Key Takeaways

- Escalating pricing pressures and patent expirations threaten growth, margins, and the value from new and existing products across key markets.

- Weak R&D productivity, mounting legal risks, and emerging market volatility undermine earnings stability and long-term strategic goals.

- Innovation in specialty medicines, global market expansion, and operational efficiencies position GSK for sustained revenue growth and stronger profitability.

Catalysts

About GSK- Engages in the research, development, and manufacture of vaccines, specialty medicines, and general medicines to prevent and treat disease in the United Kingdom, the United States, and internationally.

- GSK's future revenue growth and profit margins will be severely constrained as governments and private payors accelerate cost containment measures and implement additional pricing pressures, especially in key markets such as the U.S. and Europe, undermining the company's ability to monetize new launches or sustain premium pricing on specialty and vaccine products.

- Although expansion into emerging markets is a pillar of the long-term strategy, increased exposure will expose GSK to amplified risks from economic volatility, unpredictable regulatory changes, and intensified price competition, which will destabilize earnings and diminish the incremental revenue contribution hoped for from international markets.

- The company is approaching several major patent cliffs, most notably in the HIV portfolio, which will trigger a rapid decline in high-margin product sales as generics and biosimilars erode exclusivity, leading to steep reductions in both revenue and net margins from 2028 onward.

- Persistent underperformance in late-stage R&D productivity, combined with escalating R&D spending that is now rising ahead of sales, raises the probability that incremental pipeline investments will fail to deliver commercially significant blockbusters, resulting in resource misallocation, missed growth targets, and reduced returns on capital.

- Increasing legal liabilities-particularly ongoing Zantac litigation and potential new claims related to vaccine adverse events-will result in substantial settlement outflows and unplanned expenses, further pressuring free cash flow and limiting financial flexibility to fund future growth initiatives or maintain current shareholder distributions.

GSK Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on GSK compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming GSK's revenue will grow by 3.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 10.8% today to 19.2% in 3 years time.

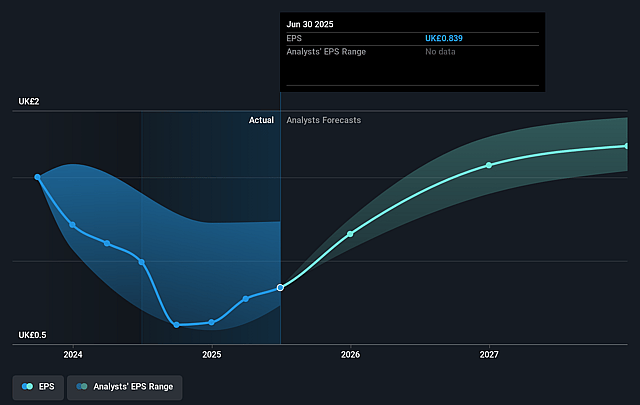

- The bearish analysts expect earnings to reach £6.6 billion (and earnings per share of £1.66) by about September 2028, up from £3.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.0x on those 2028 earnings, down from 17.4x today. This future PE is lower than the current PE for the US Pharmaceuticals industry at 21.6x.

- Analysts expect the number of shares outstanding to decline by 0.81% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.82%, as per the Simply Wall St company report.

GSK Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained expansion and innovation in Specialty Medicines and Vaccines, with 14 high-potential launches and growing revenue contribution from these areas, may underpin long-term growth in GSK's revenue and net margins.

- Robust cash flow generation and disciplined capital allocation, including investment in R&D, targeted business development, and share buybacks, could enhance both earnings and shareholder returns over time.

- Expanding global footprint, particularly in high-growth geographic markets and increased penetration of major products like Shingrix outside the U.S., may support ongoing sales and revenue strength.

- Accelerated advances in pipeline productivity, with a deep late-stage portfolio, numerous upcoming pivotal trial readouts, and multiple regulatory approvals already achieved, could drive top-line and long-term earnings growth.

- Positive momentum from operational efficiencies, supply chain optimization, and the transition toward higher-margin Specialty portfolios is likely to improve operating margins and profitability, counteracting any downward pressure on share price.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for GSK is £11.2, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of GSK's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £25.2, and the most bearish reporting a price target of just £11.2.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £34.6 billion, earnings will come to £6.6 billion, and it would be trading on a PE ratio of 8.0x, assuming you use a discount rate of 6.8%.

- Given the current share price of £14.88, the bearish analyst price target of £11.2 is 32.9% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on GSK?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.