Last Update 10 Dec 25

Fair value Decreased 9.69%SAAS: Rising Dividend And Earnings Outlook Will Drive Strong Future Returns

Narrative Update

Analysts have trimmed their price target on Microlise Group from approximately £1.68 to £1.52, reflecting slightly higher discount rates, more conservative expectations for revenue growth and profit margins, and a higher projected future P/E multiple. Together, these factors point to a more cautious valuation outlook.

What's in the News

- Microlise Group issued earnings guidance for fiscal 2025, forecasting revenue of not less than £84 million, representing around 4% growth versus adjusted fiscal 2024 revenues of £81.0 million (company guidance).

- The Board declared an increased interim dividend of 0.60 pence per share, up from 0.57 pence in H1 2024, totalling approximately £0.7 million and reaffirming the Group's progressive dividend policy (company announcement).

Valuation Changes

- Fair Value Estimate has fallen moderately from £1.68 to £1.52 per share, implying a lower central valuation for Microlise Group.

- Discount Rate has risen slightly from 8.72% to 8.79%, reflecting a marginally higher required return and risk adjustment.

- Revenue Growth has been cut significantly from 5.61% to 3.49%, indicating more cautious assumptions on top line expansion.

- Net Profit Margin has been reduced meaningfully from 4.99% to 3.69%, pointing to a less optimistic view on profitability.

- Future P/E multiple has increased notably from around 50x to 65x, implying a higher valuation multiple applied to future earnings despite more conservative forecasts.

Key Takeaways

- Successful integration of ESS and international market expansion indicate strong potential for recurring revenue and earnings growth.

- MicroliseOne offering and low customer churn boost revenue stability, while strategic leadership aims to enhance net margins.

- Operational vulnerabilities and rising employment costs pose financial risks, while challenges in talent acquisition and affected industries may hinder revenue growth and margin stability.

Catalysts

About Microlise Group- Provides transport management technology solutions in the United Kingdom.

- The integration and successful onboarding of ESS have contributed to significant increases in recurring revenue and adjusted EBITDA, demonstrating potential for further earnings growth as efficiencies and synergies are fully realized.

- Introduction of the MicroliseOne offering, which consolidates various acquired and developed products into a unified suite, is expected to enhance customer value, drive sales, and boost revenue through cross-selling opportunities.

- Expansion into international markets, particularly evidenced by double-digit growth in Australia and successful contracts in France and New Zealand, is likely to drive revenue growth as these markets continue to develop.

- The low customer churn rate, alongside the extension of key contracts like that of major customer JCV, provides long-term revenue visibility and stability, supporting ongoing earnings predictability.

- The company's focus on integrating third-party hardware and enhancing go-to-market strategies with the new Chief Revenue Officer is anticipated to improve net margins by increasing the mix of high-margin direct sales and reducing hardware-related costs.

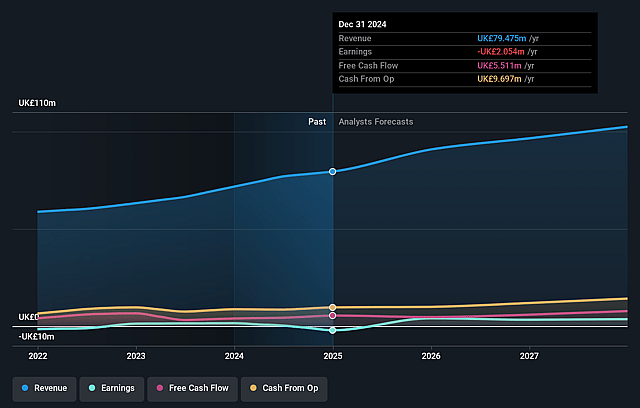

Microlise Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Microlise Group's revenue will grow by 8.9% annually over the next 3 years.

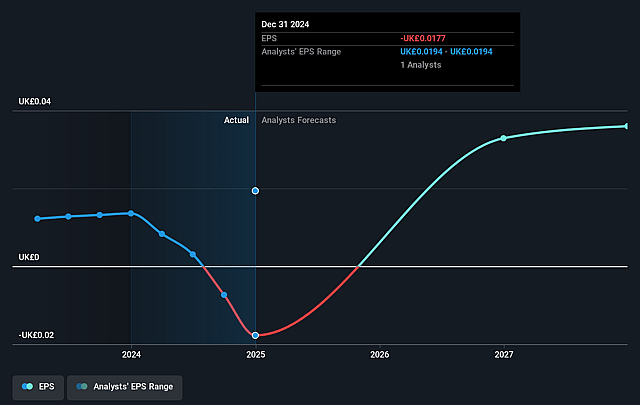

- Analysts assume that profit margins will increase from -2.6% today to 3.5% in 3 years time.

- Analysts expect earnings to reach £3.6 million (and earnings per share of £0.04) by about September 2028, up from £-2.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting £4 million in earnings, and the most bearish expecting £3.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 79.6x on those 2028 earnings, up from -74.5x today. This future PE is greater than the current PE for the GB Software industry at 37.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.64%, as per the Simply Wall St company report.

Microlise Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The cyber incident in October and November led to significant financial adjustments, including £1.5 million in revenue reduction due to SLA breaches and a £2.9 million cost provision for customer claims. This directly impacted EBITDA and highlights potential risks to revenue and earnings due to operational vulnerabilities.

- The reduction in hardware revenue, as noted in the presentation, was attributed to a slowdown in the construction and automotive industries. This sector-specific decline presents risks to the company's overall revenue growth if these industries do not recover as expected.

- Operating expenses have increased notably, with employment costs rising by 20%-21% due to acquisitions and expanded operations, which could pressure net margins if revenues do not grow proportionately.

- The sustainability of the adjusted metrics and the full coverage by insurance for the cyber incident adjustments may mask underlying financial risks. Without concrete future prevention strategies, similar incidents could again impact earnings and financial stability.

- Talent and skills acquisition, particularly in tech roles, remains challenging. This could affect the company’s operational efficiency and technology development, potentially impacting future revenue growth and margins if not effectively managed.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £1.942 for Microlise Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £102.5 million, earnings will come to £3.6 million, and it would be trading on a PE ratio of 79.6x, assuming you use a discount rate of 8.6%.

- Given the current share price of £1.32, the analyst price target of £1.94 is 32.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Microlise Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.