Key Takeaways

- Strategic investments in cybersecurity, cloud, and automation are driving superior profit growth, recurring revenue expansion, and strong operational leverage.

- Deep vendor partnerships and a customer-centric approach position Softcat to gain market share and outpace competitors amid rising demand for advanced IT solutions.

- Automation, vendor reliance, margin pressures, escalating expenses, and economic uncertainty together threaten Softcat's revenue stability and long-term earnings growth.

Catalysts

About Softcat- Operates as a value-added IT reseller and IT infrastructure solutions provider in the United Kingdom.

- Analyst consensus expects strong growth from cybersecurity, but this is likely still understated-Softcat's investments in specialized services, deep vendor partnerships (such as advanced Microsoft accreditations), and ongoing capability expansion position it to outgrow broader market security spend by a significant margin, driving sharp increases in gross profit and accelerating operating profit growth over multiple years.

- While analysts broadly expect data center, networking, and AI adoption to gradually boost revenue, the current scale of AI-driven infrastructure demand, combined with Softcat's increasing integration into multi-year, large-scale technology projects, suggests the company could capture an outsized share of higher-margin recurring contracts and rapidly elevate earnings and net margin expansion well above market forecasts.

- Softcat's unique culture and differentiated customer-centric model have enabled it to push gross profit per customer to new highs, and the accelerating conversion of 'tail' customers into high-value, highly-retentive relationships creates a powerful compounding effect, setting the stage for persistent double-digit growth in both customer base and share of wallet, resulting in structurally higher recurring revenues.

- Automation and large-scale digital investments in back-office systems-including Microsoft Dynamics and CoPilot-enabled workflow automation-are set to structurally shift Softcat's cost base, allowing gross profit growth to increasingly outpace headcount and wage increases, which over time could deliver a step change in operational leverage and sustainable margin expansion.

- The increasingly complex and fragmented IT ecosystem, especially as cloud and hybrid work proliferate, is widening the gap between capable integrators and generalist resellers; as the sector leader with deep, broad vendor access and an unrivaled reputation, Softcat stands to rapidly consolidate market share, especially as underpenetrated verticals and geographies mature, driving outsized revenue growth versus peers.

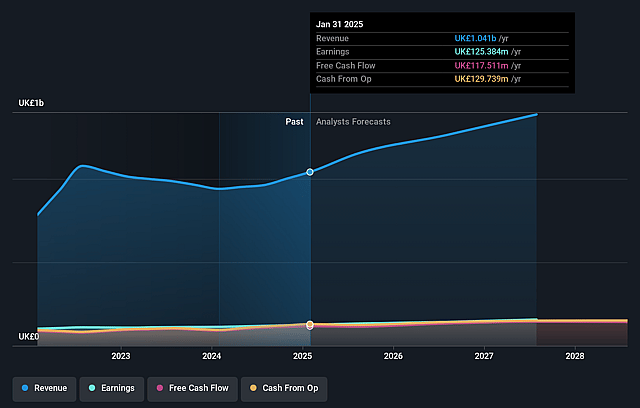

Softcat Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Softcat compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Softcat's revenue will grow by 17.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 12.0% today to 10.4% in 3 years time.

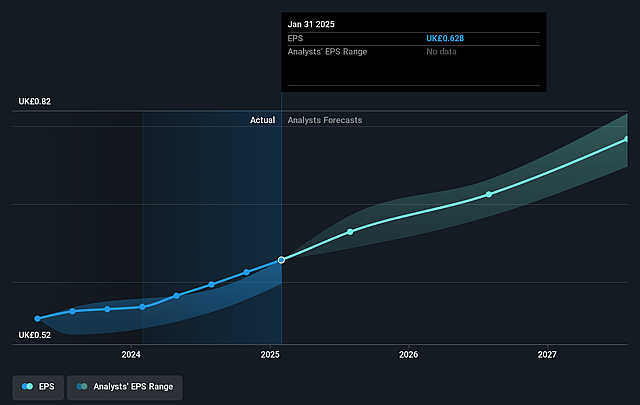

- The bullish analysts expect earnings to reach £177.1 million (and earnings per share of £0.88) by about September 2028, up from £125.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 31.3x on those 2028 earnings, up from 25.5x today. This future PE is greater than the current PE for the GB IT industry at 26.0x.

- Analysts expect the number of shares outstanding to grow by 0.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.07%, as per the Simply Wall St company report.

Softcat Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The increasing automation of IT management and adoption of AI-driven solutions could diminish the role and value proposition of resellers like Softcat, leading to long-term risks for revenue growth and pricing power as customers directly manage their infrastructure or rely less on intermediaries.

- Heavy dependence on strategic partnerships with major vendors such as Microsoft, Cisco, and HP exposes Softcat to vendor concentration risk, meaning any material changes or loss in those partnerships could negatively affect both revenue streams and gross margins over time.

- Ongoing margin pressures are evident, as gross margin declined by 100 basis points year-on-year due to higher volumes of low-margin sales and a shift in software mix; intensifying competition and the direct-to-customer strategies of both large vendors and cloud hyperscalers could further compress net margins and limit earnings growth.

- Rising operational expenses, including wage inflation and increased commissions, combined with significant investments in new offices and technology platforms, may result in sustained pressure on operating margins and restrict long-term earnings growth.

- Economic uncertainty, persistent inflation in the UK and Europe, and the risk of cyclical or prolonged reductions in IT spending-especially in the public sector-could create lasting headwinds for customer demand, placing downside risk on revenues and growth expectations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Softcat is £21.35, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Softcat's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £21.35, and the most bearish reporting a price target of just £14.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be £1.7 billion, earnings will come to £177.1 million, and it would be trading on a PE ratio of 31.3x, assuming you use a discount rate of 9.1%.

- Given the current share price of £16.03, the bullish analyst price target of £21.35 is 24.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.