Last Update 05 Nov 25

Fair value Increased 1.05%388: Sustained All-Time-High Trading Volumes Will Drive Performance Momentum

Analysts have raised their price target for Hong Kong Exchanges and Clearing to HK$499.27 from HK$494.07. They cite sustained record trading volumes and an improved revenue growth outlook as the reasons for this adjustment.

Analyst Commentary

Recent analyst updates highlight both optimistic and cautious perspectives on Hong Kong Exchanges and Clearing, following advancements in trading activity and upward EPS revisions.

Bullish Takeaways- Bullish analysts point to consistently elevated trading volumes as a sign of robust underlying demand and market participation.

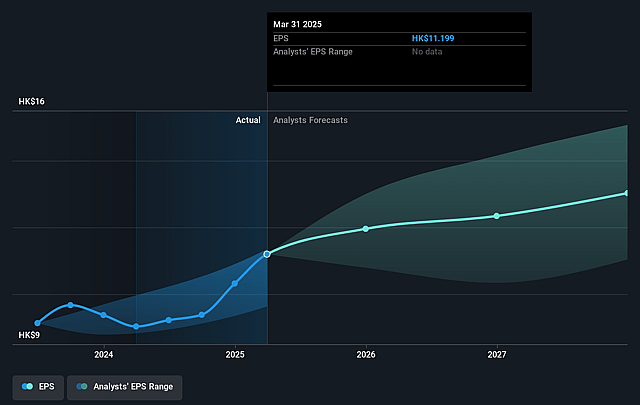

- The upward revision of FY25 to FY27 earnings per share estimates by up to 16 percent is viewed as a positive signal for earnings growth momentum.

- Valuation is seen as increasingly attractive, given the improved revenue outlook and resilience in core operations.

- Sustained all-time-high trading activity is expected to drive stronger performance over upcoming fiscal years.

- Bears caution that the company’s growth may be sensitive to fluctuations in market sentiment and trading behavior, potentially impacting revenue sustainability.

- There are concerns that current trading volume levels could normalize, placing pressure on year-over-year growth comparisons.

- Some analysts note that, despite the upgrades, competitive pressures within regional exchanges remain an ongoing execution risk.

What's in the News

- Hong Kong Exchanges and Clearing (HKEX) has signed a renewed Memorandum of Understanding with Abu Dhabi Securities Exchange, further strengthening their strategic partnership. The agreement focuses on market connectivity, joint events, dual listings, and ESG-related products. (Key Developments)

- PricewaterhouseCoopers will retire as Auditor following the 2026 AGM, concluding years of service. HKEX has expressed appreciation for their contribution. (Key Developments)

- An interim dividend of HKD 6 per share has been declared for the year ending December 2025. The ex-dividend date is 02 September and payment will be made on 16 September 2025. (Key Developments)

- A board meeting is scheduled for 05 November 2025 to approve the unaudited consolidated results for the nine months ending 30 September 2025. (Key Developments)

Valuation Changes

- The consensus analyst price target has risen slightly, from HK$494.07 to HK$499.27.

- The discount rate has fallen modestly, decreasing from 8.18 percent to 8.08 percent.

- The revenue growth forecast has increased, moving from 6.04 percent to 6.96 percent.

- The net profit margin is projected to decline marginally, from 63.31 percent to 62.25 percent.

- The future P/E ratio estimate is largely unchanged, adjusting marginally from 40.99x to 40.93x.

Key Takeaways

- HKEX is leveraging Asia's economic rise and expanding global connectivity to strengthen its position, diversify revenues, and drive sustainable, higher-margin growth.

- Investments in fintech, product expansion, and platform upgrades increase operational efficiency, scalability, and earnings resilience amid shifting industry trends.

- Intensifying competition, regulatory and political risks, technological disruption, macroeconomic sensitivity, and rising costs threaten HKEX's core revenue streams and long-term profitability.

Catalysts

About Hong Kong Exchanges and Clearing- Owns and operates stock and futures exchanges, and related clearing houses in Hong Kong, the United Kingdom, and Mainland China.

- HKEX is poised to benefit materially from the continued growth of Asia as a global economic powerhouse, as evidenced by record trading volumes across multiple asset classes, a robust IPO pipeline with increasing international listings, and ongoing enhancements to fundraising infrastructure-supporting sustainable growth in revenue and profit.

