Last Update 15 Dec 25

Fair value Increased 1.25%SGE: Cloud Transition And Buybacks Will Support Durable Long Term Upside

Analysts now set a modestly higher fair value for Sage Group at approximately £16.20 per share, up from about £16.00. This reflects confidence in its durable growth model and recent earnings delivery, even as they factor in slightly slower revenue growth and margin expectations.

Analyst Commentary

Bullish analysts continue to highlight Sage Group as a structurally attractive compounder, even as headline target changes fluctuate with near term sentiment on growth. Recent research points to the company’s ability to execute against guidance and sustain double digit cloud led expansion, supporting a premium multiple versus traditional software peers.

While some price targets have been trimmed to reflect moderation in annual recurring revenue growth and margin assumptions, the prevailing view among more optimistic voices is that these adjustments are largely tactical. They argue that the medium term earnings power of the business remains underappreciated, particularly as Sage converts its installed base to cloud subscriptions and deepens penetration in higher value mid market customers.

Incremental upgrades following the latest full year results and outlook have reinforced confidence that management can deliver on its commitments. Bullish analysts see continued scope for positive estimate revisions as operational efficiency, disciplined capital allocation, and steady mix shift toward higher margin software as a service drive an improving earnings algorithm.

Bullish Takeaways

- Recent upward revisions to price targets following stronger than expected results signal renewed confidence in Sage Group’s execution and support a valuation closer to the upper end of its historical trading range.

- Optimistic research notes frame the equity story around a durable growth model, with cloud transition and consistent upgrades viewed as drivers of sustained mid to high single digit revenue growth and expanding cash generation.

- Bullish analysts argue that market concerns over slowing ARR growth are overstated, suggesting that the risk is manageable relative to Sage’s long runway in its core segments and scope for operational leverage.

- Positive commentary emphasizes that, at current levels, the shares still screen undervalued against long term growth and margin potential, leaving room for further rerating if Sage continues to deliver against its guidance.

What's in the News

- Sage issued earnings guidance for fiscal 2026, targeting organic total revenue growth of 9% or above, underscoring management confidence in the medium term growth outlook (company guidance).

- The Board authorized a new share buyback plan, supporting capital returns and signaling confidence in the balance sheet and cash generation (buyback announcement).

- Sage launched a share repurchase program of up to £300 million, valid until March 19, 2026, adding quantitative detail to the broader buyback authorization (share repurchase program).

- The company proposed a final dividend of 14.40 pence per share for the year ended September 30, 2025, subject to AGM approval on February 5, 2026, with payment scheduled for February 10, 2026 (dividend proposal).

- Sage unveiled the UK's first AI powered MTD for Income Tax Agent, leveraging Sage Copilot to automate quarterly tax updates for accountants ahead of the 2026 Making Tax Digital deadline (product announcement).

Valuation Changes

- Fair Value: nudged higher from £16.00 to £16.20 per share, reflecting a modest uplift in long term expectations.

- Discount Rate: risen slightly from 9.11% to about 9.20%, indicating a marginally higher assumed cost of capital or risk profile.

- Revenue Growth: trimmed from roughly 10.63% to 10.01%, signaling a small moderation in medium term top line growth assumptions.

- Net Profit Margin: reduced slightly from about 19.18% to 18.79%, implying a modestly more cautious view on future profitability.

- Future P/E: effectively unchanged, easing marginally from 29.77x to 29.72x, suggesting a stable valuation multiple despite the updated inputs.

Key Takeaways

- AI-driven automation and cloud-native products position Sage for stronger customer retention, gross margin expansion, and leading growth in compliance-focused SaaS financial solutions.

- Intacct's rapid international adoption and Sage's embedded network services enable market share gains, multi-year revenue acceleration, and scalable margin improvements through operating leverage.

- Slow cloud transition, increased competition, rising tech costs, and reliance on SMB clients threaten revenue stability and margin growth amid industry AI and automation shifts.

Catalysts

About Sage Group- Provides technology solutions and services for small and medium businesses in North America, Europe, the United Kingdom, Ireland, Africa and Asia-Pacific.

- While analyst consensus sees the rollout of AI (via Sage Copilot) as a catalyst for accelerating workflow automation and customer retention, this narrative may understate just how transformative Sage's agentic AI roadmap could be for SMBs globally; rapidly advancing toward end-to-end finance process automation and sector-specific use cases could meaningfully increase customer stickiness, raise annual contract values, and significantly boost both top-line growth and gross margins in coming years.

- Analyst consensus highlights Intacct's international expansion as a source of new ARR, but early signs from the UK and Europe show Intacct is on the cusp of establishing category leadership, with 60%+ ARR growth from a growing base; this implies Intacct could outpace analyst ARR expectations, providing a powerful multi-year revenue growth engine as new markets mature and adoption accelerates.

