Catalysts

About Corero Network Security

Corero Network Security provides specialised cyber protection that keeps customers' online services available by filtering and blocking disruptive attacks in real time.

What are the underlying business or industry changes driving this perspective?

- The rising frequency and scale of cyberattacks that take critical services offline is pushing more service providers, banks and enterprises to adopt always-on protection. This can support sustained growth in annual recurring revenue as more of the existing US$4b addressable market is captured.

- The expansion of the product set beyond traditional DDoS protection into areas such as web application firewall and Zero Trust Access Control gives Corero more ways to sell into its installed base and into new sectors such as health care and banking. This can increase contract values and earnings over time.

- A shift in customer preference from upfront CapEx to SaaS and OpEx contracts is feeding directly into ARR, which already stands at US$21.6m and 71% of first half revenue. This higher visibility revenue mix can support more stable net margins and earnings quality.

- Growing awareness that availability attacks and DDoS activity are linked to broader threats such as ransomware is pushing resilient infrastructure higher up IT budgets. This can support long-term demand for Corero's core protection offerings and underpin revenue growth.

- Global sales expansion into Latin America, South Asia Pacific and the Middle East, combined with OEM and alliance routes into Tier 1 telcos and large service providers, broadens Corero's reach beyond its historic US-focused base and can support revenue diversification and operating leverage as the cost base is spread over a wider customer set.

Assumptions

This narrative explores a more optimistic perspective on Corero Network Security compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

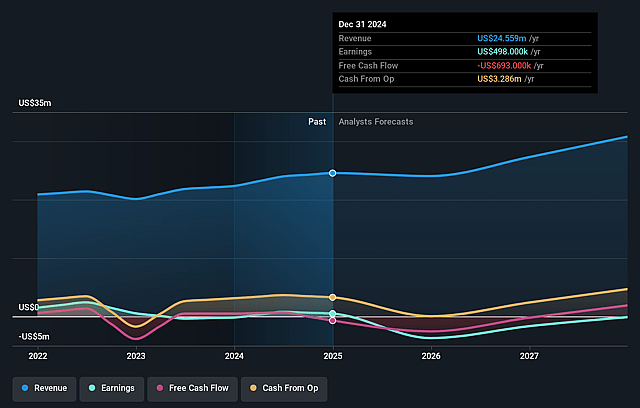

- The bullish analysts are assuming Corero Network Security's revenue will grow by 17.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -7.0% today to 5.0% in 3 years time.

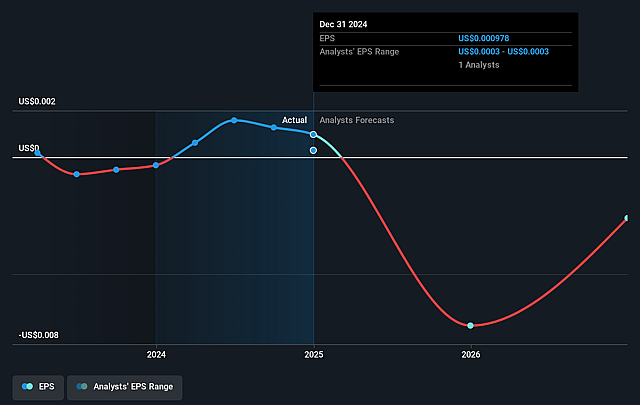

- The bullish analysts expect earnings to reach $1.9 million (and earnings per share of $0.0) by about January 2029, up from $-1.6 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $-169.0 thousand.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 90.3x on those 2029 earnings, up from -53.7x today. This future PE is greater than the current PE for the GB Software industry at 34.2x.

- The bullish analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.68%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The shift from upfront CapEx licenses to SaaS and OpEx spreads revenue over multi year contracts. Even if order intake is healthy, reported revenue in any given period can be lower than expected, which can weigh on earnings and EBITDA.

- Reliance on a small number of alliance partners and large customers, including Tier 1 telcos and OEMs such as Juniper or HPE Networking, introduces concentration risk. Any slowdown, reprioritisation or disruption in those relationships could pressure revenue and gross profit.

- The company is increasing headcount in sales, channels and global hubs while ARR is still building. If ARR growth slows or larger deals are delayed, the higher fixed cost base could compress net margins and delay the path to sustained profitability.

- Exposure to macro factors such as tariff uncertainty, changes in customer purchasing behaviour and higher logistics costs for hardware can alter deal timing and mix. This may reduce near term revenue recognition and create volatility in earnings and cash flow.

- Competition from larger security vendors that already serve banks, cloud providers and Tier 1 telcos can limit Corero's ability to win or expand key accounts over time. This could constrain ARR growth and keep earnings below the bullish expectations in the optimistic scenario.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Corero Network Security is £0.19, which represents up to two standard deviations above the consensus price target of £0.14. This valuation is based on what can be assumed as the expectations of Corero Network Security's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £0.19, and the most bearish reporting a price target of just £0.1.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2029, revenues will be $38.0 million, earnings will come to $1.9 million, and it would be trading on a PE ratio of 90.3x, assuming you use a discount rate of 8.7%.

- Given the current share price of £0.12, the analyst price target of £0.19 is 33.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Corero Network Security?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.