Key Takeaways

- Reliance on central London offices and large developments exposes the company to sector downturns, riskier leasing, and unstable rental income streams.

- Elevated sustainability demands and changing tenant preferences increase costs, pressure margins, and threaten long-term income stability and competitiveness of the asset base.

- Strong demand for premium, sustainable office space and a robust development pipeline underpin Derwent London's revenue growth, resilience, and long-term profitability amid industry challenges.

Catalysts

About Derwent London- Derwent London plc owns 62 buildings in a commercial real estate portfolio predominantly in central London valued at £5.0 billion as at 31 December 2024, making it the largest London office-focused real estate investment trust (REIT).

- Persistent adoption of remote and hybrid working in London is likely to permanently reduce aggregate demand for central office space, resulting in long-term pressure on occupancy levels and rental income, which may severely constrain Derwent London's revenue growth and lead to a structural decline in operating earnings.

- Tightening sustainability requirements and accelerated climate change will impose escalating retrofit and compliance costs on Derwent London's extensive development pipeline, squeezing net margins as older assets struggle to remain competitive amid rising capital expenditure needs.

- Derwent London's heavy concentration in the central London office market exposes the company to acute geographic risk and leaves it highly vulnerable to sectoral downturns, increasing volatility in earnings and elevating the prospect of sustained underperformance if the London office market deteriorates.

- The company's reliance on large, development-centric projects in a structurally oversupplied and rapidly evolving market creates heightened leasing and execution risk, threatening prolonged void periods and subdued revenue contributions from major assets that fail to attract long-term tenants or premium rents.

- As tenants increasingly shift towards shorter, more flexible leases and smaller footprints enabled by technology and automation, Derwent London's traditional income visibility and long-duration lease profile will erode, introducing greater volatility in cash flows and undermining the defensibility of net operating income and future dividend sustainability.

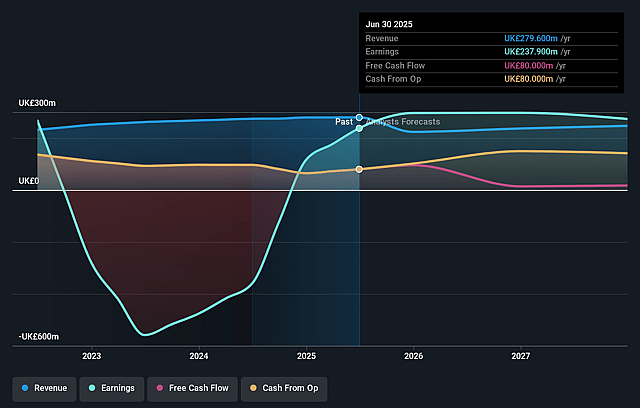

Derwent London Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Derwent London compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Derwent London's revenue will decrease by 4.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 85.1% today to 84.1% in 3 years time.

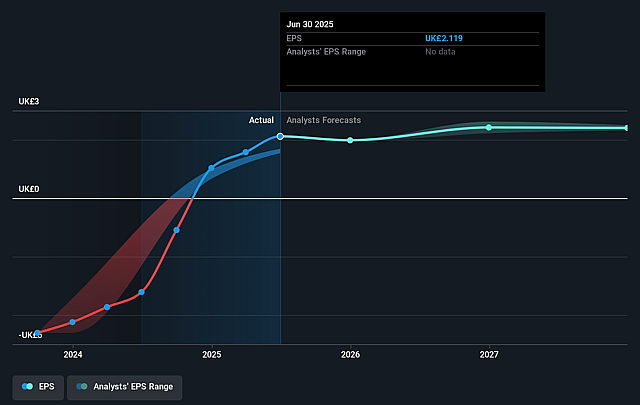

- The bearish analysts expect earnings to reach £205.7 million (and earnings per share of £2.35) by about September 2028, down from £237.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.4x on those 2028 earnings, up from 7.8x today. This future PE is greater than the current PE for the GB Office REITs industry at 10.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.5%, as per the Simply Wall St company report.

Derwent London Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite current industry challenges, sustained demand for Grade A office space in central London and a significant supply shortage-especially in prime West End locations-support rental growth and lower vacancy, which should help Derwent London maintain and potentially increase revenue.

- The company's consistent outperformance of the MSCI London Office Index over multiple years, along with strong leasing momentum, high pre-letting rates on new developments, and meaningful rent uplifts on renewals and reviews, point to structural strengths that can drive long-term net operating income.

- Derwent London has a robust pipeline of class-leading, design-focused, sustainably developed projects with rents and yields on completion expected to outperform current levels, indicating strong potential for capital growth and improvements in earnings and net asset value in the medium and long term.

- Strategic capital recycling, prudent balance sheet management, growing cash reserves, and improving financing terms position the company to weather short-term earnings volatility, invest through downturns, and deliver stable to growing margins and returns to shareholders.

- The move to low-carbon, amenity-rich, technologically advanced offices is accelerating, and Derwent's leadership in sustainability, smart buildings, and flexibility makes its assets more attractive to tenants and investors-likely supporting asset values, occupancy, and long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Derwent London is £16.4, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Derwent London's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £27.67, and the most bearish reporting a price target of just £16.4.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £244.5 million, earnings will come to £205.7 million, and it would be trading on a PE ratio of 11.4x, assuming you use a discount rate of 8.5%.

- Given the current share price of £16.43, the bearish analyst price target of £16.4 is 0.2% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that the bearish analysts believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.