Key Takeaways

- Increasing automation and direct vendor-customer engagement threaten Softcat's reseller model, compressing margins and diminishing its long-term earnings potential.

- Rising operational costs and intense competition risk further eroding Softcat's profitability as industry commoditization and regulatory challenges grow.

- Diverse IT offerings, strong vendor relationships, and operational efficiency support resilient revenue growth, margin expansion, and sustainable shareholder returns amid evolving digital trends.

Catalysts

About Softcat- Operates as a value-added IT reseller and IT infrastructure solutions provider in the United Kingdom.

- The accelerating shift by enterprise customers and vendors toward direct cloud-native solutions and automation is likely to erode Softcat's traditional reseller value proposition, compressing long-term gross margins and limiting revenue growth even as the company invests in automation and operational scale.

- Increasing direct-to-customer engagement by major technology vendors and hyperscalers threatens to bypass channel intermediaries like Softcat, which could significantly reduce recurring income from license renewals and large-scale projects, impacting both revenues and long-term earnings potential.

- Persistent global economic and geopolitical uncertainty is expected to result in elongated enterprise sales cycles and ongoing IT budget constraints, limiting Softcat's ability to sustain historical double-digit profit growth, particularly as public sector demand shows signs of moderating.

- The company's operational expenditure continues to rise in the form of higher commissions, wage inflation, office expansion and ongoing investment in new hires and technical capacity, which is likely to outpace gross profit growth over time, leading to further margin compression and deteriorating operating leverage.

- Industry-wide technological commoditization and intensifying competition from both local and global IT service providers are poised to exert downward pressure on pricing, reducing Softcat's differentiated value and increasing the risk of gross profit and net margin decline in the coming years, particularly if regulatory hurdles around data and cross-border digital services escalate.

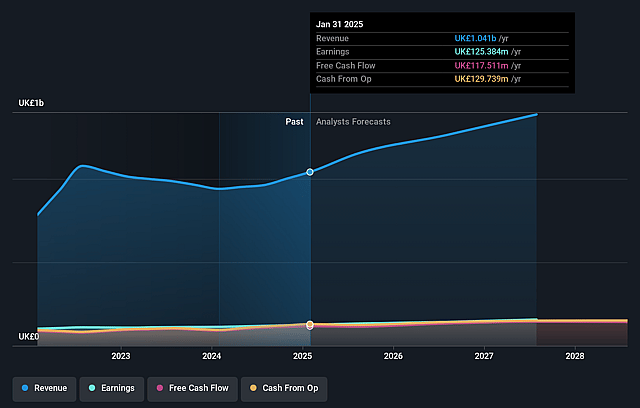

Softcat Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Softcat compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Softcat's revenue will grow by 9.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 12.0% today to 11.9% in 3 years time.

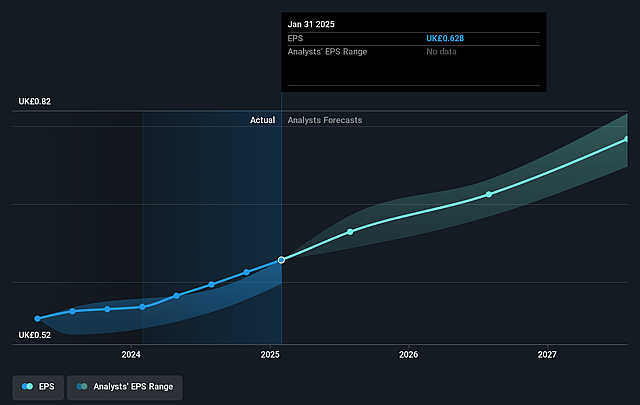

- The bearish analysts expect earnings to reach £163.2 million (and earnings per share of £0.81) by about September 2028, up from £125.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 22.3x on those 2028 earnings, down from 25.5x today. This future PE is lower than the current PE for the GB IT industry at 26.0x.

- Analysts expect the number of shares outstanding to grow by 0.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.07%, as per the Simply Wall St company report.

Softcat Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Softcat's ability to consistently grow both its customer base and average gross profit per customer while maintaining low customer churn, particularly as trusted adviser relationships deepen over time, strongly suggests that revenue growth could continue at a healthy rate, even in more challenging macro environments.

- The breadth and diversity of its product and services offering-spanning cybersecurity, cloud, networking, AI, and managed services-positions the company well to benefit from secular IT trends like digital transformation, cybersecurity demand, and the rise of AI, which are all likely to drive long-term increases in gross profit and operating earnings.

- Ongoing investment in automation, operational efficiency, and digital platforms such as Microsoft Dynamics and AI integration is designed to allow Softcat to grow gross profit faster than headcount, directly supporting margin expansion and long-term scalability of earnings.

- The company's strong relationships and status as a key partner with major global vendors (like Microsoft) provide access to cutting-edge technology and help Softcat remain competitively relevant, supporting stable gross profit, future revenue resilience, and improved supplier terms which can benefit net margins.

- A robust balance sheet, industry-leading cash conversion metrics, and a progressive capital allocation policy (including ongoing dividends and potential value-enhancing acquisitions) reduce financial risk and provide optionality for further growth, supporting the long-term sustainability of profit after tax and shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Softcat is £14.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Softcat's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £21.35, and the most bearish reporting a price target of just £14.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £1.4 billion, earnings will come to £163.2 million, and it would be trading on a PE ratio of 22.3x, assuming you use a discount rate of 9.1%.

- Given the current share price of £16.03, the bearish analyst price target of £14.0 is 14.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.