- HKEX has firmly positioned itself as a global gateway between China and the world, with strong growth in Southbound and Northbound Connect volumes, expanding access for Mainland and international investors, and upcoming initiatives such as Southbound RMB counters and expanded product eligibility-likely to drive further increases in trading and listing-related revenues.

- Strategic investments in fintech, platform upgrades, and efficiency improvements-such as introducing severe weather trading, ongoing market microstructure enhancements, and studies into digital asset integration-should drive operational scalability and support long-term margin expansion.

- Product diversification via successful expansion into derivatives, ETPs, commodities, fixed income, and ESG-related offerings has created new recurring and higher-margin revenue streams, reducing reliance on traditional cash equities and enhancing overall earnings stability.

- Structural industry shifts toward increased ETF usage, passive investing, and heightened retail and institutional activity in Asia have translated into surging ETP and derivatives volumes (e.g., record 163% YoY growth in ETP turnover), supporting growth in transaction revenues and future-proofing the top line against cyclical volatility.

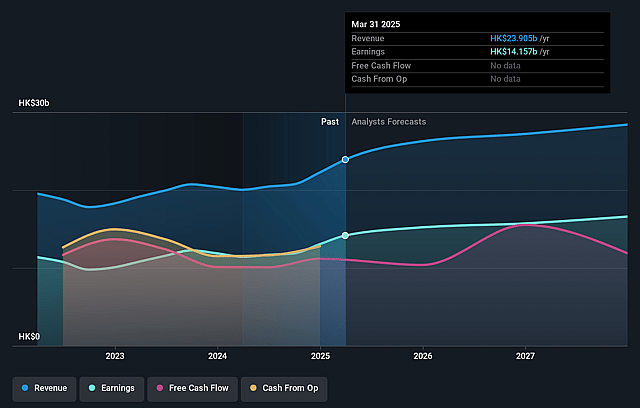

Hong Kong Exchanges and Clearing Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Hong Kong Exchanges and Clearing's revenue will grow by 6.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 60.3% today to 63.2% in 3 years time.

- Analysts expect earnings to reach HK$19.3 billion (and earnings per share of HK$15.16) by about September 2028, up from HK$15.4 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as HK$15.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 40.6x on those 2028 earnings, up from 35.8x today. This future PE is greater than the current PE for the HK Capital Markets industry at 27.5x.

- Analysts expect the number of shares outstanding to grow by 0.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.09%, as per the Simply Wall St company report.

Hong Kong Exchanges and Clearing Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid growth in onshore China's domestic exchanges and the reopening of the Asia IPO queue could intensify competition for listings, potentially diverting Mainland Chinese and regional IPOs away from HKEX, risking a slowdown in new listing revenue and affecting future top-line growth.

- HKEX's continued reliance on Southbound and Northbound capital flows exposes it to potential regulatory changes, capital controls, or political tensions between Mainland China and Hong Kong, which could materially dampen trading volumes and core revenue streams over the long term.

- The global shift toward digital assets and decentralized finance (DeFi), as evidenced by rapid advances in digital asset ecosystems and regulatory changes (e.g., stablecoin legislation in Hong Kong), may erode HKEX's traditional exchange infrastructure-if adaptation lags, this threatens long-term relevance and could displace significant trading and clearing revenues.

- Despite ongoing diversification, HKEX remains highly sensitive to macroeconomic conditions and short-term interest rates (e.g., HIBOR volatility impacting net investment income). Prolonged low interest rate environments and market downturns would pressure both net margins and earnings, given the cyclical nature of capital market activity.

- Increased operational and compliance costs-including rising staff and IT expenses, one-off regulatory fines, and mounting requirements under new global tax and regulatory regimes-could place persistent downward pressure on net margins, particularly if revenue growth slows or competitive fee compression accelerates.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of HK$488.429 for Hong Kong Exchanges and Clearing based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$542.0, and the most bearish reporting a price target of just HK$340.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be HK$30.5 billion, earnings will come to HK$19.3 billion, and it would be trading on a PE ratio of 40.6x, assuming you use a discount rate of 8.1%.

- Given the current share price of HK$437.6, the analyst price target of HK$488.43 is 10.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.