Key Takeaways

- Deep integration of AI, quantum, and proprietary platforms across industries positions China Telecom for transformative, durable revenue and margin growth far beyond consensus estimates.

- International expansion, digital backbone leadership, and rapid uptake of next-generation infrastructure drive outsized recurring revenues, operating leverage, and superior cash flow durability.

- Intensifying competition, regulatory pressures, and heavy investment in new technology threaten China Telecom's profitability, adaptability, and global growth potential amid geopolitical uncertainty.

Catalysts

About China Telecom- Provides mobile communications, wireline and satellite communications, internet access, cloud computing and computing power, AI, big data, quantum, ICT integration in the People’s Republic of China.

- Analyst consensus sees strong AI and Quantum as meaningful revenue drivers, but this likely understates the scale and velocity of market adoption; China Telecom's deep integration and first-mover advantage in localized AI/Quantum applications across thousands of industry verticals could trigger exponential revenue growth and net margin expansion, well beyond current projections.

- While analysts broadly expect China Telecom's cloud and digital transformation initiatives (like Xirang and local GPU/AI solutions) to grow service revenue, the company's accelerated success in embedding proprietary models and intelligent platforms into over 10,000 large-scale B2B and government projects could transform recurring revenues into a defensible, annuity-like stream, significantly increasing EBITDA durability and multi-year earnings visibility.

- China Telecom's rapid internationalization-especially its deployment of global cloud/IDC platforms, direct-to-satellite connectivity, and quantum-enabled IoT across 260 global markets-positions the company as the primary Chinese digital backbone overseas and could allow for outsized, non-domestic revenue and margin contribution as international businesses and governments shift to trusted, SOE-backed providers.

- Powerful macro forces, including government-backed infrastructure upgrades and surging digital consumption among China's fast-expanding urban middle class, create an environment where core user base and ARPU can compound at a faster rate than most expect, supporting accelerating top-line growth and more robust margin improvement.

- The industry-wide transition to 5G B2B, smart city deployments, and cross-sector digitalization is giving China Telecom unrivaled opportunities for scale and high-value service bundling; its leadership in network integration, edge computing and green infrastructure is likely to set a new standard for operating leverage, with sustained growth in operating and free cash flow outpacing sector peers.

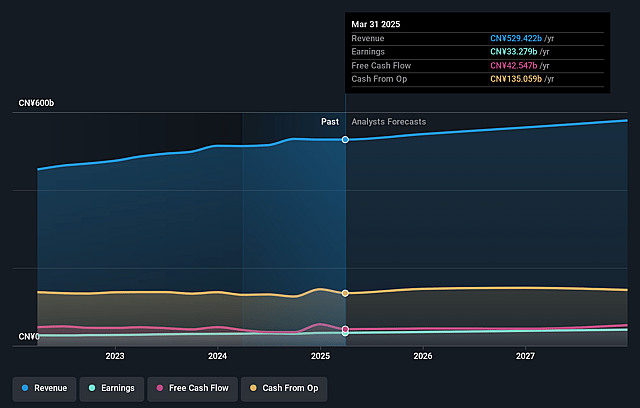

China Telecom Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on China Telecom compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming China Telecom's revenue will grow by 4.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 6.4% today to 7.6% in 3 years time.

- The bullish analysts expect earnings to reach CN¥46.1 billion (and earnings per share of CN¥0.5) by about September 2028, up from CN¥34.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 18.9x on those 2028 earnings, up from 14.3x today. This future PE is greater than the current PE for the US Telecom industry at 13.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.89%, as per the Simply Wall St company report.

China Telecom Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- China Telecom's long-term growth potential is at risk due to intensifying competition from domestic players such as China Mobile and China Unicom, along with emerging technology-driven disruptors, which threatens to squeeze average revenue per user and exert ongoing pressure on net margins and overall profitability.

- The rapid pace of innovation and pivot toward digital and software-defined networks globally favors agile, tech-centric firms, raising the risk that China Telecom's legacy operator structure could slow its adaptation, erode its market share, and limit growth in both revenue and earnings.

- Sustained geopolitical tensions and decoupling trends between China and Western economies could limit China Telecom's access to advanced technologies and key international partnerships, undermining its ability to innovate and compete globally and potentially stunting future revenue growth.

- Ongoing and significant capital expenditure on 5G, fiber, cloud, and quantum infrastructure-despite recent optimization-could strain free cash flow, increase leverage on the balance sheet, and weigh on returns to shareholders through higher ongoing costs and potentially muted growth in earnings.

- Persistent government pricing regulation and social responsibility mandates, including the provision of affordable universal service and participation in low-return infrastructure projects, may constrain long-term revenue growth and inhibit further improvement in net profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for China Telecom is HK$8.54, which represents two standard deviations above the consensus price target of HK$7.32. This valuation is based on what can be assumed as the expectations of China Telecom's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$8.75, and the most bearish reporting a price target of just HK$6.2.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CN¥608.2 billion, earnings will come to CN¥46.1 billion, and it would be trading on a PE ratio of 18.9x, assuming you use a discount rate of 6.9%.

- Given the current share price of HK$5.84, the bullish analyst price target of HK$8.54 is 31.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on China Telecom?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.