Catalysts

About Derwent London

Derwent London is a Central London office specialist focused on design-led, sustainable regeneration projects that aim to deliver attractive long-term total returns.

What are the underlying business or industry changes driving this perspective?

- Acute undersupply of high-quality Grade A West End offices, with vacancy of about 1.4% and constrained speculative development, is likely to support sustained ERV growth and drive higher like-for-like rental income and earnings over the medium term.

- A structurally higher occupier focus on offices as a strategic tool for culture and talent attraction, combined with Derwent London's design led, amenity rich product and clustering model, should underpin above market leasing spreads and improve net operating margins.

- A multi year, fully consented development and refurbishment pipeline of roughly 2.2 million square feet, targeted profit on cost of 15% to 25% and expected yields on completion above 6.5% provide visible avenues for capital value growth and future uplift in EPRA NTA per share.

- Intensifying environmental standards and occupier demand for low carbon, intelligently managed buildings play to Derwent London's track record in retrofit, circular economy and embodied carbon reduction, supporting pricing power on rents and reducing long term obsolescence risks in valuations.

- Improving financing conditions, active recycling of approximately GBP 1 billion of capital over 5 years and contracted disposals of around GBP 180 million create capacity to fund high return projects and lower average funding costs, supporting future earnings per share growth and total accounting return.

Assumptions

How have these above catalysts been quantified?

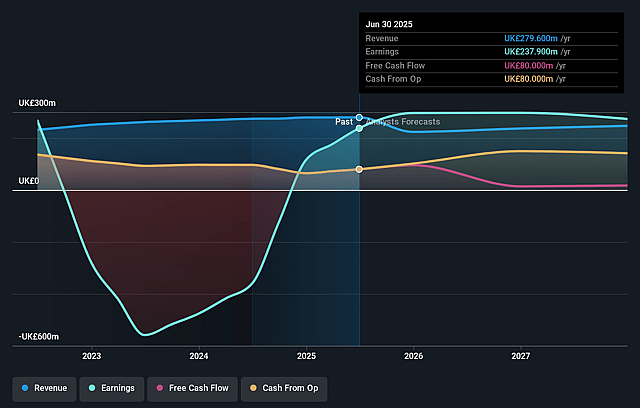

- Analysts are assuming Derwent London's revenue will decrease by 6.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 85.1% today to 124.9% in 3 years time.

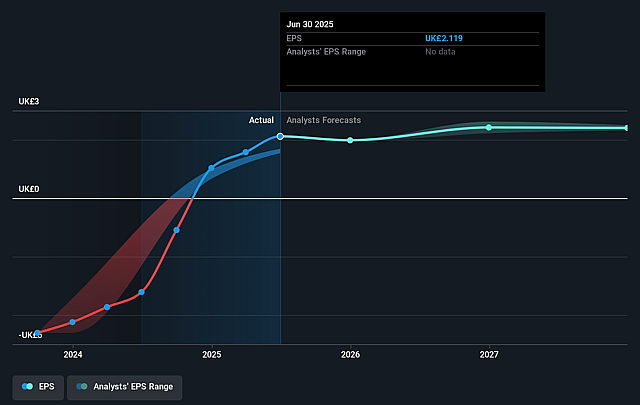

- Analysts expect earnings to reach £283.4 million (and earnings per share of £2.36) by about December 2028, up from £237.9 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting £330.0 million in earnings, and the most bearish expecting £214.6 million.

- In order for the above numbers to justify the price target of the analysts, the company would need to trade at a PE ratio of 10.4x on those 2028 earnings, up from 7.9x today. This future PE is greater than the current PE for the GB Office REITs industry at 9.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.0%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- A cyclical or structural slowdown in London office demand, for example due to weaker economic growth, higher unemployment or a renewed shift toward remote and hybrid working, could erode the current scarcity of Grade A space and put pressure on ERV growth and rental income. This could ultimately weigh on earnings and total accounting return.

- The sizable multi year development and refurbishment pipeline, including Holden House, Network, 50 Baker Street and longer term mixed use projects, exposes Derwent London to construction cost inflation, delivery delays and potential pre letting shortfalls. These factors could compress profit on cost, reduce yields on completion and dilute future net margins.

- Persistently elevated financing costs or a slower than expected decline in interest rates would limit the benefit of recent and upcoming refinancings, keeping the average cost of debt higher for longer and restraining EPRA earnings growth despite positive rental trends.

- Regulatory and policy shifts, such as the proposed prohibition of upwards only rent reviews or tighter environmental and building safety requirements, could weaken pricing power on leases, increase compliance and upgrade expenditure, and compress net rental income and long term margins.

- A prolonged disconnect between public market valuations and asset values, evidenced by the ongoing discount of the share price to EPRA NTA and implied high yields, may constrain the company’s ability to raise equity on attractive terms, slow capital recycling and limit accretive reinvestment. This could cap growth in revenue, earnings and NTA per share.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of £20.84 for Derwent London based on their expectations of its future earnings growth, profit margins and other risk factors.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £27.67, and the most bearish reporting a price target of just £16.4.

- In order for you to agree with the analysts, you'd need to believe that by 2028, revenues will be £226.9 million, earnings will come to £283.4 million, and it would be trading on a PE ratio of 10.4x, assuming you use a discount rate of 8.0%.

- Given the current share price of £16.77, the analyst price target of £20.84 is 19.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Derwent London?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.