Last Update 20 Nov 25

Fair value Decreased 5.75%WKP: Long-Term Leasing And Partnerships Will Drive Future Resilience

Workspace Group's analyst price target was reduced from £6.53 to £4.87. Analysts cited modest adjustments to fair value and updated forecasts for growth and profit margins.

Analyst Commentary

Bullish Takeaways

- Bullish analysts continue to recommend buying the shares, indicating confidence in Workspace Group's long-term growth potential despite the revised price target.

- The company's core fundamentals remain positive, with expectations for steady operational performance supporting the investment case.

- Adjustments to forecasts reflect a more realistic approach to future growth and profitability. This could strengthen resilience over time.

- Workspace Group’s portfolio and market positioning are viewed as well-suited to navigate cyclical challenges and capitalize on recovery trends.

Bearish Takeaways

- Bearish analysts are cautious about near-term growth prospects, leading to a notable reduction in fair value estimates and price targets.

- Updated margins and profit expectations suggest the pathway to improved returns may be slower than previously anticipated.

- Market and economic headwinds could present continued execution risks and impact Workspace Group’s ability to meet previous projections.

- The lowered price target signals concern about potential obstacles to achieving robust outperformance in the current environment.

What's in the News

- Workspace Group has signed a 20-year, 32,000 sq. ft. lease with Qube at The Old Dairy in Shoreditch. Qube will create a new hub for music and content creators, aligning with Workspace's strategic focus on specialist industries (Key Developments).

- Workspace has made a £3 million strategic investment in Qube for a minority equity stake, gaining board observer rights and partnering to expand specialist offerings in the flexible workspace market (Key Developments).

- Wild Cosmetics, recently acquired by Unilever, has signed a new five-year lease with Workspace. This nearly doubles its footprint to 14,000 sq. ft. at Kennington Park. Workspace will also relocate its headquarters to The Centro Buildings in Camden (Key Developments).

- Workspace has secured additional large space lettings at Kennington Park, totaling nearly 16,000 sq. ft. This reflects ongoing positive leasing momentum (Key Developments).

Valuation Changes

- Fair Value Estimate: Decreased slightly from £5.33 to £5.02, reflecting modest downward adjustments.

- Discount Rate: Lowered from 8.90 percent to 8.51 percent. This suggests slightly reduced perceived risk or cost of capital.

- Revenue Growth: Improved marginally, with the forecast contraction easing from -10.82 percent to -10.63 percent.

- Net Profit Margin: Declined subtly from 99.84 percent to 99.19 percent, indicating a minor reduction in expected profitability.

- Future P/E Ratio: Fallen from 10.08x to 9.40x. This reflects lower growth expectations and revised valuations.

Key Takeaways

- Upgrading operations, targeting SME growth, and focusing on flexible spaces are set to boost occupancy, customer retention, and long-term earnings potential.

- Portfolio repositioning and ESG-aligned investments support premium pricing, resilient cash flow, and stronger asset quality.

- Macroeconomic headwinds, heightened competition, and rising costs threaten Workspace Group's profitability, while sector concentration and oversupply risks constrain revenue growth and margin resilience.

Catalysts

About Workspace Group- Workspace is London's leading owner and operator of flexible workspace, currently managing 4.3 million sq.

- Workspace Group is actively upgrading its operational platform and customer offerings-including launching enhanced amenities, new CRM/data systems, stronger retention incentives, and value-add services-which is expected to strengthen customer loyalty, reduce churn, and support an eventual recovery in occupancy and rental income, positively impacting revenue and net margins.

- The company is capitalizing on the ongoing growth of London's SME sector and "creators/innovators" segment, supported by data showing robust long-term business formation in the capital; Workspace's targeted acquisition and retention of these tenants positions it to gain market share and grow occupancy in alignment with enduring urbanization and SME growth, boosting medium-term top-line growth and earnings.

- Portfolio repositioning and disciplined capital recycling-disposing of low-yielding/non-core assets and reinvesting in high-conviction, high-return locations-should help fund value-accretive refurbishment, keep leverage in check, and improve overall asset quality; this is expected to lift average rental rates, optimize capital returns, and drive future earnings growth.

