Catalysts

About Microlise Group

Microlise Group provides Software as a Service transport technology that helps fleets run more efficiently, safely and profitably.

What are the underlying business or industry changes driving this perspective?

- Expansion into long-haul and cross-border logistics through localized standards such as TCA, EWD in Australia and eCMR in France significantly enlarges Microlise's addressable market in core geographies, supporting sustained double digit revenue growth.

- Deep integration with third-party telematics, cameras and handheld hardware allows Microlise to sell high margin software into fleets that have already made substantial capital investments. This accelerates deployment cycles and structurally lifts gross and EBITDA margins.

- Increasing customer focus on operational efficiency and profitability, rather than capital intensive vehicle replacement, directly aligns with Microlise's data driven SaaS solutions. This drives higher uptake of premium functionality and supports recurring revenue growth and pricing power.

- Ongoing product innovation in AI and machine learning, powered by large proprietary data sets from leading UK and international fleets, is expected to unlock new optimisation and automation modules that enhance customer ROI and underpin higher ARPU and earnings growth.

- Scalable, integrated platform strategy via MicroliseOne and targeted, product led international M&A supported by over GBP 40 million of available funding create a clear path to broaden the solution suite and geographic footprint, driving higher recurring revenue and operating leverage.

Assumptions

This narrative explores a more optimistic perspective on Microlise Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

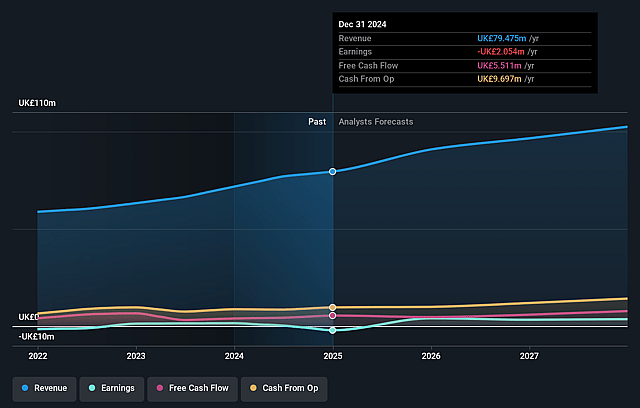

- The bullish analysts are assuming Microlise Group's revenue will grow by 4.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -0.9% today to 5.5% in 3 years time.

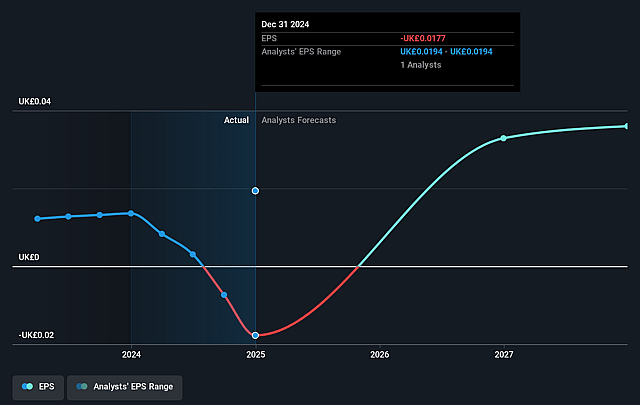

- The bullish analysts expect earnings to reach £5.4 million (and earnings per share of £0.02) by about December 2028, up from £-787.0 thousand today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as £4.0 million.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 53.1x on those 2028 earnings, up from -142.2x today. This future PE is greater than the current PE for the GB Software industry at 33.3x.

- The bullish analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.76%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Dependence on large OEM customers and the broader automotive sector, where management already expects flat OEM sales and where tariffs and volume uncertainty persist, could cap growth and compress pricing power. This may limit revenue expansion and slow earnings growth.

- Ongoing and escalating cybersecurity threats, highlighted by industry wide attacks and Microlise's own prior incident plus rising security and IT spend, risk further project delays and structurally higher operating costs. This would pressure net margins and EBITDA.

- Execution risk in international expansion and M&A, including delayed IT infrastructure projects and the need to integrate acquired technologies and partners across Australia, France and other target markets, could lead to cost overruns and slower than expected adoption. This would weigh on revenue growth and operating margins.

- Constraints in critical IT hardware supply and persistent shortages in technical talent, both of which the company is already experiencing, may delay product rollouts, margin enhancement programs and hosting cost savings. This could reduce the pace of recurring revenue growth and limit improvement in earnings.

- Increasing reliance on direct sales to mid market fleets and complex, long duration implementation projects, together with customer specific disruptions such as cyber incidents at key clients like M&S and JLR, heightens the risk of timing slippage and contract delays. This could weaken ARR growth and dampen cash conversion and profit growth.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Microlise Group is £1.91, which represents up to two standard deviations above the consensus price target of £1.51. This valuation is based on what can be assumed as the expectations of Microlise Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £1.91, and the most bearish reporting a price target of just £1.2.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be £97.3 million, earnings will come to £5.4 million, and it would be trading on a PE ratio of 53.1x, assuming you use a discount rate of 8.8%.

- Given the current share price of £0.96, the analyst price target of £1.91 is 49.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Microlise Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.