Key Takeaways

- International expansion and green technology leadership are set to drive outsized, resilient growth and margins far beyond current analyst expectations.

- Rapid shift to digital solutions and growing data center business create high-margin recurring revenues, while disciplined capital management supports strong shareholder returns.

- Heightened competition, regulatory risks, and rapid technological shifts threaten Wasion's margins, revenue stability, and ability to adapt amidst increasing global and compliance pressures.

Catalysts

About Wasion Holdings- An investment holding company, engages in the research and development, production, and sale of energy metering and energy efficiency management solutions for energy supply industries.

- Analysts broadly agree that Wasion's overseas expansion will continue to drive diversified and resilient revenue growth; however, they may be understating the scale, as Wasion is positioned to move from large contract wins in regions like Mexico, Tanzania, and across Southeast Asia, to a sustained leadership through new factories and local partnerships, unlocking exponential international revenue growth that could rapidly eclipse the domestic business.

- Analyst consensus notes that Wasion will benefit from secular smart grid upgrades and infrastructure cycles; yet, this misses the outsized impact of the accelerating global push for carbon neutrality, where Wasion's pioneering green and carbon metering technology and integration into new national standards could see it become the de facto provider to entire regions at premium pricing, ultimately lifting both revenue and net margins above peer averages.

- Wasion's transformation from hardware supplier to a full-stack energy digital solutions provider-including AI, IoT, big data, and advanced analytics-is accelerating faster than recognized, building a software and services revenue base that supports much higher long-term net margins and predictable recurring earnings than currently priced in.

- The rapidly expanding data center infrastructure and liquid cooling segment, including deepening strategic relationships with major clients like GDS, DayOne, ByteDance, and major telecom operators, is creating a new high-growth, high-margin business line that is on the verge of dramatically scaling up, with order backlogs already exceeding 1 billion RMB and visibility for several years of compounding earnings growth.

- With an ongoing commitment to generous dividend policies and robust free cash flow generation, alongside tight cost control and supply chain management in the face of increasing competition, Wasion is set to deliver sector-leading return on equity and earnings per share growth, reinforcing investor demand and supporting a potential re-rating of the stock.

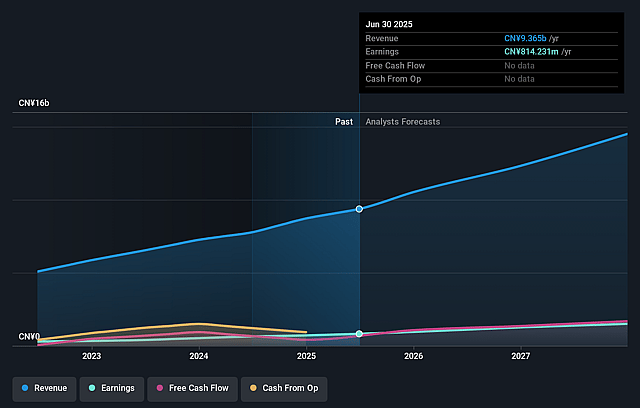

Wasion Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Wasion Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Wasion Holdings's revenue will grow by 23.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 8.7% today to 10.2% in 3 years time.

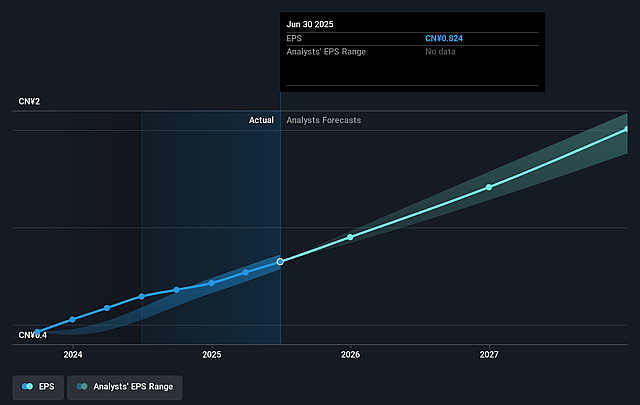

- The bullish analysts expect earnings to reach CN¥1.8 billion (and earnings per share of CN¥1.83) by about September 2028, up from CN¥814.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 9.7x on those 2028 earnings, down from 11.9x today. This future PE is lower than the current PE for the HK Electronic industry at 12.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.1%, as per the Simply Wall St company report.

Wasion Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition and price wars in both the domestic and international smart metering markets, especially as the company notes increased new entrants and fierce pricing battles in Southeast Asia, Africa, and South America, may compress gross margins and erode long-term profitability.

- Overreliance on large, state-owned enterprises and centralized grid tenders in China makes Wasion Holdings vulnerable to domestic regulatory changes, shifts in state procurement policies, and reductions in centralized tender volumes, all of which could materially impact future revenue stability and growth.

- Rapid technological advancements in areas like AI integration, digitalization of the power system, and data center cooling solutions may outpace Wasion's current R&D capabilities or product development, risking product obsolescence and undermining their ability to sustain net margins as competitors introduce disruptive innovations.

- Global geopolitical tensions, deglobalization trends, and the risk of US-China technological decoupling could restrict Wasion's access to advanced components and technology, hinder overseas expansion, and expose the company to foreign market access barriers, which could result in persistently weaker revenue diversification and impact earnings stability.

- The proliferation of alternative energy management and IoT platforms from global conglomerates, alongside stricter ESG and climate regulation requirements, may force higher ongoing capital expenditures and compliance costs, which could dilute net margins and require significant investments that may not translate to proportional revenue or profit growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Wasion Holdings is HK$14.99, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Wasion Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$14.99, and the most bearish reporting a price target of just HK$11.03.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CN¥17.8 billion, earnings will come to CN¥1.8 billion, and it would be trading on a PE ratio of 9.7x, assuming you use a discount rate of 9.1%.

- Given the current share price of HK$10.61, the bullish analyst price target of HK$14.99 is 29.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Wasion Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.