Key Takeaways

- Shifts toward automation, cloud subscriptions, and direct vendor sales threaten the company's traditional reseller model and may pressure margins and revenue growth.

- Heavy dependence on key vendor partnerships and challenges scaling higher-margin services or expanding internationally could constrain future profitability and growth.

- Dependence on Microsoft, industry automation, rising compliance costs, fierce competition, and slow new customer growth threaten future profitability and market share.

Catalysts

About Bytes Technology Group- Offers software, security, AI, and cloud services in the United Kingdom, Europe, and internationally.

- Although Bytes Technology Group continues to benefit from ongoing digital transformation and the rising importance of cybersecurity-which support recurring revenue streams and strong client retention-intensifying automation and the trend toward AI-driven self-service procurement among customers could erode the company's relevance as a traditional software reseller over the longer term and may reduce revenue growth beyond current forecasts.

- While adoption of cloud computing remains a powerful revenue tailwind, the continued shift by major software vendors toward direct, subscription-based cloud models poses a threat to Bytes' core reseller business model and could increasingly bypass their intermediary role, potentially pressuring both net margins and top-line revenue as vendor strategies evolve.

- Despite a robust, long-term strategic partnership with Microsoft driving access to high-value enterprise clients, Bytes faces concentration risk in its vendor relationships-any change in Microsoft's incentive structure, channel strategy, or partnership terms could disproportionately impact profitability and earnings, as demonstrated by the partial reversals and ongoing adaptation to Microsoft incentive programs.

- Although the company is expanding its range of managed and value-added services in response to more complex IT environments, scaling these higher-margin offerings requires substantial upfront investment in staff, infrastructure, and IP development; slow ramp-up or unproven demand for new services could pressure net margins if the transition away from lower-margin reselling is less successful than anticipated.

- While the business has demonstrated sustained organic growth in the UK, further expansion could be hampered by difficulties in scaling outside its core market or diversifying its business model-particularly as the domestic addressable market may eventually plateau-placing longer-term constraints on both revenue growth and overall earnings potential.

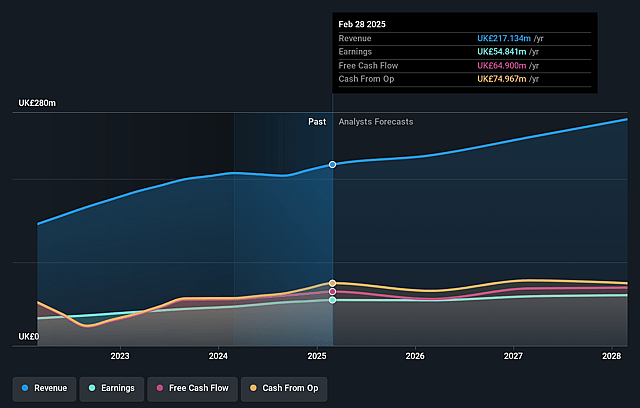

Bytes Technology Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Bytes Technology Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Bytes Technology Group's revenue will grow by 4.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 25.3% today to 24.3% in 3 years time.

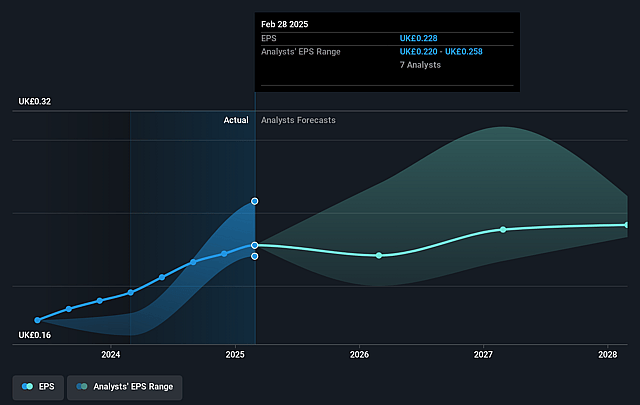

- The bearish analysts expect earnings to reach £59.4 million (and earnings per share of £0.24) by about September 2028, up from £54.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 19.8x on those 2028 earnings, up from 18.0x today. This future PE is lower than the current PE for the GB Software industry at 37.8x.

- Analysts expect the number of shares outstanding to grow by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.62%, as per the Simply Wall St company report.

Bytes Technology Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Bytes Technology Group's heavy reliance on Microsoft as both a key vendor and source of gross profit introduces concentration risk; any adverse changes in Microsoft's channel strategy, incentive programs, or shift to direct-to-customer models could materially impact Bytes' future revenues and profitability.

- The ongoing industry trend toward automation and self-service IT procurement, including cloud marketplaces and direct software subscriptions, may erode Bytes' traditional reseller advantage, leading to shrinking gross margins and long-term pressure on earnings.

- Growing regulatory and compliance obligations, such as increased national insurance costs and potentially stricter data privacy rules, are steadily raising operating expenses, which may constrain the company's ability to maintain or expand net margins over time.

- Intensifying competition from larger multinational IT service providers and incumbent resellers, especially if they seek greater penetration in Bytes' mid-market and public sector segments, could drive down prices or slow customer acquisition, limiting revenue growth and overall market share.

- The company's relatively slow pace of expansion into new customer segments and low contribution from net new customers, as evidenced by most growth coming from existing clients, could cap long-term earnings growth if broader market demand softens or if customer churn increases.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Bytes Technology Group is £3.8, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Bytes Technology Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £6.38, and the most bearish reporting a price target of just £3.8.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £244.7 million, earnings will come to £59.4 million, and it would be trading on a PE ratio of 19.8x, assuming you use a discount rate of 8.6%.

- Given the current share price of £4.08, the bearish analyst price target of £3.8 is 7.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Bytes Technology Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.