Key Takeaways

- Accelerated advancement in specialty medicines, vaccines, and anti-infective therapies positions GSK for outsized revenue and margin growth relative to peers.

- Strategic investments in digital capabilities and global scale enhance productivity, unlock new markets, and support long-term, defensible earnings streams.

- Margin pressure and muted long-term growth are likely, given regulatory pricing constraints, patent expiries, litigation risks, and reliance on few late-stage pipeline successes.

Catalysts

About GSK- Engages in the research, development, and manufacture of vaccines, specialty medicines, and general medicines to prevent and treat disease in the United Kingdom, the United States, and internationally.

- While analyst consensus anticipates new product launches from GSK's pipeline to drive revenue growth, the breadth and accelerated progression of GSK's 66 clinical-stage assets-including 16 now in late stage and 8 regulatory breakthrough designations this year-positions GSK to substantially exceed market expectations for both top-line and earnings growth by 2031 due to multiple high-impact approvals clustered in a short timeframe.

- Analyst consensus expects margin gains from a shift to Specialty Medicines, but GSK's rapid transformation-driven by its reinvestment of Haleon demerger proceeds into higher-margin therapies, global manufacturing scale-up in the U.S., and disciplined SG&A reduction-suggests a more dramatic net margin expansion, with the potential to reach best-in-class margin levels ahead of rivals as new launches outpace legacy product erosion.

- GSK's vaccines business is poised for a step change in global growth as emerging market penetration accelerates; with broadening immunization access and rising middle-class demand, GSK's established leadership and new launches (such as pentavalent meningococcal and RSV vaccines) can unlock a multi-billion pound revenue opportunity and generate sustained double-digit growth in vaccine earnings throughout the decade.

- As digital health adoption and big data analytics transform pharma commercialization, GSK's scale and proactive investments in digital supply chain, real-world evidence, and patient engagement uniquely position it to drive better sales force productivity, improve adherence, and expand market share-supporting a structural lift in both revenue and operating leverage.

- The expansion of GSK's pioneering anti-infective and HIV injectable portfolio, supported by strong real-world adoption and leading intellectual property protection, creates the potential for GSK to command premium pricing and defend long-duration earnings streams, while addressing global health priorities that benefit from robust policy and regulatory incentives.

GSK Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on GSK compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming GSK's revenue will grow by 8.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 10.8% today to 19.0% in 3 years time.

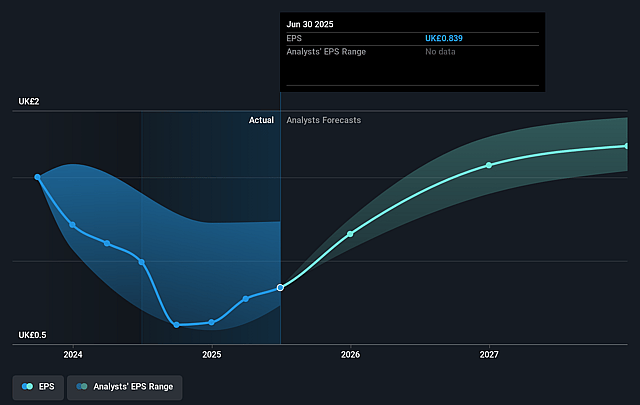

- The bullish analysts expect earnings to reach £7.6 billion (and earnings per share of £1.94) by about August 2028, up from £3.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 14.8x on those 2028 earnings, down from 16.3x today. This future PE is lower than the current PE for the US Pharmaceuticals industry at 27.3x.

- Analysts expect the number of shares outstanding to decline by 0.78% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.82%, as per the Simply Wall St company report.

GSK Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heightened global pricing scrutiny and cost controls, especially from governments and payers in major markets, are limiting GSK's ability to raise prices on new and existing medicines, which could constrain long-term revenue growth and put pressure on margins over time.

- GSK faces material pipeline execution risk, as much of its long-term growth outlook depends on successful development, regulatory approval, and commercialization of a limited number of late-stage pipeline assets, particularly in specialty medicines and vaccines, meaning failures or delays could significantly undermine future revenue and earnings growth.

- The looming expiration of patents-including key assets such as dolutegravir in HIV-will expose GSK to increased generic and biosimilar competition, threatening sustained revenue streams and likely leading to lower net margins as pricing power erodes.

- Ongoing litigation and product liability risks, most notably related to Zantac, could result in substantial one-off settlement costs, damage to reputation, and sustained increases in insurance and compliance expenses, negatively impacting net earnings and free cash flow over multiple years.

- Escalating research and development spend, paired with industry-wide declining R&D productivity and GSK's relatively weaker positioning in high-growth areas like oncology and novel gene therapies, may hamper the company's ability to generate innovative drugs that offset losses from patent expiries, ultimately constraining long-term revenue and operating margin expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for GSK is £23.48, which represents two standard deviations above the consensus price target of £16.42. This valuation is based on what can be assumed as the expectations of GSK's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £25.2, and the most bearish reporting a price target of just £11.2.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be £40.3 billion, earnings will come to £7.6 billion, and it would be trading on a PE ratio of 14.8x, assuming you use a discount rate of 6.8%.

- Given the current share price of £13.83, the bullish analyst price target of £23.48 is 41.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.