Last Update 11 Dec 25

Fair value Decreased 0.079%CNA: Cost Cutting Plan Will Support Long Term Earnings Momentum

Analysts have nudged their average price target for Centrica slightly lower to about £1.96. This reflects a modest recalibration of fair value assumptions, even as they highlight potential upside from sector tailwinds, improving renewables exposure, and prospective cost cutting initiatives.

Analyst Commentary

Bullish Takeaways

- Bullish analysts highlight Centrica's positioning as a leading UK utilities name, noting that its scale and diversified operations support sustained earnings growth and a premium relative valuation within the sector.

- Recent target price increases to around 210 GBp reflect confidence that improving onshore wind and solar economics can enhance returns from Centrica's growing renewables exposure.

- Expectations for a potential cost cutting plan in early 2026 are seen as a catalyst that could lift margins, underpin free cash flow, and support further capital returns to shareholders.

- Supportive sector dynamics in European utilities, combined with the UK being viewed as an attractive regulatory and demand backdrop, are cited as reasons for further upside to current price targets.

Bearish Takeaways

- Bearish analysts argue that after a strong share price performance, much of the near term earnings recovery is already reflected in valuations, which justifies a more neutral stance.

- Some caution that execution risks around delivering planned cost reductions and integrating additional renewables capacity could limit upside if timelines slip or savings fall short.

- There is concern that ongoing regulatory scrutiny and potential policy changes in the UK utilities market could compress allowed returns and weigh on long term growth assumptions.

- More conservative forecasts point to limited multiple expansion from here, with upside increasingly dependent on flawless operational delivery and favorable market conditions.

What's in the News

- Centrica and X-Energy sign a Joint Development Agreement to deploy Xe-100 advanced modular nuclear reactors in the UK, targeting a potential fleet of up to 6 GW of capacity (Key Developments).

- The preferred first site for the Xe-100 rollout is EDF and Centrica's Hartlepool location, positioning the North East of England as an early hub for advanced nuclear deployment (Key Developments).

- X-Energy's Xe-100 reactors, designed to deliver 80 MW of electricity or 200 MW of thermal heat each, aim to support both power generation and industrial steam applications through modular, scalable plants (Key Developments).

- The partnership is expected to leverage X-Energy's experience from projects with Dow in Texas and Energy Northwest with Amazon, potentially accelerating timelines and de-risking construction for UK deployment (Key Developments).

Valuation Changes

- Consensus analyst price target fair value estimate nudged slightly lower from £1.96 to about £1.96, implying a marginal downward revision in implied upside.

- Discount rate unchanged at 7.07 percent, indicating no shift in the assumed risk profile or cost of capital.

- Revenue growth forecast has risen slightly from approximately 1.17 percent to about 1.17 percent, reflecting a modestly more optimistic top line outlook.

- Net profit margin estimate has edged down marginally from around 3.41 percent to about 3.41 percent, signalling a very small softening in profitability expectations.

- Future P/E multiple has fallen slightly from roughly 16.41x to about 16.40x, pointing to a minimal compression in the valuation underpinning the model.

Key Takeaways

- Expanding low-carbon and regulated infrastructure investments, alongside regulatory support, strengthen revenue stability and protect earnings from market volatility.

- Digital transformation and growth in distributed energy and ancillary services drive cost efficiency, customer retention, and unlock higher-margin revenue opportunities.

- Dependence on favorable regulation, weather volatility, rising competition, and persistent bad debt are threatening Centrica's revenue stability, margins, and long-term earnings predictability.

Catalysts

About Centrica- Operates as an integrated energy company in the United Kingdom, Ireland, Scandinavia, North America, and internationally.

- Centrica's expanding investment in regulated, low-carbon generation assets (notably the Sizewell C nuclear project), combined with opportunities in potential nuclear life extensions and carbon storage (Morecambe Net Zero), positions the company to capture stable, long-duration, inflation-linked returns amid accelerating decarbonization policies-supporting predictable revenue and enhanced margins over the long term.

- Ongoing digital transformation-migration to cloud platforms, deployment of AI, and automation of customer and operational processes-is already reducing operating costs and improving customer retention, with management targeting a significant rebasing of the cost base and improved cross-selling, driving higher operating margins and EPS growth.

- Centrica is well-placed to benefit from rising electrification of heating and transport, as the shift increases demand for integrated energy solutions, distributed energy, and demand response services, enlarging the company's addressable revenue base in both residential and SME markets.

- The growth and future commercialization of Centrica's Meter Asset Provider (MAP) and potential to bundle/finance other distributed energy assets (e.g., heat pumps, EV chargers) could create new contracted revenue streams and higher-margin ancillary services, diversifying and smoothing top-line growth.

