Last Update 17 Sep 25

Fair value Increased 13%Personal Group Holdings’ consensus price target has increased notably to £4.16, reflecting improved future earnings expectations (as indicated by a higher forward P/E), despite a modest decline in net profit margin.

Valuation Changes

Summary of Valuation Changes for Personal Group Holdings

- The Consensus Analyst Price Target has significantly risen from £3.68 to £4.16.

- The Future P/E for Personal Group Holdings has significantly risen from 14.64x to 16.75x.

- The Net Profit Margin for Personal Group Holdings has fallen from 15.74% to 14.77%.

Key Takeaways

- Expanding digital insurance channels and new strategic partnerships support growth in revenues and recurring income streams.

- Exploring acquisitions and new insurance products could enhance market reach and contribute to earnings growth.

- Reliance on face-to-face interactions, digital integration challenges, market expansion dependency, insurance profitability assumptions, and key partnerships could impact revenue and growth.

Catalysts

About Personal Group Holdings- Provides benefits and platform products, pay and reward consultancy services, and salary sacrifice technology products in the United Kingdom.

- Personal Group Holdings is focusing on expanding its insurance offering through digital channels, which is expected to drive future revenue growth by reaching a broader audience beyond face-to-face interactions.

- The company has successfully migrated its benefits platform to Hapi 2.0, resulting in material cost savings and increased operational efficiencies, likely improving net margins.

- The strategic partnerships, such as the one with Sage, are expected to generate significant new leads, supporting an increase in recurring revenues from SaaS products.

- Personal Group Holdings plans to explore new insurance products and channels, including group cash plans and digital offerings, which are anticipated to contribute to earnings growth.

- The company is exploring potential acquisitions to accelerate growth, which could enhance revenue and expand market reach if synergistic targets are acquired.

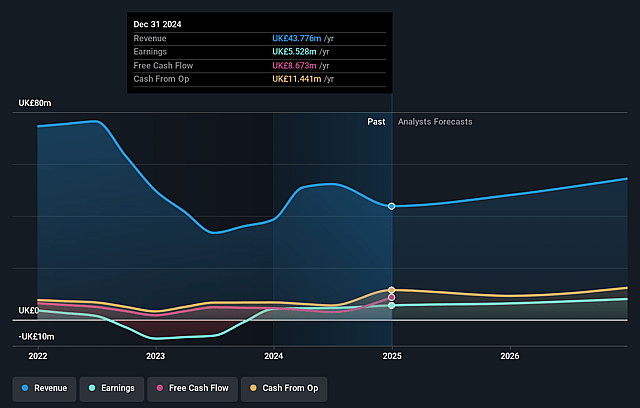

Personal Group Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Personal Group Holdings's revenue will grow by 11.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.6% today to 15.7% in 3 years time.

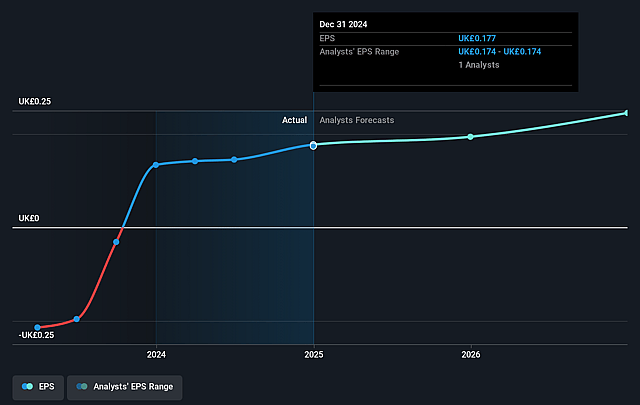

- Analysts expect earnings to reach £9.5 million (and earnings per share of £0.29) by about September 2028, up from £5.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.6x on those 2028 earnings, down from 21.9x today. This future PE is greater than the current PE for the GB Insurance industry at 11.2x.

- Analysts expect the number of shares outstanding to decline by 0.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.82%, as per the Simply Wall St company report.

Personal Group Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The reliance on face-to-face consultations as a key differentiator could be a risk if circumstances change (e.g. resurgence of a pandemic) that limit in-person interactions, potentially impacting sales and thereby affecting revenue and earnings.

- The competitive landscape, particularly in digital offerings, may challenge Personal Group's growth if they cannot effectively integrate and expand their digital channels, impacting their ability to capture market share and grow revenue streams.

- The company's plan for growth depends on successful expansion into new markets and increasing penetration within existing markets; failure to achieve these objectives could limit revenue potential and impact future earnings.

- The insurance segment's profitability relies on favorable claims ratios and other actuarial assumptions. Any significant deviations due to external factors like changes in NHS service levels could negatively impact net margins and profitability.

- The dependency on key partnerships, such as with Sage, means that any deterioration or loss of these relationships could affect Personal Group's ability to generate recurring revenue, impacting the company's revenue stability and growth potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £3.68 for Personal Group Holdings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £60.3 million, earnings will come to £9.5 million, and it would be trading on a PE ratio of 14.6x, assuming you use a discount rate of 6.8%.

- Given the current share price of £3.88, the analyst price target of £3.68 is 5.4% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.