Key Takeaways

- Strategic investments in technology, AI, and cloud capabilities, alongside a strong Microsoft partnership, position Bytes for accelerated revenue growth and margin expansion ahead of peers.

- Strong employee retention, sales force growth, and proprietary platform development support industry-best customer acquisition and maximize opportunities within a rapidly expanding IT market.

- Reliance on major vendors, industry shifts toward cloud and open-source models, regulatory demands, and talent challenges threaten margin stability and long-term growth potential.

Catalysts

About Bytes Technology Group- Offers software, security, AI, and cloud services in the United Kingdom, Europe, and internationally.

- Analyst consensus expects investments in new enterprise systems and office environments to support future growth, but given Bytes' historical track record of doubling key income metrics in five years while maintaining exceptional cash conversion and operational efficiency, these upgrades could deliver even greater scale and recurring margin expansion than currently forecasted-directly boosting both earnings and net margins.

- While analysts broadly agree that the expansion of the cloud base, strategic focus on AI-powered software, and deepened cybersecurity expertise will drive revenue, Bytes' unique position as Microsoft's leading UK partner, early AI adoption with Copilot integration, and intense penetration into both public and mid-market corporate sectors position it to outpace peers and potentially capture a disproportionate share of UK cloud and cybersecurity spending, raising the ceiling for multi-year revenue acceleration.

- The company's established culture of high staff retention, rigorous technician training, and aggressive sales force expansion-underscored by a nearly 18% year-on-year headcount increase and industry-leading employee satisfaction-will further compound growth by enabling industry-best customer acquisition and superior cross-selling opportunities, supporting double-digit revenue growth and long-term operating leverage.

- Bytes' proprietary investment in a fully integrated, multi-cloud, customer-facing portal with advanced automation and analytics will not only drive cost efficiencies and margin expansion, but-by offering a single pane of glass for cloud and SaaS procurement-could transform Bytes into the go-to cloud marketplace for mid-size and public-sector UK IT buyers, dramatically expanding addressable revenue streams and consultative services income.

- Amidst accelerating digital transformation and the rapid adoption of hybrid work, Bytes' minuscule current market share (around 3% of its target market) and deep, long-tenured customer relationships mean the company is uniquely positioned to capitalize on the enduring, structural expansion in UK IT outsourcing and software consumption, giving it one of the longest, most attractive revenue runways in the sector.

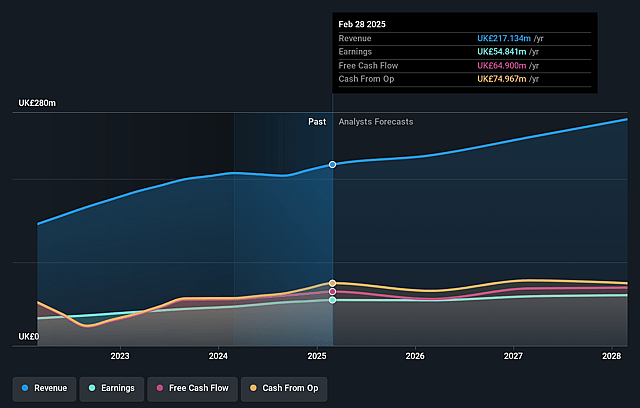

Bytes Technology Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Bytes Technology Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Bytes Technology Group's revenue will grow by 17.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 25.3% today to 18.4% in 3 years time.

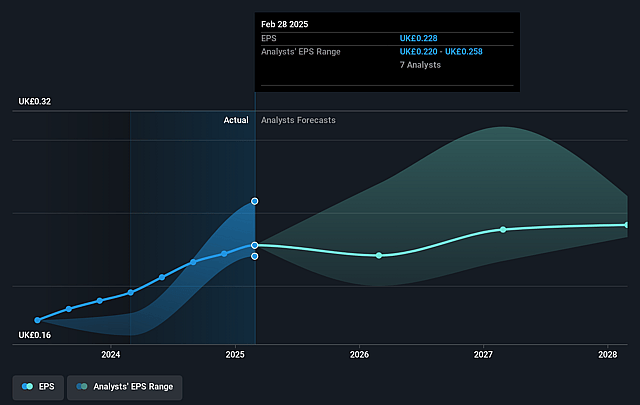

- The bullish analysts expect earnings to reach £65.0 million (and earnings per share of £0.26) by about September 2028, up from £54.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 30.3x on those 2028 earnings, up from 18.7x today. This future PE is lower than the current PE for the GB Software industry at 37.3x.

- Analysts expect the number of shares outstanding to grow by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.61%, as per the Simply Wall St company report.

Bytes Technology Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Bytes Technology Group's increasing reliance on Microsoft as a key vendor exposes it to concentrated risk, and any negative shift in Microsoft's channel strategy, reduction of rebates, or changes to incentive structures could materially impact revenues and long-term margin stability.

- The accelerating migration of software distribution to cloud subscription and self-service marketplace models, driven by hyperscale providers like AWS, Google, and Microsoft itself, threatens to bypass traditional resellers, potentially leading to shrinking gross profit margins and revenue erosion over time.

- The proliferation of open-source software and low-cost alternatives presents a secular risk that could undercut Bytes' value proposition as a software reseller, increasing pricing pressure and leading to margin compression as customers find free or cheaper substitutes.

- Long-term sustainability trends and increasing ESG regulations, such as requirements around data center carbon footprints and broader compliance initiatives, may impose additional operational costs and restrict Bytes' access to certain customer segments, potentially squeezing net profits.

- Persistent challenges in recruiting and retaining high-quality technical talent, especially as wage inflation and competition for skilled IT professionals intensifies, could increase cost bases and impact Bytes' ability to scale or deliver new service offerings, thus putting pressure on earnings growth in future years.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Bytes Technology Group is £6.38, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Bytes Technology Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £6.38, and the most bearish reporting a price target of just £3.8.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be £352.7 million, earnings will come to £65.0 million, and it would be trading on a PE ratio of 30.3x, assuming you use a discount rate of 8.6%.

- Given the current share price of £4.24, the bullish analyst price target of £6.38 is 33.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Bytes Technology Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.