Key Takeaways

- Reko Diq and MSALABS have potential to deliver much greater, higher-margin growth than analysts currently project, driven by unique assets and innovative technologies.

- Operational leverage, automation, and environmental leadership strongly position Capital to capture premium contracts and sustained recurring revenue as mining industry dynamics shift.

- Heavy reliance on few contracts, rising capital demands, operational delays, and exposure to regulatory and industry shifts create structural risks for stable growth and profitability.

Catalysts

About Capital- Provides drilling, mining, mineral assaying, and surveying services.

- Analyst consensus expects the Reko Diq contract to simply bring mining revenue back to 2024 levels by 2026, but this view may underestimate both the sheer scale and margin quality of Reko Diq, which, as a top-10 global copper mine with a 40-year life and Barrick as operator, could drive structurally higher and more resilient earnings and free cash flow than the business has ever achieved, especially as copper prices strengthen amid global electrification.

- Analysts broadly agree that MSALABS' Nevada Gold Mines laboratory will propel accelerated revenue growth and margin expansion by 2025, yet this likely underrates the potential for MSALABS to become a global laboratory leader and technology standard-bearer, as widespread adoption of its Chrysos technology and new contract wins could push segment margins above 20% and deliver revenue far beyond current $80 million annualized guidance.

- The current valuation overlooks the powerful operational leverage and margin expansion Capital can unlock as its proprietary technology, equipment, and digital systems are increasingly embedded in client operations, with automation and data-driven workflows driving sustained double-digit improvements in EBITDA margins.

- Capital's material footprint and established partnerships across high-growth African jurisdictions (where major mines are ramping up and new deposits continue to be discovered) position the company to capture a disproportionate share of new drilling and mining contracts, structurally enhancing group-level recurring revenue growth rates.

- As mining houses and exploration companies accelerate outsourcing to focus on core competencies while confronting acute labor shortages and ESG scrutiny, Capital's end-to-end compliance and environmental leadership profile will allow it to win higher-value, longer-duration contracts with premium pricing, which will directly lift net margins and future earnings power.

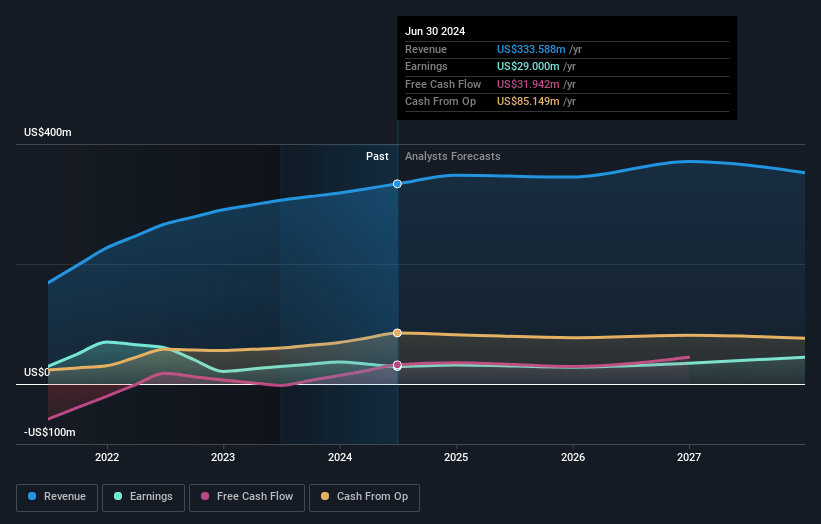

Capital Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Capital compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Capital's revenue will grow by 6.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 5.0% today to 10.7% in 3 years time.

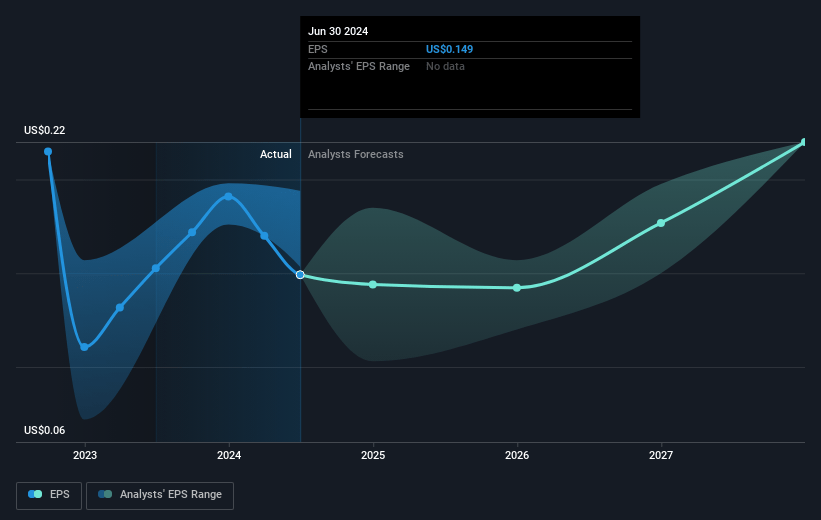

- The bullish analysts expect earnings to reach $44.4 million (and earnings per share of $0.1) by about July 2028, up from $17.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 12.4x on those 2028 earnings, down from 14.7x today. This future PE is greater than the current PE for the GB Metals and Mining industry at 9.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.85%, as per the Simply Wall St company report.

Capital Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Capital's heavy reliance on a concentrated client base and limited geographic diversification is demonstrated by the significant impact from the simultaneous end and early termination of its two largest mining contracts, Sukari and Gabon, which caused material revenue and profit volatility, indicating a structural risk to revenue stability and future earnings.

- Ongoing capital intensity for fleet expansion and property investments, combined with the company's increased gross debt and elevated leverage ratios, raises the risk of compressed net margins and potential pressure on free cash flow, especially during periods of delayed contract ramp-ups or underutilization.

- Delays in the ramp-up and utilization of new laboratories (most notably the Nevada Gold Mines Laboratory within MSALABS) and slower-than-hoped adoption rates of Chrysos technology point to execution difficulties and challenges in scaling high-margin services; this erodes potential revenue growth and margin expansion.

- Capital remains exposed to heightened political and regulatory risk in several higher-risk jurisdictions (such as Mali, where impairments and increased VAT receivable provisions were necessary), and changes in global ESG or regulatory demands may further increase operational costs and liability risks, negatively influencing net margins and future profitability.

- Secular and industry-wide trends such as accelerating energy transition, automation, and mining sector consolidation threaten to reduce long-term demand for traditional mining services, limit contract volumes, and intensify competitive pressure on pricing, putting future revenues and sustainable earnings at risk.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Capital is £1.6, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Capital's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £1.6, and the most bearish reporting a price target of just £0.8.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $414.7 million, earnings will come to $44.4 million, and it would be trading on a PE ratio of 12.4x, assuming you use a discount rate of 8.9%.

- Given the current share price of £0.95, the bullish analyst price target of £1.6 is 40.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.