Key Takeaways

- Global pricing pressures, regulatory reforms, and litigation risks are expected to compress GSK's profitability and raise compliance costs.

- Heavy reliance on a few blockbuster products exposes GSK to significant competition, patent expiries, and market share erosion.

- Strong pipeline, growth in specialty and HIV medicines, expanding vaccines, and operational efficiency position GSK for resilient long-term profitability and shareholder value.

Catalysts

About GSK- Engages in the research, development, and manufacture of vaccines, specialty medicines, and general medicines to prevent and treat disease in the United Kingdom, the United States, and internationally.

- Intensifying global pressure on drug pricing, driven by healthcare cost containment policies and regulatory reforms such as the U.S. Inflation Reduction Act, is expected to erode GSK's pricing power and undermine revenue growth, with compounded effects as similar measures expand to other markets over the next decade, compressing net margins and overall profitability.

- GSK's dependency on a limited number of blockbuster products, especially Shingrix and recently-launched specialty medicines, leaves future revenue streams highly vulnerable to patent cliffs, faster-than-expected generic competition, and regulatory reviews, raising material risk for sustained earnings and margin contraction as exclusivity fades.

- A sustained rise in regulatory and public scrutiny over drug safety and marketing practices, coupled with ongoing and unresolved litigation risks such as the Zantac lawsuits, is likely to drive up compliance expenses, increase the incidence of one-off legal charges and significantly reduce future net income.

- The accelerating pace of biotechnology innovation is increasing competitive threats from nimble biotech startups and non-traditional players, which may outpace GSK in areas like gene therapies, mRNA vaccines, and digital drug discovery, threatening long-term market share and resulting in lower-than-anticipated revenue and earnings growth.

- Slowing and/or reversing demographic trends in developed markets, combined with heightened competition and more restrictive national reimbursement policies, could further slow volume growth and per-patient revenues for GSK's key products, diminishing the company's ability to sustain long-term top-line and net margin expansion.

GSK Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on GSK compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming GSK's revenue will grow by 2.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 10.0% today to 18.8% in 3 years time.

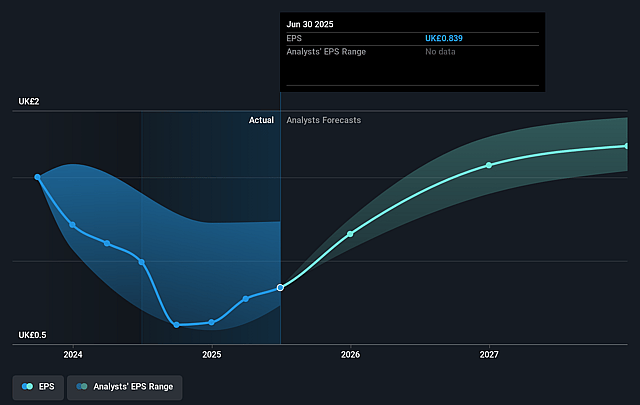

- The bearish analysts expect earnings to reach £6.5 billion (and earnings per share of £1.64) by about July 2028, up from £3.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.5x on those 2028 earnings, down from 17.6x today. This future PE is lower than the current PE for the US Pharmaceuticals industry at 28.5x.

- Analysts expect the number of shares outstanding to grow by 0.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.64%, as per the Simply Wall St company report.

GSK Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- GSK's robust pipeline and expected string of specialty medicine approvals-including Nucala for COPD, Blenrep for multiple myeloma, and depemokimab in severe asthma-present significant opportunities for new high-margin revenue streams and future earnings growth.

- The company's leading presence and ongoing growth in long-acting HIV therapeutics, with Cabenuva and Apretude showing strong double-digit volume increases and further high-potential long-acting pipeline candidates, positions GSK to benefit from rising demand and expanding patient preference, likely supporting higher future revenues and earnings.

- Global demographic and healthcare trends, such as an aging population and the increasing prevalence of chronic diseases like COPD and asthma, continue to drive sustained demand for GSK's respiratory and specialty medicines, contributing to long-term revenue resilience and profitability.

- The strengthening vaccines division, despite short-term volatility, has significant long-term growth potential, with leading products like Shingrix and Arexvy gaining traction in new geographies, national reimbursement programs expanding, and a growing global emphasis on preventative healthcare, which should bolster future revenues and margin stability.

- GSK's focus on productivity improvements, regionalized manufacturing, and operational leverage, as well as a strong balance sheet and disciplined capital allocation (including share buybacks and continued dividend increases), provide a strong foundation for improving operating margins, cash flow, and long-term shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for GSK is £11.2, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of GSK's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £25.1, and the most bearish reporting a price target of just £11.2.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £34.4 billion, earnings will come to £6.5 billion, and it would be trading on a PE ratio of 8.5x, assuming you use a discount rate of 6.6%.

- Given the current share price of £13.72, the bearish analyst price target of £11.2 is 22.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.