Key Takeaways

- Expansion of Connect programs, data monetization, and cross-border capital flows position HKEX for significant, structural long-term revenue growth and improved profit margins.

- Investments in derivatives, new platforms, and robust trading infrastructure enhance HKEX's competitiveness, enabling stronger earnings scalability and increased market share among global exchanges.

- Structural decoupling, regulatory uncertainty, rising competition, market sentiment shifts, and industry fee pressures threaten HKEX's revenues, margins, and long-term growth prospects.

Catalysts

About Hong Kong Exchanges and Clearing- Owns and operates stock and futures exchanges, and related clearing houses in Hong Kong, the United Kingdom, and Mainland China.

- While analysts broadly agree that enhancements to Connect programs (such as inclusion of ETFs, REITs, and RMB Counters) should raise trading activity, this may greatly understate the potential for exponential revenue growth; deepening capital market reforms in China and continued liberalization could unlock a wave of cross-border flows, positioning HKEX as the single most important access point for both global and Chinese investors, structurally boosting long-term revenues and margins far beyond current consensus.

- Analyst consensus believes that expansion and modernization of derivatives, ETPs, and new platforms can modestly increase trading volume and earnings; however, the accelerating shift toward more sophisticated risk management, increased use of alternatives by Asian institutional investors, and the digitization of market access could drive a step-change in derivatives and ETP volumes, fundamentally improving earnings scalability and operating leverage for HKEX.

- The rapid internationalization of Chinese capital and listings-particularly a surge in dual primary and secondary IPOs from globally minded Asian technology and specialist companies-could soon turn Hong Kong into the dominant Asian hub for new economy listings, supporting a multi-year compound annual growth rate in recurring listing and trading fee revenues.

- HKEX's move to monetize vast proprietary data assets through its new Data Marketplace and development of indices and ESG-related products is set to transform the company's business mix, with high-margin, subscription-based revenue streams potentially rivaling traditional trading income and materially expanding overall group net profit margins.

- As regional and global investors structurally allocate more to Chinese and broader Asian assets, HKEX's investments in resilient, always-on infrastructure-such as severe weather trading and the coming 24/7 derivatives trading-uniquely position it to outcompete regional exchanges, driving sustained share gains in international capital flows and underpinning double-digit annual growth in core earnings over the next decade.

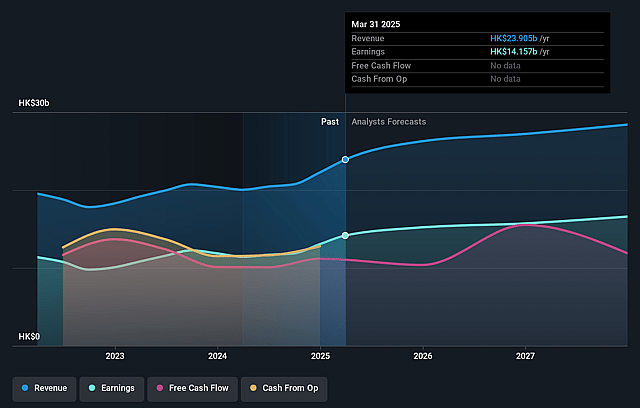

Hong Kong Exchanges and Clearing Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Hong Kong Exchanges and Clearing compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Hong Kong Exchanges and Clearing's revenue will grow by 12.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 59.2% today to 59.4% in 3 years time.

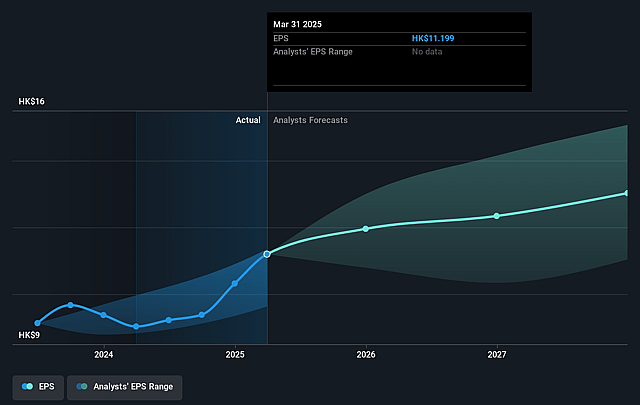

- The bullish analysts expect earnings to reach HK$19.9 billion (and earnings per share of HK$15.68) by about August 2028, up from HK$14.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 43.2x on those 2028 earnings, up from 39.4x today. This future PE is greater than the current PE for the HK Capital Markets industry at 32.7x.

- Analysts expect the number of shares outstanding to decline by 0.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.12%, as per the Simply Wall St company report.

Hong Kong Exchanges and Clearing Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Structural decoupling between China and Western economies could limit cross-border listings and international investor flows, which would negatively impact HKEX's trading volumes and transaction-based revenue.

- The IPO pipeline remains vulnerable to ongoing regulatory scrutiny and capital controls in Mainland China, as suggested by market discussions about stepped-up approval processes for IPO proceeds, potentially reducing new listings and impacting listing fee and commission revenue.

- Heightened competition from increasingly sophisticated Mainland exchanges and evolving international exchanges could erode HKEX's market share, leading to slower top-line revenue growth and squeezing net margins due to higher costs to maintain competitiveness.

- Reliance on market vibrancy and turnover, as seen with the recent outperformance tied to short-term stimulus, exposes HKEX to significant earnings volatility if global investment sentiment shifts or if the rally in China/Hong Kong equities loses momentum.

- Industry-wide fee compression, coupled with global exchange consolidation and the rise of decentralized finance platforms, poses a long-term risk to HKEX's ability to maintain historical revenue growth and robust profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Hong Kong Exchanges and Clearing is HK$540.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Hong Kong Exchanges and Clearing's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$540.0, and the most bearish reporting a price target of just HK$340.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be HK$33.5 billion, earnings will come to HK$19.9 billion, and it would be trading on a PE ratio of 43.2x, assuming you use a discount rate of 8.1%.

- Given the current share price of HK$441.2, the bullish analyst price target of HK$540.0 is 18.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.