Catalysts

About Corero Network Security

Corero Network Security provides solutions that protect organizations against cyberattacks that disrupt availability, with a core focus on DDoS protection and related services.

What are the underlying business or industry changes driving this perspective?

- The addressable market for availability focused cyber protection is described as moving from US$4b to a much larger figure over roughly 10 years. However, Corero is still a relatively small vendor that many potential customers are not aware of, which can cap long term revenue growth if larger, better known suppliers capture most of this expansion.

- Management highlights that most industries and critical infrastructure now face escalating, more sophisticated attacks. If larger security platforms bundle DDoS and availability tools into broader suites at aggressive pricing, Corero may be pressured to discount, which could limit net margin progress even if revenue continues to grow.

- The mix shift toward SaaS and OpEx contracts increases ARR, which is cited at US$21.6m. It also flattens revenue recognition over multi year terms, so if order growth slows in any period the company could see a more prolonged drag on reported revenue and EBITDA than a hardware heavy model might have shown.

- The company is expanding sales coverage across Latin America, the Middle East and Asia and has doubled its direct sales headcount to 16. However, if new regions and channels take longer than expected to convert strong pipelines into closed business, the added cost base could weigh on earnings and delay any move toward consistent cash generation.

- Reliance on major alliance partners and OEM relationships such as Juniper, now HPE Networking, provides access to Tier 1 telcos and other large buyers. Changes in partner priorities, branding or integration focus could slow Corero’s access to those customers, which would directly affect future revenue growth and the pace at which ARR scales.

Assumptions

This narrative explores a more pessimistic perspective on Corero Network Security compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

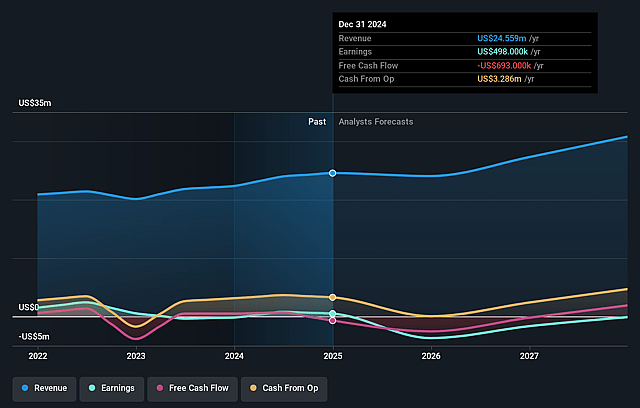

- The bearish analysts are assuming Corero Network Security's revenue will grow by 14.3% annually over the next 3 years.

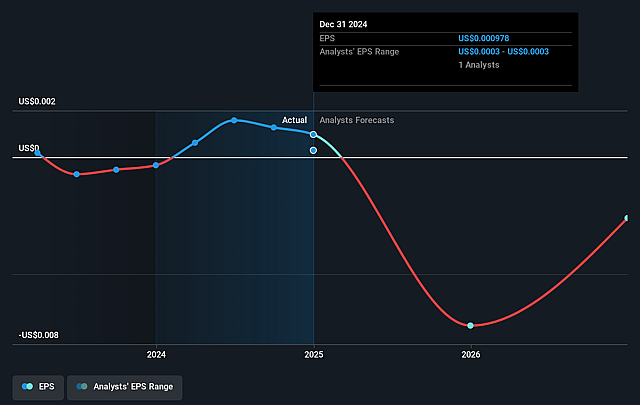

- The bearish analysts are not forecasting that Corero Network Security will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Corero Network Security's profit margin will increase from -7.0% to the average GB Software industry of 10.1% in 3 years.

- If Corero Network Security's profit margin were to converge on the industry average, you could expect earnings to reach $3.5 million (and earnings per share of $0.01) by about January 2029, up from $-1.6 million today.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 25.2x on those 2029 earnings, up from -49.3x today. This future PE is lower than the current PE for the GB Software industry at 33.2x.

- The bearish analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.72%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The company reports annual recurring revenue of US$21.6 million, 25% ARR growth and very high customer retention, and management describes ARR as accelerating, which could support steadier revenue and earnings over time if that trajectory is maintained.

- Management states that the addressable market for Corero’s core availability focused cyber protection is already about US$4b, with independent analysis referenced that suggests it could reach US$10b over roughly 10 years, and Corero believes it can address US$2b to US$2.5b of that, which could underpin revenue growth if the company captures more of this spend.

- The shift away from upfront CapEx deals toward SaaS and OpEx is reducing point in time revenue recognition today, but is increasing the proportion of contracted ARR. Management believes this improves revenue visibility, which may support more predictable revenue, EBITDA and cash generation.

- Corero has doubled its direct salesforce from 8 to 16, expanded into Latin America, South Asia Pacific and the Middle East, and is leaning more on channel and alliance partners. This could widen the funnel of opportunities and support revenue and ARR if these teams and partners are productive at scale.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Corero Network Security is £0.1, which represents up to two standard deviations below the consensus price target of £0.14. This valuation is based on what can be assumed as the expectations of Corero Network Security's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £0.19, and the most bearish reporting a price target of just £0.1.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2029, revenues will be $34.8 million, earnings will come to $3.5 million, and it would be trading on a PE ratio of 25.2x, assuming you use a discount rate of 8.7%.

- Given the current share price of £0.12, the analyst price target of £0.1 is 18.0% lower. Despite analysts expecting the underlying business to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Corero Network Security?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.