Key Takeaways

- Intensifying competition, regulatory fragmentation, and the maturation of China's domestic markets are undermining HKEX's position as a premier listing venue.

- Shifts to decentralized finance and private capital markets threaten core revenue streams by reducing trading volumes and curtailing long-term growth opportunities.

- Expansion of cross-border initiatives, technology modernization, and diversification into data products solidify HKEX's role as a resilient, innovative, and profitable capital markets platform.

Catalysts

About Hong Kong Exchanges and Clearing- Owns and operates stock and futures exchanges, and related clearing houses in Hong Kong, the United Kingdom, and Mainland China.

- The growing divergence between Chinese and Western regulatory frameworks, combined with ongoing geopolitical tensions, threatens to suppress cross-border capital flows and discourage global firms from choosing Hong Kong for listings, leading to a significant long-term decline in IPO volumes and trading revenues.

- Hong Kong's increasing competition with regional financial centers such as Singapore is eroding its status as the dominant gateway to China; as companies and investors diversify away, HKEX's pipeline of new listings and cross-border activity faces structural headwinds that will constrain revenue and earnings growth.

- The persistent rise of decentralized finance platforms is starting to divert trading and settlement activity away from traditional exchanges, putting at risk HKEX's core revenue streams by undercutting transaction volumes and shrinking net margins over the coming years.

- The maturing of China's domestic capital markets, combined with stricter capital controls and onshore alternatives, will gradually sap the overseas IPO pipeline and capital-raising activity in Hong Kong, resulting in diminished listing, trading, and clearing revenues for HKEX.

- Industry-wide shifts towards private capital markets and regulatory fragmentation are reducing the number of public listings and increasing barriers to international trading, progressively shrinking HKEX's addressable market and putting downward pressure on medium

- and long-term earnings potential.

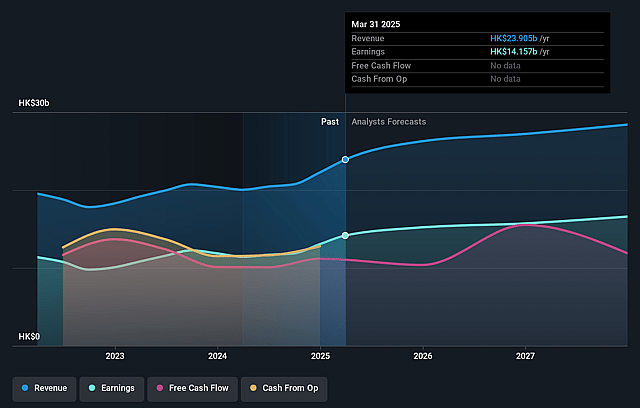

Hong Kong Exchanges and Clearing Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Hong Kong Exchanges and Clearing compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Hong Kong Exchanges and Clearing's revenue will grow by 3.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 59.2% today to 55.6% in 3 years time.

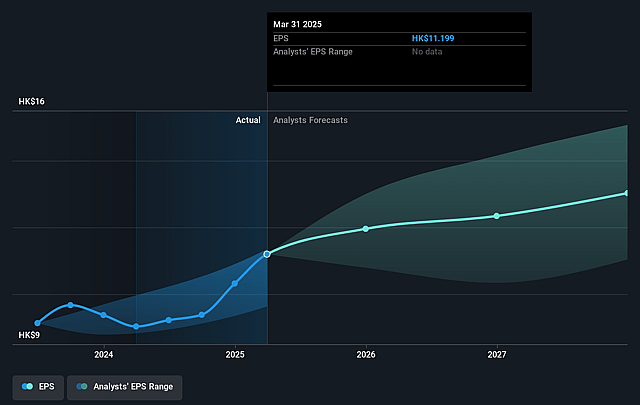

- The bearish analysts expect earnings to reach HK$14.6 billion (and earnings per share of HK$11.48) by about August 2028, up from HK$14.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 38.8x on those 2028 earnings, down from 39.4x today. This future PE is greater than the current PE for the HK Capital Markets industry at 32.7x.

- Analysts expect the number of shares outstanding to decline by 0.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.12%, as per the Simply Wall St company report.

Hong Kong Exchanges and Clearing Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite macro and geopolitical uncertainties, HKEX continues to see record financial performance, with revenue and profit both up double digits year-on-year in 2024, suggesting robust core earnings momentum that may support future share price resilience.

- The ongoing enhancement and expansion of Connect programs has led to all-time highs in Stock Connect volumes and derivatives activity, broadening revenue opportunities and reinforcing HKEX as an essential platform for cross-border capital flows between China and the world.

- Strategic diversification into adjacent businesses, including new data and index products, and plans for modern technology platforms such as real-time trade processing and around-the-clock derivatives trading, provide the potential for higher-margin, recurring revenue streams that could lift net margins over time.

- The listing pipeline remains strong, with 30 Asia-listed companies pursuing dual listings and recent regulatory reforms making Hong Kong increasingly attractive for innovative companies and major IPOs, which could drive future growth in listing fee revenues.

- Ongoing investment in talent, technology, and operational improvements, together with consistently high EBITDA margins above 70 percent, demonstrate long-term cost discipline and sustainable profit generation, supporting the potential for continued earnings and dividend growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Hong Kong Exchanges and Clearing is HK$354.68, which represents two standard deviations below the consensus price target of HK$462.64. This valuation is based on what can be assumed as the expectations of Hong Kong Exchanges and Clearing's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$540.0, and the most bearish reporting a price target of just HK$340.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be HK$26.2 billion, earnings will come to HK$14.6 billion, and it would be trading on a PE ratio of 38.8x, assuming you use a discount rate of 8.1%.

- Given the current share price of HK$441.2, the bearish analyst price target of HK$354.68 is 24.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.