Key Takeaways

- Strong integration of recent acquisitions, portfolio transformation, and operational efficiencies position Spectris for accelerated revenue and margin growth ahead of expectations.

- Strategic focus on automation, innovation, and digital solutions is boosting recurring revenue, resilience, and access to high-growth sectors like life sciences and clean energy.

- Overexposure to core sectors, sluggish market demand, and integration risks from acquisitions could threaten revenue stability, margin strength, and Spectris' long-term competitive position.

Catalysts

About Spectris- Provides precision measurement solutions.

- Analysts broadly agree that recent acquisitions will yield operational synergies, but the cross-division integration of Micromeritics, SciAps, and Piezocryst is progressing ahead of expectations, with management and teams already identifying greater revenue and cost synergy opportunities than initially forecast-supporting higher-than-expected growth in both revenue and net margins by 2026.

- The profit improvement program, including accelerated ERP rollout, is on track to deliver benefits faster and at lower run-rate costs than consensus assumes; the company has learned from early rollouts and is already seeing marked operational efficiencies that could result in operating margins exceeding the 20 percent target before 2027, directly lifting earnings and margin trajectory.

- The global shift toward automation, digitisation, and stricter quality/regulatory standards across industries is driving structurally rising demand for precision measurement and analytics solutions, and Spectris-with its expanded, innovation-led portfolio and leading positions in high-growth sectors such as life sciences, semiconductors, and clean energy-is optimally positioned to capture sustained double-digit top-line growth as these trends accelerate.

- Record R&D investment, coupled with an expanding suite of software-enabled and data analytics products, is rapidly increasing higher-margin recurring revenue streams, meaning earnings growth and cash conversion are likely to surpass consensus forecasts as product mix shifts toward digital and subscription-based models.

- Portfolio transformation and disciplined capital allocation-demonstrated by the divestment of eight lower-margin businesses and redeployment into higher-margin assets-have created a structurally more resilient and less cyclical business model, reducing downside risk and driving continued improvement in return on capital employed and earnings stability over the medium to long term.

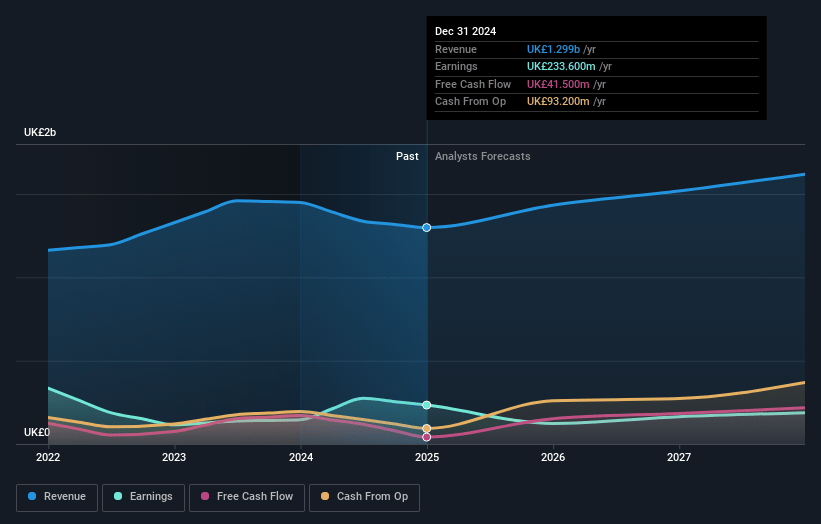

Spectris Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Spectris compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Spectris's revenue will grow by 8.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 18.0% today to 20.6% in 3 years time.

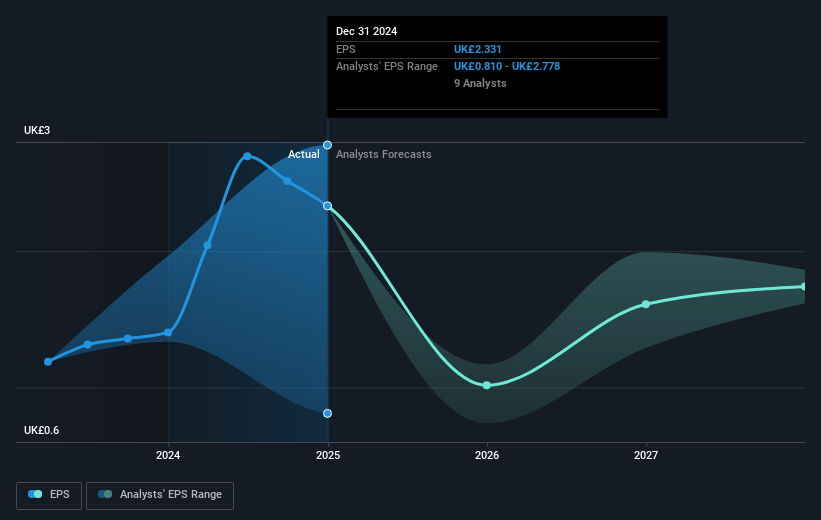

- The bullish analysts expect earnings to reach £344.5 million (and earnings per share of £2.01) by about July 2028, up from £233.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.8x on those 2028 earnings, down from 16.9x today. This future PE is lower than the current PE for the GB Electronic industry at 30.2x.

- Analysts expect the number of shares outstanding to decline by 1.99% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.62%, as per the Simply Wall St company report.

Spectris Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged weakness and subdued demand across multiple end markets, alongside customer hesitance to invest in CapEx and R&D due to high capital costs, may suppress future revenues and profit growth if macroeconomic recovery remains slow.

- Spectris' increasing reliance on a handful of core sectors like automotive, aerospace, and academia exposes the company to sector-specific downturns, which can cause significant earnings volatility and risk depressed revenue, as evidenced by declines in automotive and academia during 2024.

- The ongoing global transition towards digitalization and automation in measurement solutions poses a threat to Spectris' traditional hardware-centric product lines, and if the pace of R&D and product innovation lags behind competitors or fails to meet evolving customer preferences, the company could face both margin compression and loss of market share.

- Continued divestiture of non-core assets, while improving the focus of the portfolio, may decrease operational scale and hinder the ability to absorb fixed costs, thereby increasing pressure on net margins if top-line sales do not recover in line with expectations.

- Execution and integration risks from recent sizable acquisitions, especially in integrating complex new businesses and ERP rollout, could lead to increased costs, operational inefficiencies, and potential dilution of earnings per share if synergies fail to materialize at the planned pace.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Spectris is £40.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Spectris's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £40.0, and the most bearish reporting a price target of just £26.25.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be £1.7 billion, earnings will come to £344.5 million, and it would be trading on a PE ratio of 13.8x, assuming you use a discount rate of 8.6%.

- Given the current share price of £39.8, the bullish analyst price target of £40.0 is 0.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.