- The focus on flexible, short-term lease models and customizable spaces directly leverages shifts in employer demand for hybrid/flexible work arrangements, leaving Workspace well-placed to capture incremental demand as companies seek adaptability-a trend that supports resilience in rental rates and occupancy, stabilizing cash flow and supporting dividend growth.

- Workspace's asset upgrades, targeted amenity enhancements, and capex discipline are aligned with rising tenant ESG expectations and the growing preference for high-quality, sustainable office space, helping to future-proof the portfolio, enhance asset values, and support premium pricing-contributing to improved occupancy, higher rent per sq ft, and strengthened net margins over time.

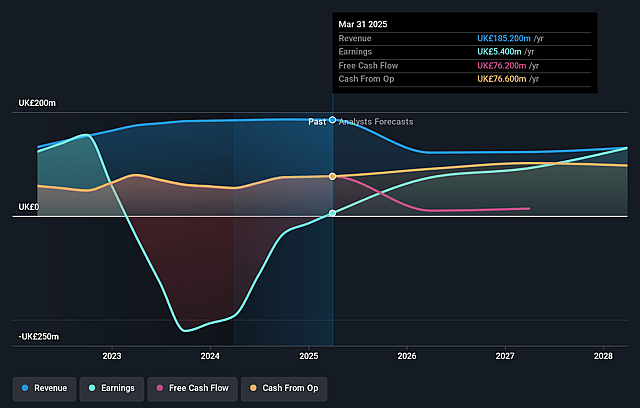

Workspace Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Workspace Group's revenue will decrease by 10.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.9% today to 99.8% in 3 years time.

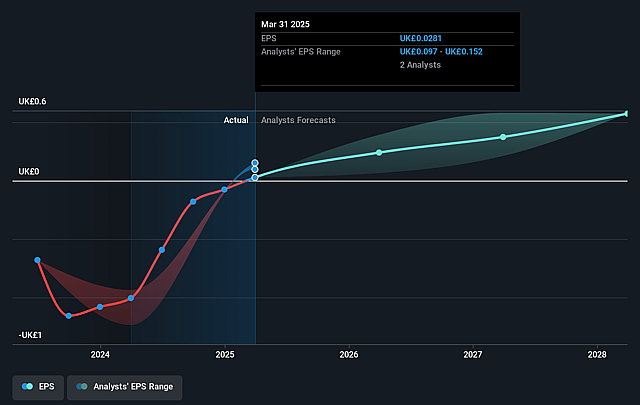

- Analysts expect earnings to reach £131.1 million (and earnings per share of £0.57) by about September 2028, up from £5.4 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting £159.5 million in earnings, and the most bearish expecting £111.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.1x on those 2028 earnings, down from 140.5x today. This future PE is lower than the current PE for the GB Office REITs industry at 10.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.9%, as per the Simply Wall St company report.

Workspace Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent macroeconomic uncertainty, combined with declining occupancy rates-which management expects to worsen further before stabilizing-puts downward pressure on revenues and raises the risk that rental income and earnings could stagnate or decline if demand for flexible office space remains soft.

- Intensifying competition in the London flexible office market, including a more fragmented landscape and new, capital-light operators, risks driving increased pricing pressure and elevated customer acquisition costs-potentially eroding net margins and compressing Workspace Group's profitability.

- Workspace Group's reliance on London SMEs creates significant sector and geographic concentration risk; should there be any prolonged structural downturn, cyclical weakness in the London economy, or reduced SME formation/growth, this would threaten both revenue visibility and occupancy recovery.

- Rising operational costs-including higher living wages, national insurance contributions, and increased CapEx requirements for upgrades and value-add initiatives-may outpace Workspace Group's ability to pass on costs to tenants, pressuring earnings and reducing net margin resilience over time.

- The over-supply risk in the flexible workspace sector, particularly as more landlords and specialist operators add capacity, may limit Workspace Group's ability to rebuild occupancy or push through rent increases, constraining long-term top-line rental growth and overall earnings power.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £5.331 for Workspace Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £6.53, and the most bearish reporting a price target of just £5.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £131.4 million, earnings will come to £131.1 million, and it would be trading on a PE ratio of 10.1x, assuming you use a discount rate of 8.9%.

- Given the current share price of £3.94, the analyst price target of £5.33 is 26.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Workspace Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.