Key Takeaways

- Strategic focus on corporate and consumer loans with digital and branch transformations is expected to improve revenue and net margins.

- Asset quality improvement and prudent provisioning efforts are likely to stabilize earnings and support sustainable profit growth.

- Exchange rate volatility, funding competition, and asset quality issues may compress margins and constrain loan growth, impacting Bank Negara Indonesia's revenue and earnings.

Catalysts

About Bank Negara Indonesia (Persero)- Provides various banking products and services in Indonesia, rest of Asia, New York, and Europe.

- The corporate shift towards a higher risk-adjusted return segment, focusing on Corporate and Consumer loans, is expected to improve revenue growth as these segments showed a Compound Annual Growth Rate of 12%, impacting overall earnings positively.

- The transformation initiatives, including the development of the wondr mobile app, are aimed at increasing consumer engagement and customer acquisitions, potentially driving growth in retail and transaction accounts, which can enhance revenue through increased transactions.

- The strategic focus on low-cost funding through branch transformations and mobile app enhancements is expected to improve the net interest margin (NIM) by reducing cost of funds, thereby potentially enhancing net margins.

- The ongoing digital transformation and investments in IT capabilities are anticipated to increase operational efficiency and lower future operating expenses, thereby improving net margins over the long term.

- Asset quality improvement initiatives, such as focusing on cleaning up the legacy portfolio and prudent provisioning, are likely to decrease the credit cost ratio to around 1%, which is expected to stabilize earnings and support sustainable profit growth.

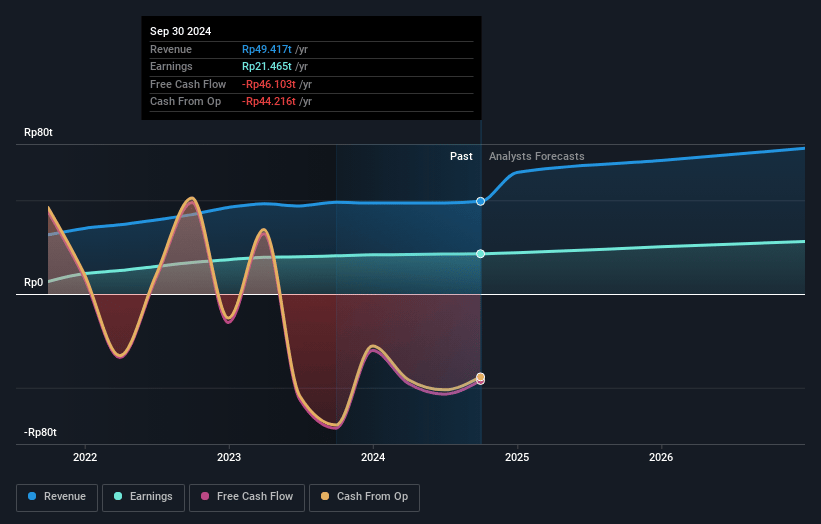

Bank Negara Indonesia (Persero) Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Bank Negara Indonesia (Persero)'s revenue will grow by 18.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 42.4% today to 33.0% in 3 years time.

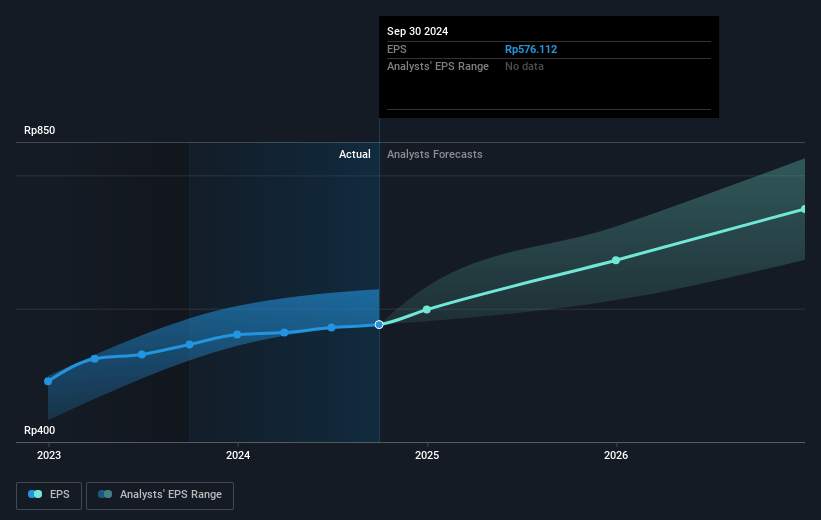

- Analysts expect earnings to reach IDR 28184.3 billion (and earnings per share of IDR 755.2) by about May 2028, up from IDR 21517.6 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as IDR23649.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.5x on those 2028 earnings, up from 7.2x today. This future PE is lower than the current PE for the ID Banks industry at 19.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.67%, as per the Simply Wall St company report.

Bank Negara Indonesia (Persero) Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The exchange rate volatility with a downward trend could limit the central bank's ability to implement monetary easing, potentially impacting the net interest margin (NIM) due to higher costs of funds.

- The focus on low-cost funding is vital as growth in internal savings was supported by the wondr app, yet the substantial reliance on this strategy might not sustain loan growth if wider system liquidity deteriorates, affecting net interest income.

- The increase in competition for funding and rising SRBI yields have slightly elevated the cost of funds, which may counterbalance efforts to maintain competitive loan yields and compress profit margins.

- High write-off rates, particularly from legacy portfolios, while helping to clean up the balance sheet, reflect underlying asset quality concerns that may necessitate ongoing high provisions and impact earnings.

- Potential risks associated with delayed government spending and front-loaded bond issuance could crowd out money supply growth, leading to liquidity challenges that may constrain loan book expansion and affect revenue generation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of IDR5434.182 for Bank Negara Indonesia (Persero) based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of IDR6400.0, and the most bearish reporting a price target of just IDR3500.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be IDR85352.0 billion, earnings will come to IDR28184.3 billion, and it would be trading on a PE ratio of 10.5x, assuming you use a discount rate of 13.7%.

- Given the current share price of IDR4180.0, the analyst price target of IDR5434.18 is 23.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.