- Regulatory shifts supporting energy security (e.g., capacity market contracts for peaker plants and potential support for gas storage/Rough) and resilience underpin a larger share of infrastructure-based, stable cash flows, shielding net earnings from energy market volatility and enhancing downside protection for long-term investors.

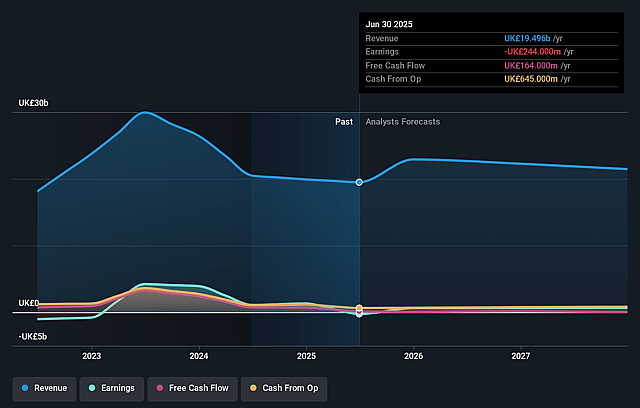

Centrica Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Centrica's revenue will grow by 1.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from -1.3% today to 3.4% in 3 years time.

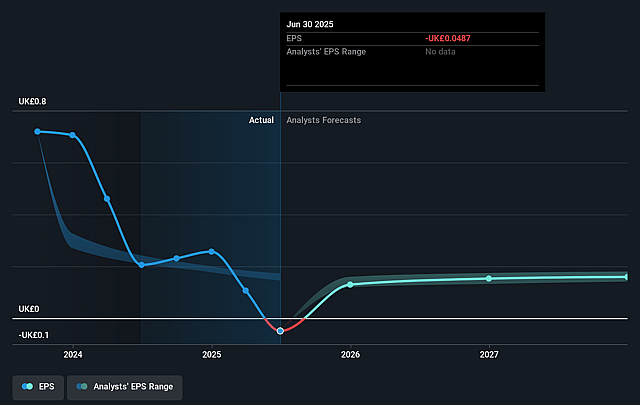

- Analysts expect earnings to reach £693.3 million (and earnings per share of £0.17) by about September 2028, up from £-244.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting £799 million in earnings, and the most bearish expecting £433 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.7x on those 2028 earnings, up from -29.9x today. This future PE is lower than the current PE for the GB Integrated Utilities industry at 18.4x.

- Analysts expect the number of shares outstanding to decline by 1.62% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.82%, as per the Simply Wall St company report.

Centrica Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing closure risk and financial losses at the Rough gas storage facility underscore Centrica's dependence on supportive government regulation; if regulatory or market outcomes are unfavorable, Rough could shut down, leading to a sizeable loss of stable revenue, significant decommissioning costs (£300 million), and reduced balance sheet flexibility over several years, impairing earnings predictability.

- Centrica's core British Gas Energy residential supply business continues to face stubbornly high bad debt levels (at 3% of revenue, around triple pre-crisis levels), ongoing customer attrition in certain product areas, and increased switching as customers move away from regulated tariffs to fixed tariffs, all of which threaten top-line revenue, increase credit risk, and pressure net margins over the long term.

- Weather volatility and structural climate change risk (e.g., persistent warm winters) materially impact energy demand and Centrica's ability to forecast and hedge exposure, causing major swings in operating profit (£100 million reversal this period); this introduces long-term unpredictability in earnings and may lead to sustained downward pressure on profits if abnormal weather patterns persist.

- The company's investment pipeline is heavily reliant on regulatory, governmental, or policy decisions (e.g., Sizewell C nuclear, Morecambe Net Zero, and new energy infrastructure projects), introducing execution delays, risks of policy reversals, and capital deployment uncertainty-potentially resulting in idle cash, foregone revenues, and lower long-term returns if decisions or terms are unfavorable or slow to materialize.

- Increased competition in the energy retail and services markets-facilitated by digital switching, ongoing consumer migration to fixed tariffs, and commoditization of protection products-coupled with heightened regulatory intervention (price caps, consumer protections), is eroding Centrica's pricing power, customer retention, and market share, which may constrain revenue growth and compress margins in its core business lines over the coming years.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £1.868 for Centrica based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £2.2, and the most bearish reporting a price target of just £1.55.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £20.2 billion, earnings will come to £693.3 million, and it would be trading on a PE ratio of 14.7x, assuming you use a discount rate of 6.8%.

- Given the current share price of £1.55, the analyst price target of £1.87 is 17.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Centrica?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.