than half and dramatically accelerates innovation cycles, potentially enabling GoTo to outpace rivals in both revenue growth and net margin gains.

- Analysts broadly agree that FinTech and On-Demand Services will see steady engagement and profitability, but current user momentum-such as 29% FinTech user growth, a 90% loan book increase, and record On-Demand margins-suggests that the platform's network effects could deliver faster-than-expected compounding revenue and sustained EBITDA growth.

- Surging adoption of mobile internet in untapped rural and secondary cities, combined with GoTo's focused low-cost and gamified GoPay app strategy, could unlock entirely new large user cohorts and drive a step-change in transaction volume and payment-related revenues.

- Deep partnerships with Indonesia's largest consumer-facing platforms-such as TikTok and Telkomsel-provide a rapid, frictionless channel to tens of millions of new users, dramatically expanding the addressable market for GoPay, lending, and commerce, with direct upside to top-line and ecosystem-wide monetization.

- As digital payments, credit, and e-commerce continue to displace cash and traditional retail-particularly among the growing middle class-GoTo's uniquely integrated ecosystem is poised to capture an outsized share of this shift, positioning the company for structurally higher revenue, improving net margins, and superior long-term earnings power.

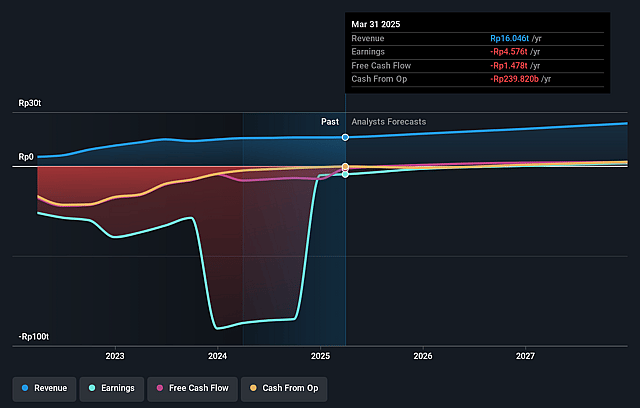

GoTo Gojek Tokopedia Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on GoTo Gojek Tokopedia compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming GoTo Gojek Tokopedia's revenue will grow by 20.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -18.2% today to 16.3% in 3 years time.

- The bullish analysts expect earnings to reach IDR 4776.6 billion (and earnings per share of IDR 3.97) by about September 2028, up from IDR -3035.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 42.3x on those 2028 earnings, up from -19.5x today. This future PE is greater than the current PE for the ID Multiline Retail industry at 10.1x.

- Analysts expect the number of shares outstanding to decline by 1.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.94%, as per the Simply Wall St company report.

GoTo Gojek Tokopedia Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Slowing consumer spending, peaking smartphone penetration and macro headwinds in Indonesia and other Southeast Asian markets could limit user growth and gross transaction volume, restricting the pace of topline revenue expansion over the long term.

- Intensified competition from Grab, Shopee, and new entrants is prompting targeted responses and attempts to protect market share, which risks margin compression due to potentially unsustainable incentives and ongoing competitive pricing, thereby pressuring long-run net margins and profitability.

- The company is heavily touting growth potential from digital payments, lending, and integration with partners like TikTok and Telkomsel, but regulatory tightening around digital privacy and super-app data monetization may increase compliance costs and restrict data-driven revenue streams, ultimately constraining earnings.

- Despite claims of cost efficiency gains through technology upgrades and migration to new cloud providers, rising energy and wage costs in emerging markets pose a risk to delivery and logistics cost structures, which could eat into operating leverage and erode future net margins.

- While management emphasizes ecosystem synergies, historical difficulties in fully integrating services between Gojek, Tokopedia, and the FinTech arms highlight an ongoing risk of unrealized cross-platform efficiencies leading to higher-than-expected operating expenses and limiting improvement in group operating margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for GoTo Gojek Tokopedia is IDR131.56, which represents two standard deviations above the consensus price target of IDR96.32. This valuation is based on what can be assumed as the expectations of GoTo Gojek Tokopedia's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of IDR140.0, and the most bearish reporting a price target of just IDR70.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be IDR29269.1 billion, earnings will come to IDR4776.6 billion, and it would be trading on a PE ratio of 42.3x, assuming you use a discount rate of 14.9%.

- Given the current share price of IDR56.0, the bullish analyst price target of IDR131.56 is 57.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.