- The accelerating shift to cloud-native subscription products, combined with Sage's dominant footprint among SMEs in regulated industries, positions the company to capture an outsized share of the escalating demand for compliance-driven, always-on, SaaS financial management tools-supporting persistently high subscription penetration, best-in-class customer retention rates, and expanding recurring revenue streams.

- As small and mid-sized enterprises worldwide face rising complexity from remote work, digital collaboration, and regulatory obligations, Sage's investments in embedded network services (such as payment automation, e-invoicing, and open ecosystem partnerships) are set to make its platform a critical workflow backbone for millions of businesses-driving market share gains, higher ARPU, and unlocking scale-driven operating leverage, which will enhance net margins over time.

- With a robust balance sheet, strong free cash flow, and capacity for further value-accretive M&A, Sage can opportunistically accelerate growth via targeted acquisitions that broaden its suite or geographic reach-enabling faster expansion of ARR, greater cross-sell potential, and sustained EPS growth beyond what is currently embedded in market expectations.

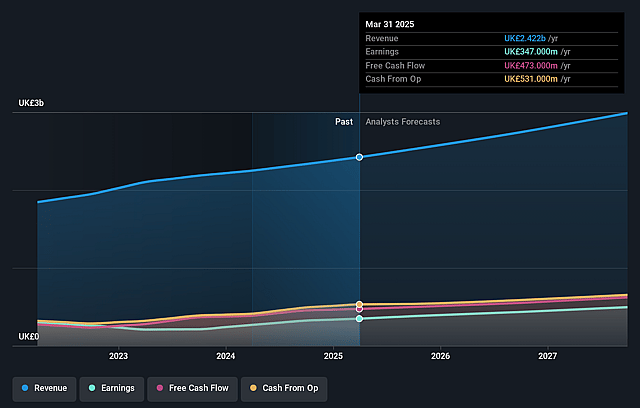

Sage Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Sage Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Sage Group's revenue will grow by 10.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 14.3% today to 19.2% in 3 years time.

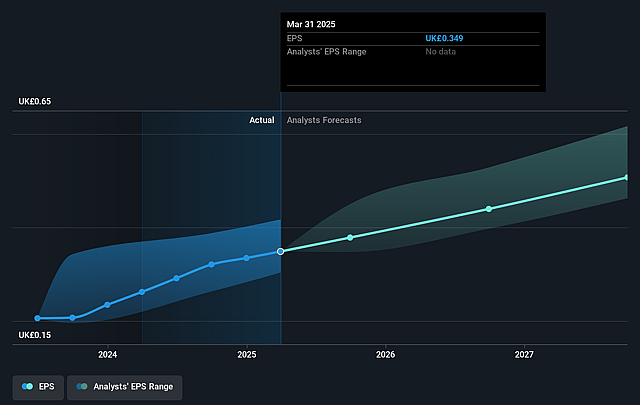

- The bullish analysts expect earnings to reach £629.1 million (and earnings per share of £0.7) by about September 2028, up from £347.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 29.8x on those 2028 earnings, up from 29.7x today. This future PE is lower than the current PE for the GB Software industry at 37.3x.

- Analysts expect the number of shares outstanding to decline by 1.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.11%, as per the Simply Wall St company report.

Sage Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerated adoption of artificial intelligence and automation across the broader industry may reduce demand for traditional mid-market accounting solutions, potentially requiring Sage to rapidly reinvent its product portfolio or risk customer attrition, which could pressure revenue growth if client migration to more advanced platforms outpaces Sage's innovation efforts.

- Persistent talent shortages and rising technology staff costs could erode Sage's cost advantage in product development and support, resulting in compressed operating margins over time, particularly as the company continues to prioritize R&D investment.

- Sage's slow progress in fully transitioning from legacy products to a modern cloud-based SaaS model, as shown by the need to maintain and support older solutions alongside new offerings, increases the risk of customer churn and may weaken recurring revenue growth if competitors further outpace Sage in cloud adoption.

- Heavy dependence on the small-to-medium business customer base leaves Sage especially vulnerable to economic downturns and volatile macroeconomic conditions, raising the likelihood of revenue and earnings instability during periods of reduced SMB spending.

- Intensifying competition from global software suite providers and cloud-native disruptors-with rivals like Intuit, Oracle, and Microsoft expanding their product ranges and integration capabilities-may increase pricing pressure and customer acquisition costs for Sage, threatening margins and the group's ability to sustain current profit growth rates.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Sage Group is £16.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Sage Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £16.0, and the most bearish reporting a price target of just £10.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be £3.3 billion, earnings will come to £629.1 million, and it would be trading on a PE ratio of 29.8x, assuming you use a discount rate of 9.1%.

- Given the current share price of £10.88, the bullish analyst price target of £16.0 is 32.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Sage Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.