Last Update 28 Oct 25

Fair value Decreased 14%The consensus analyst price target for YouGov has decreased from £5.28 to £4.52 per share, as analysts cite a higher discount rate along with modestly improved profit margins and revenue growth in their revised outlook.

Analyst Commentary

Recent analyst reports provide mixed views on YouGov's outlook, as reflected in their revised price targets and ratings. While some analysts remain constructive on the company’s growth trajectory, others have raised concerns about current challenges and valuation.

Bullish Takeaways- Bullish analysts continue to see value in YouGov’s long-term growth prospects. Some are maintaining Buy ratings, although they have lowered their price targets.

- Expectations for improved profit margins indicate ongoing confidence in the company’s ability to enhance operational efficiency.

- Analysts highlight YouGov’s revenue growth as a key factor supporting its current valuation, even in the face of broader market uncertainties.

- Some view the recent target adjustments as a recalibration due to a higher discount rate rather than a fundamental change in the company’s execution or market position.

- Bearish analysts suggest that the lower price targets reflect increased caution regarding valuation, particularly given higher discount rates in the current market environment.

- There are concerns that profit margin improvements may be more modest than previously expected, which could affect future earnings growth.

- Some analysts maintain neutral stances, indicating ongoing uncertainty about YouGov’s ability to deliver outsized growth compared to its current market capitalization.

- Persistent market challenges and a cautious sector outlook contribute to the downward revisions in target prices.

What's in the News

- YouGov plc provided group earnings guidance for the fiscal year 2026, expecting modest progress in revenue due to ongoing incremental investments (Key Developments).

- YouGov plc recommended a dividend of 9.25 pence per share, payable on 9 December 2025, if approved at the company’s Annual General Meeting on 4 December 2025 (Key Developments).

- YouGov plc issued earnings guidance for FY25, projecting strong reported revenue due to the full year impact of the CPS acquisition (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has fallen significantly from £5.28 to £4.52 per share.

- Discount Rate has risen slightly from 7.99% to 8.12%.

- Revenue Growth expectations have increased modestly from 2.66% to 2.89%.

- Net Profit Margin has improved slightly from 8.01% to 8.32%.

- Future P/E ratio has declined from 23.20x to 18.95x, which suggests a lower valuation relative to projected earnings.

Key Takeaways

- Commitment to SP3 strategy and AI enhancements suggest potential revenue growth and improved product offerings through technology and automation.

- Cost optimization and expansion into new regions indicate improved financial performance and market diversification potential.

- Flat growth, missed opportunities, and macroeconomic uncertainties threaten revenue, margins, and investor confidence amid rising costs and structural challenges in key sectors.

Catalysts

About YouGov- Provides online market research services in the United Kingdom, the Americas, the Middle East, Mainland Europe, Africa, and the Asia Pacific.

- The company's commitment to refocusing on its SP3 strategy as a data product-centered platform suggests potential for future revenue growth by leveraging technology and automation, which could enhance product offerings and market reach.

- Cost optimization plans aiming for £20 million in savings, with 70% expected to be realized within the year, indicate potential for improved net margins, contributing to better financial performance.

- Expansion into new regions such as Scandinavia and plans to extend CPS data collection beyond Europe, including potential future U.S. expansion, suggests potential revenue growth through market diversification.

- AI enhancements to data products, incorporating insights from the company's acquisition of AI company Yabble, could increase the appeal and utility of offerings, positively impacting revenue growth.

- A renewed focus on building dedicated sales teams for data products aims to increase new sales and renewal rates, potentially boosting earnings and cash flow.

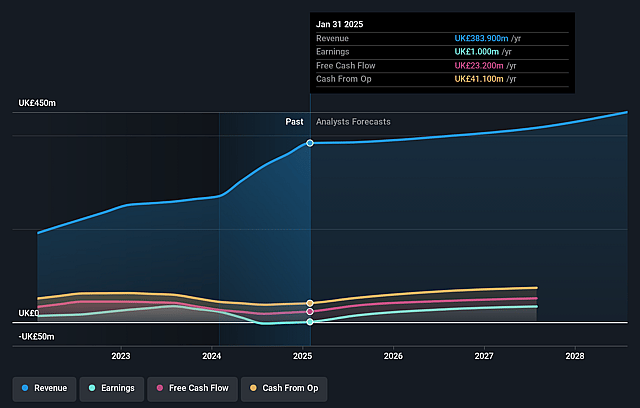

YouGov Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming YouGov's revenue will grow by 4.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.3% today to 11.9% in 3 years time.

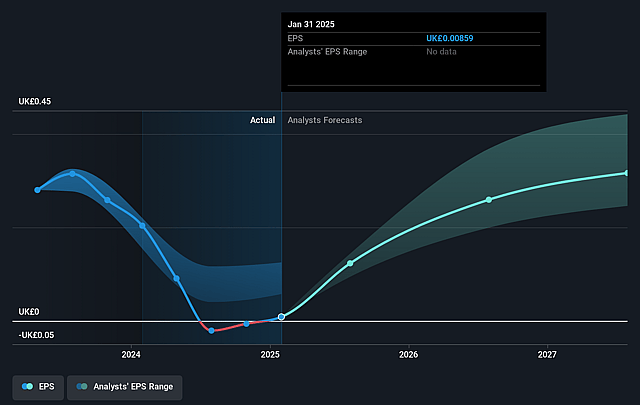

- Analysts expect earnings to reach £51.4 million (and earnings per share of £0.32) by about September 2028, up from £1.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.8x on those 2028 earnings, down from 421.6x today. This future PE is greater than the current PE for the GB Media industry at 12.2x.

- Analysts expect the number of shares outstanding to grow by 0.77% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.78%, as per the Simply Wall St company report.

YouGov Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company experienced flat growth over the years and missed some opportunities, which could impact future revenue growth and investor confidence.

- There have been higher staff costs in the first half and challenges with third-party data purchasing, which have impacted the company's gross margins.

- The CPS integration has been limited, with a reliance on transfer service agreements that may contribute to inconsistent cash flow and net margins.

- Significant changes in key sectors such as e-sports and gaming result in structural challenges, potentially impacting future revenue potential.

- There are macroeconomic uncertainties in key markets, particularly in Switzerland and the Nordics, which may create headwinds against revenue growth and overall financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £5.808 for YouGov based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £7.6, and the most bearish reporting a price target of just £3.4.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £433.3 million, earnings will come to £51.4 million, and it would be trading on a PE ratio of 16.8x, assuming you use a discount rate of 7.8%.

- Given the current share price of £3.6, the analyst price target of £5.81 is 38.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.