Key Takeaways

- Geopolitical risks, regulatory shifts, and rapid tech advancements threaten overseas growth, product relevance, and require increased R&D, compressing margins and pressuring future earnings.

- Heightened competition, reliance on unpredictable procurement cycles, and tightening contract terms from powerful utilities will erode market share, drive down prices, and contract long-term margins.

- Robust global expansion, operational efficiency, and leadership in green energy solutions are driving profit growth and strong shareholder returns amid accelerating international demand.

Catalysts

About Wasion Holdings- An investment holding company, engages in the research and development, production, and sale of energy metering and energy efficiency management solutions for energy supply industries.

- Mounting geopolitical tensions and rising protectionism threaten to disrupt Wasion's overseas expansion, increasing costs and putting recent growth in export markets such as Southeast Asia, Africa, and the Americas at risk, likely resulting in stagnating or declining revenue from international markets over the next several years.

- The rapid pace of regulatory change regarding global sustainability and carbon standards, along with accelerated advancements in new metering technologies, threatens to render Wasion's current product portfolio obsolete faster than anticipated. This will require heavier investment in R&D and compliance, compressing net margins and putting future earnings under sustained pressure.

- Intensifying competition in both domestic and international markets, especially from new Chinese entrants and global rivals, is expected to drive down average selling prices for smart meters and energy management products, eroding Wasion's market share and significantly squeezing gross and net margins long-term.

- Wasion's strategic dependence on Chinese state-grid-driven procurement cycles and project tenders introduces volatility and unpredictability to earnings and cash flow, especially as future centralized procurement in China and other emerging markets becomes less frequent or more fragmented, leading to inconsistent growth rates.

- As utilities continue to consolidate globally and gain bargaining power, contract terms are likely to tighten and pricing leverage will shift away from suppliers like Wasion, making it harder to maintain or grow top-line revenue and all but ensuring long-term margin contraction.

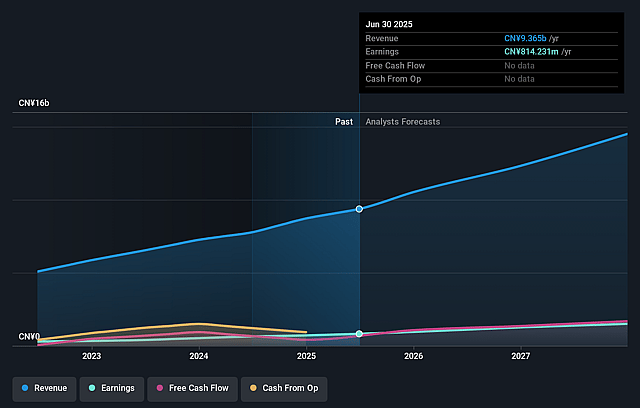

Wasion Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Wasion Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Wasion Holdings's revenue will grow by 16.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 8.7% today to 10.7% in 3 years time.

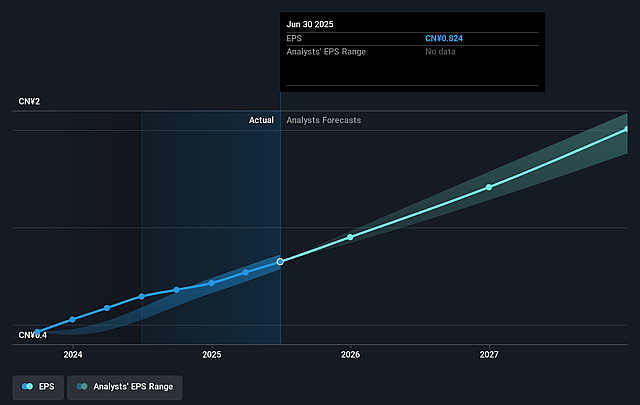

- The bearish analysts expect earnings to reach CN¥1.6 billion (and earnings per share of CN¥1.58) by about August 2028, up from CN¥814.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.2x on those 2028 earnings, down from 12.9x today. This future PE is lower than the current PE for the HK Electronic industry at 12.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.92%, as per the Simply Wall St company report.

Wasion Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Wasion Holdings is experiencing strong and diversified growth across all three of its major business segments, with Power AMI, C&F AMI, and ADO reporting significant year-on-year revenue increases of 30%, 13%, and 6% respectively, which supports expanding total group revenue and rising net profits.

- The company is executing on an expansive internationalization strategy, establishing newly operational factories in Indonesia, Malaysia, and Hungary, and winning major contracts across Asia, Africa, the Americas, and Europe, resulting in a 19% year-on-year increase in overseas revenue and a record RMB 3.6 billion in unfinished overseas orders, indicating robust forward visibility in future revenues.

- Wasion has achieved operating leverage and improved profitability through effective cost controls, automation, optimized supply chain, and a commitment to sustained R&D investment representing 7.2% of operating income, which resulted in higher margins and net profit attributable to parents rising by 33%, alongside an increase in net return on equity to 15.9%.

- The company is capitalizing on secular trends of global green energy, smart grid, and digital transformation, securing high-profile partnerships (e.g., GDS and DayOne for data centers, ByteDance, China Mobile, and China Telecom) and rolling out advanced solutions in data centers and liquid cooling, positioning itself at the forefront of utility and infrastructure digitization, which could provide multi-year revenue and profit tailwinds.

- Shareholder returns are being prioritized with a strong historical and sustained dividend payout ratio (50% in both 2024 and 2025), healthy cash flow, and moderate capex relative to the balance sheet, supporting financial flexibility and further increasing shareholder value through both earnings growth and capital return.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Wasion Holdings is HK$10.98, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Wasion Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$15.0, and the most bearish reporting a price target of just HK$10.98.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be CN¥14.7 billion, earnings will come to CN¥1.6 billion, and it would be trading on a PE ratio of 8.2x, assuming you use a discount rate of 8.9%.

- Given the current share price of HK$11.56, the bearish analyst price target of HK$10.98 is 5.3% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.