Key Takeaways

- Accelerating digitalization and new low-cost competitors threaten Spectris's pricing power, margins, and traditional hardware market share.

- Lagging SaaS innovation and mounting regulatory demands may restrict growth, increase costs, and weaken earnings resilience.

- Focus on premium analytical solutions, digital growth, innovation, and successful acquisitions drives sustained margin expansion and strengthens market leadership.

Catalysts

About Spectris- Provides precision measurement solutions.

- Accelerating adoption of AI-powered data analytics and digital twin technologies threatens to commoditize Spectris's core test and measurement instrumentation, leading to sustained price erosion and persistent margin pressure even as the company invests in digital product launches; this risk undermines both long-term pricing power and net margins.

- Increasing protectionism and ongoing geopolitical tensions, particularly between major trading blocs, may continually disrupt Spectris's international supply chains and restrict access to critical growth markets such as China, resulting in elevated input costs and greater revenue volatility over the planning horizon.

- The persistent rise of open-source instrumentation platforms and aggressive entry of lower-cost Asian competitors is likely to erode Spectris's market share in traditional hardware categories, limiting the ability to offset cyclical revenue declines with volume growth and compressing overall gross margins.

- Prolonged underinvestment in true SaaS-enabled analytics and cloud-native offerings compared to more agile peers risks Spectris being outpaced in recurring software revenue streams, ultimately constraining future top-line growth and weakening long-term earnings resilience as industry reliance on cloud platforms intensifies.

- Stricter sustainability regulations and heightened ESG scrutiny worldwide will require Spectris to invest heavily in R&D and compliance just to maintain access to key end markets, increasing operating costs and absorbing capital that would otherwise support innovation, further restricting growth in net profit and return on invested capital.

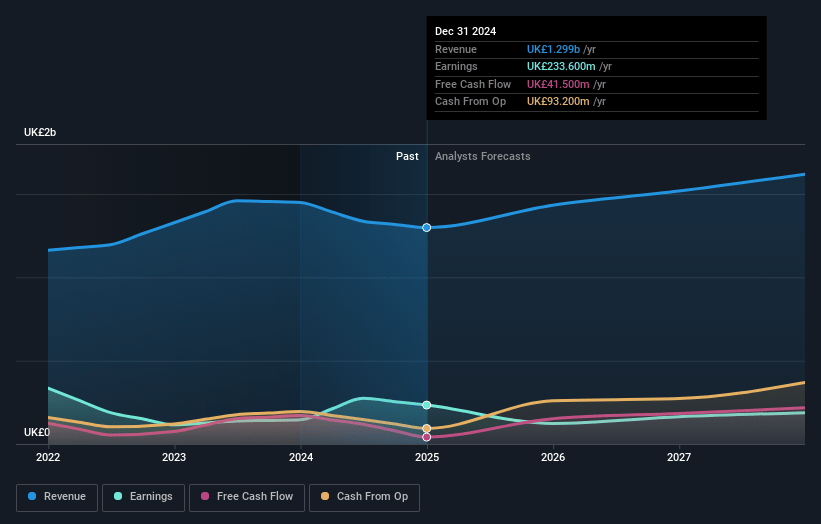

Spectris Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Spectris compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Spectris's revenue will grow by 5.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 18.0% today to 11.1% in 3 years time.

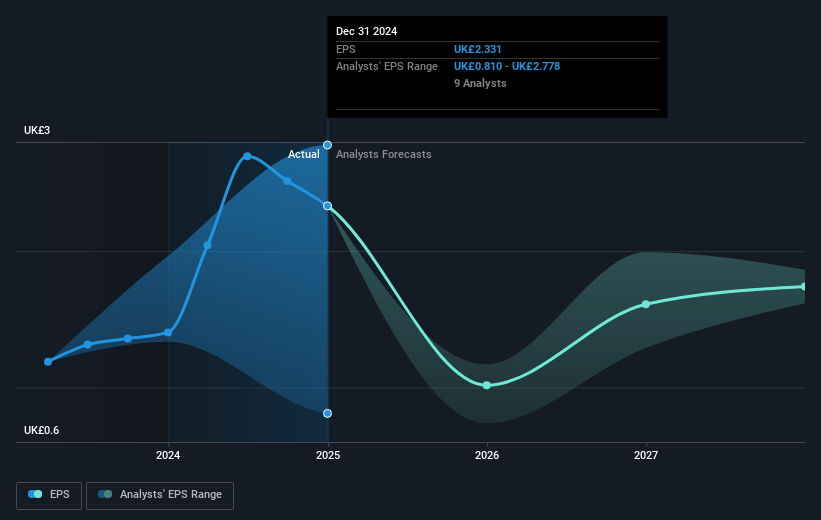

- The bearish analysts expect earnings to reach £171.1 million (and earnings per share of £1.68) by about July 2028, down from £233.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 18.3x on those 2028 earnings, up from 16.9x today. This future PE is lower than the current PE for the GB Electronic industry at 30.0x.

- Analysts expect the number of shares outstanding to decline by 1.99% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.62%, as per the Simply Wall St company report.

Spectris Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Spectris has completed a significant portfolio rationalization and is now focused on high-growth, high-margin segments with leading global positions in premium analytical and test measurement solutions, which positions the company to capitalize on long-term secular trends such as industry digitization and advanced manufacturing, supporting sustained revenue and profit growth.

- The company is benefiting from an acceleration of service and software revenues, with a strong emphasis on digital solutions and recurring revenue streams-delivering better earnings predictability and margin resilience, and underpinning long-term operating profit expansion.

- Continued, disciplined investment in innovation and R&D has resulted in a record year for new product launches and a robust pipeline of digital product offerings, strengthening the company's market position and pricing power, and enhancing prospects for organic revenue growth.

- The successful integration of recent high-quality, high-growth acquisitions (Micromeritics, SciAps, and Piezocryst) is expected to deliver substantial cost and revenue synergies, supporting a material uplift in earnings and operating margins over the next two years as the synergy benefits are realized.

- Spectris' operational performance is further supported by a comprehensive profit improvement program and the rollout of an advanced ERP system, which is targeting at least 150 basis points of margin improvement and improved working capital efficiency, setting a clear pathway to operating margins in excess of 20 percent and stronger net income generation by 2027.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Spectris is £26.25, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Spectris's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £40.0, and the most bearish reporting a price target of just £26.25.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £1.5 billion, earnings will come to £171.1 million, and it would be trading on a PE ratio of 18.3x, assuming you use a discount rate of 8.6%.

- Given the current share price of £39.74, the bearish analyst price target of £26.25 is 51.4% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.