Key Takeaways

- Geopolitical risks, strict regulations, and slowing population growth threaten China Telecom's overseas expansion, global competitiveness, and future domestic revenue potential.

- Heavy technology investments and intensifying competition from local and digital rivals are reducing margins, compressing profitability, and straining sustainable earnings growth.

- Expanding high-margin tech segments, strong market position, disciplined cost controls, policy tailwinds, and global diversification are driving sustainable profit growth and long-term resilience.

Catalysts

About China Telecom- Provides mobile communications, wireline and satellite communications, internet access, cloud computing and computing power, AI, big data, quantum, ICT integration in the People’s Republic of China.

- Geopolitical tensions and ongoing international technology decoupling pose a significant threat to China Telecom's future access to advanced networking equipment, AI hardware, and global partnerships, which could diminish the company's global competitiveness, stall its overseas business revenue growth, and limit contributions to overall top-line growth.

- Heightened global regulatory barriers and escalating data sovereignty laws are likely to inhibit China Telecom's overseas expansion and partnerships, resulting in restricted access to high-growth international markets and reducing future international revenues and diversification potential.

- Persistent heavy capital expenditures in AI infrastructure, cloud computing, quantum technology, and network upgrades are set to continue putting pressure on free cash flow and may necessitate increased debt, ultimately eroding net margins and constraining sustainable earnings growth despite current gains in profit.

- Intensifying competition from domestic giants and emerging digital disruptors threatens to initiate price wars and drive down ARPU as more services become commoditized, directly impairing China Telecom's core revenue streams and compressing overall profitability over the long term.

- The slowing and eventual decline of China's population signals a shrinking addressable market for mobile, broadband, and digital services, which will limit organic revenue growth opportunities and could lead to long-term stagnation or contraction in domestic earnings as market saturation accelerates.

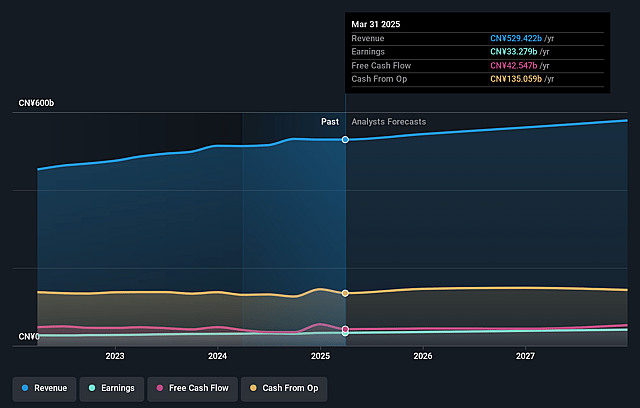

China Telecom Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on China Telecom compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming China Telecom's revenue will grow by 1.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 6.3% today to 6.8% in 3 years time.

- The bearish analysts expect earnings to reach CN¥37.9 billion (and earnings per share of CN¥0.41) by about June 2028, up from CN¥33.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 14.0x on those 2028 earnings, down from 14.6x today. This future PE is lower than the current PE for the US Telecom industry at 14.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.81%, as per the Simply Wall St company report.

China Telecom Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid growth of China Telecom's cloud, AI, and quantum technology segments-with cloud revenue rising 17.1% year-over-year and quantum-related revenues more than doubling-suggests new high-margin businesses are becoming a significant driver of top-line growth and net profit, which could support share price appreciation.

- High and stable customer satisfaction levels, as well as market share leadership in multiple areas (such as industrial digitalization and CRM applications), indicate robust franchise strength, which reduces churn, supports pricing power, and enhances recurring revenue and earnings stability.

- Successful cost control initiatives, evidenced by a 2.8% rise in operating expenses that lagged behind revenue growth, and a 70.7% rise in free cash flow, point to increasing efficiency and improving net margins, which can sustain or lift the company's valuation.

- Ongoing national policy support for digital infrastructure, green energy upgrades, and AI adoption aligns with China Telecom's stated strategy and investments, which de-risks capex, promotes long-term secular revenue expansion, and supports consistent growth in operating profits.

- Strategic international expansion, including rapid growth in overseas business and successful cloud, IoT, and submarine cable projects, is diversifying revenue sources beyond the mature domestic market, which can mitigate domestic saturation risk and bolster consolidated growth and earnings over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for China Telecom is HK$5.2, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of China Telecom's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$9.01, and the most bearish reporting a price target of just HK$5.2.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be CN¥558.3 billion, earnings will come to CN¥37.9 billion, and it would be trading on a PE ratio of 14.0x, assuming you use a discount rate of 6.8%.

- Given the current share price of HK$5.78, the bearish analyst price target of HK$5.2 is 11.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.