Key Takeaways

- Diversification into gold, copper, and downstream initiatives reduces reliance on thermal coal, enhancing revenue stability and mitigating long-term market volatility.

- Operational efficiencies, expanded coal reserves, and Indonesia's favorable export position strengthen margins and support sustained earnings despite industry headwinds.

- Heavy reliance on coal and high debt burden, alongside slow diversification and mounting regulatory pressures, jeopardize Bumi's profitability, flexibility, and long-term earnings stability.

Catalysts

About Bumi Resources- Engages in the mining activities in Indonesia.

- Expanding coal reserves at KPC, with expected government approval for an additional 145 million tonnes and further mine development, could extend Bumi's production life and support export volumes, positively impacting long-term revenue and earnings.

- Indonesia's role as a stable alternative coal supplier amid geopolitical tensions (e.g., supply constraints in Russia and Australia) is increasing global demand for Indonesian coal, allowing Bumi to benefit from potential price premiums and higher export sales, supporting revenue stability.

- The acquisition of the Wolfram gold and copper project in Australia, with production targeted by 2026-2027 and plans for further mineral asset acquisitions, diversifies Bumi's revenue streams and reduces long-term earnings vulnerability to thermal coal market volatility.

- Ongoing cost optimization through lower strip ratios, production cost reductions (from $47/tonne to $42.2/tonne), and operational synergies from improved mining practices bolster EBITDA margins and protect net income during periods of low coal prices.

- Continued advancement of downstream initiatives (e.g., methanol project and coal upgrading) and potential technical partnerships position Bumi to capture more value from its coal chain, partially insulating profitability from raw coal price fluctuations and supporting medium-term margin growth.

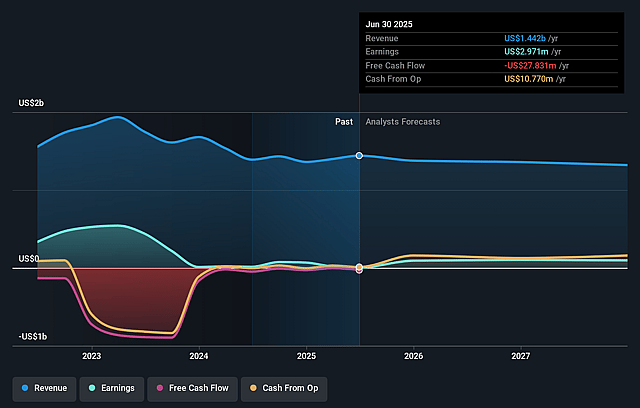

Bumi Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Bumi Resources's revenue will decrease by 3.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.2% today to 10.7% in 3 years time.

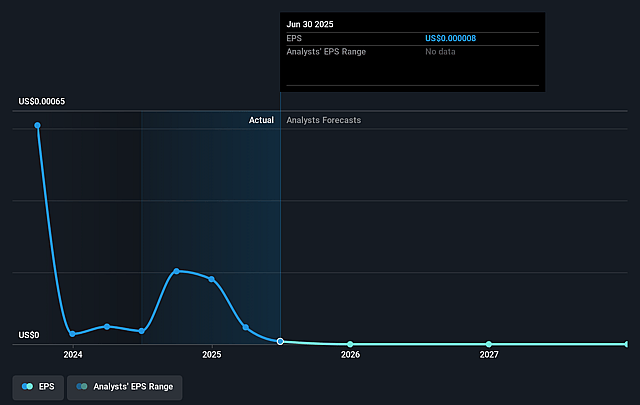

- Analysts expect earnings to reach $138.8 million (and earnings per share of $0.0) by about September 2028, up from $3.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 38.2x on those 2028 earnings, down from 858.5x today. This future PE is greater than the current PE for the ID Oil and Gas industry at 11.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.51%, as per the Simply Wall St company report.

Bumi Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent global oversupply in coal, particularly from major producers like Indonesia, and increasing domestic production in key markets (India, China) is leading to sharp deterioration in coal prices and compressing Bumi Resources' revenue and gross margins.

- Dependence on coal as a core business makes Bumi highly susceptible to long-term structural declines in coal demand from the accelerating global energy transition and stricter ESG mandates, putting sustained pressure on company earnings and future revenue stability.

- Bumi's foray into gold and copper mining via acquisitions is in the early stages, with initial production and cash flow not expected until at least 2027–2028, exposing the company to execution risk, potential integration challenges, and delayed financial contribution, which may further strain near-term profitability and net income.

- High and increasing debt levels, including new bond issuances to fund acquisitions, are likely to elevate ongoing interest expenses, reduce financial flexibility, and constrain the ability to invest in capital-intensive projects or withstand market downturns, ultimately weighing on net margins and earnings.

- Continued exposure to regulatory and environmental risks, including potential future carbon pricing, stricter compliance requirements, and rising societal opposition to coal, may increase operating costs, risk stranded assets, and limit Bumi's competitiveness, adversely impacting long-term profitability and overall shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of IDR165.15 for Bumi Resources based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.3 billion, earnings will come to $138.8 million, and it would be trading on a PE ratio of 38.2x, assuming you use a discount rate of 12.5%.

- Given the current share price of IDR113.0, the analyst price target of IDR165.15 is 31.6% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.