Last Update 05 Sep 25

Fair value Decreased 0.32%AI And Quantum Advancements Will Drive Cloud And IoT Expansion

China Telecom’s higher future P/E multiple paired with a slight reduction in revenue growth forecasts suggests increased valuation pressure despite a marginal dip in the consensus price target from HK$7.35 to HK$7.32.

What's in the News

- Announced interim dividend of RMB 0.1812 per share for the first half of 2025.

- Reported 432.71 million mobile subscribers for the second quarter of 2025.

- Held board meeting to approve interim results and consider interim dividend for H1 2025.

- Removed from Shanghai Stock Exchange 180 Value Index.

Valuation Changes

Summary of Valuation Changes for China Telecom

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from HK$7.35 to HK$7.32.

- The Future P/E for China Telecom has risen from 17.85x to 19.45x.

- The Consensus Revenue Growth forecasts for China Telecom has fallen slightly from 3.6% per annum to 3.5% per annum.

Key Takeaways

- Strategic investments in AI, Quantum tech, and cloud services are set to improve margins and significantly boost revenue and earnings.

- International expansion and focus on digital innovation are diversifying income sources, enhancing market value and financial standing.

- China Telecom's focus on tech innovation and R&D, alongside ambitious projects, brings financial risk due to high costs, market volatility, and geopolitical challenges.

Catalysts

About China Telecom- Provides mobile communications, wireline and satellite communications, internet access, cloud computing and computing power, AI, big data, quantum, ICT integration in the People’s Republic of China.

- The company is accelerating its AI and Quantum technology developments, including AI+ and Quantum+, to drive industrial innovation and create new revenue streams. This is likely to significantly impact revenue and enhance net margins as the company integrates these high-tech solutions into various sectors.

- Investment in cloud and digital transformation strategies, such as the Xirang platform and local GPU training solutions, is expected to increase service revenue by meeting the growing demand for intelligent cloud services, thereby improving the company’s EBITDA and net profit.

- China Telecom's deepened engagement in industrial digitalization and AI is expected to broaden market expansion and drive intelligent revenue, nearly doubling year-over-year, which should positively affect overall earnings.

- The company is optimizing capital expenditures, focusing on developing advanced cloud network infrastructure and green technologies. This strategic allocation is intended to reduce operating expenses and enhance free cash flow and net margins by improving operational efficiencies.

- Strategic international expansion, including significant growth in overseas business and innovative offerings like Quantum satellite IoT, aligns with the company’s goals to boost revenue and diversify income sources, thereby strengthening the company's financial standing and market value.

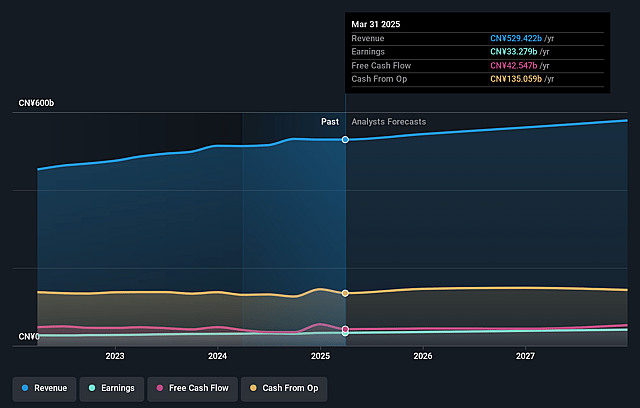

China Telecom Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming China Telecom's revenue will grow by 3.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.4% today to 7.1% in 3 years time.

- Analysts expect earnings to reach CN¥42.1 billion (and earnings per share of CN¥0.46) by about September 2028, up from CN¥34.2 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as CN¥37.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.9x on those 2028 earnings, up from 14.0x today. This future PE is greater than the current PE for the US Telecom industry at 14.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.89%, as per the Simply Wall St company report.

China Telecom Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's focus on technological innovation and R&D comes with high costs, as evidenced by the 11.3% increase in R&D expenses, which could impact net margins if these investments do not yield expected returns.

- China Telecom's ambitious AI and quantum technology projects require substantial resources, and any failure to achieve technological breakthroughs or market adoption could negatively affect future earnings growth.

- The reliance on growth in cloud and intelligent service sectors introduces volatility and execution risks, which could lead to fluctuating revenue streams and affect overall financial stability.

- A significant increase in capital expenditure for infrastructure upgrades may strain free cash flow and impact the company’s ability to sustain dividend payouts or invest in other growth opportunities.

- The competitive landscape in international and domestic markets, combined with potential geopolitical tensions, may pose risks to revenue growth and market expansion efforts.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of HK$7.349 for China Telecom based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$9.02, and the most bearish reporting a price target of just HK$6.21.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥593.4 billion, earnings will come to CN¥42.1 billion, and it would be trading on a PE ratio of 17.9x, assuming you use a discount rate of 6.9%.

- Given the current share price of HK$5.7, the analyst price target of HK$7.35 is 22.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.