Key Takeaways

- Brand-driven innovation, operational streamlining, and digital transformation are poised to unlock above-market revenue growth, margin expansion, and cash flow gains.

- Strategic focus on health, wellbeing, and sustainability positions Unilever to outpace industry trends in premiumization, consumer demand, and long-term value creation.

- Shifting consumer preferences, regulatory pressures, reliance on mature markets, emerging market risks, and digital disruption threaten Unilever's revenue growth and profit margins.

Catalysts

About Unilever- Operates as a fast-moving consumer goods company in the Asia Pacific, Africa, the Americas, and Europe.

- Analyst consensus expects the Growth Action Plan (GAP 2030) to lift growth and premiumization, but the market is likely underestimating the potential for rapid scale effects: with brand superiority initiatives, a highly focused innovation agenda, and accelerated investment behind Power Brands, Unilever could unlock sustainable top-line growth outpacing both peers and emerging market consumer acceleration, resulting in mid

- to high single-digit revenue growth and structurally higher gross margins over several years.

- While analysts broadly recognize cost-saving benefits from the ongoing productivity program, they are likely not fully pricing in the cultural and operational transformation underway: the combination of faster de-layering, sharper category focus, and higher accountability is expected to drive long-lasting OPEX efficiencies, fueling operational margin expansion beyond consensus expectations and elevating underlying ROIC even after the major cost program concludes.

- Unilever's strategic push into high-growth health and wellbeing segments

- through aggressive international expansion of brands like Liquid I.V., targeted portfolio moves in premium beauty and nutrition, and ramped R&D spend

- positions the company to benefit disproportionately from the global rise in health

- and wellness-focused consumer behavior, likely driving outsized revenue and EBITDA growth.

- Digital transformation efforts, exemplified by rolling out AI-enabled supply planning (like Project Sky) and direct-to-consumer models in key emerging economies, are likely to accelerate distribution efficiency, agile pricing, and category share gains well ahead of industry trends, structurally supporting higher net margins and cash generation.

- The company's deeply embedded commitment to regenerative agriculture, reduced plastic intensity, and supplier wage improvements positions Unilever to uniquely capture growing market share and pricing power as retailers and consumers globally accelerate adoption of sustainable products, which should drive significant medium-term gains in both brand premiumization and free cash flow.

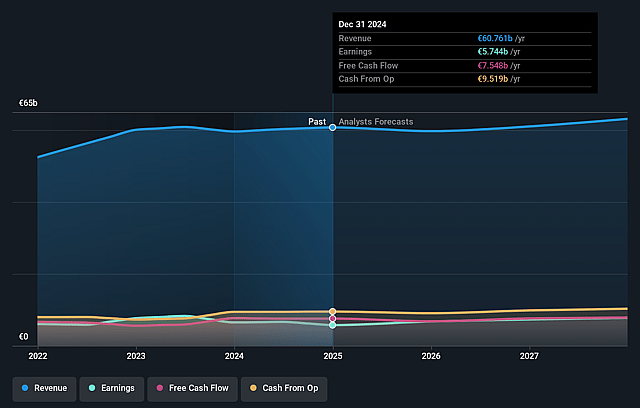

Unilever Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Unilever compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Unilever's revenue will grow by 4.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 9.5% today to 12.5% in 3 years time.

- The bullish analysts expect earnings to reach €8.6 billion (and earnings per share of €3.38) by about July 2028, up from €5.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 24.7x on those 2028 earnings, up from 22.3x today. This future PE is greater than the current PE for the US Personal Products industry at 19.6x.

- Analysts expect the number of shares outstanding to decline by 0.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.25%, as per the Simply Wall St company report.

Unilever Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Shifting consumer preferences toward local and small brands over large multinationals like Unilever could erode its long-term market share, limiting both revenue growth and the company's ability to consistently grow top-line sales.

- Accelerating regulatory and environmental pressures-including increased scrutiny of plastic packaging, chemicals, and overall sustainability-risk raising compliance and operational costs, thereby weighing on net margins and limiting profit expansion.

- Unilever's continued reliance on slow-growth, mature markets such as Europe may constrain overall revenue and earnings, as these markets are expected to underperform global averages and could limit the company's ability to accelerate group-wide financial performance.

- Currency volatility and economic headwinds in emerging markets, where Unilever generates significant revenue, could negatively impact reported earnings and margins due to adverse currency translation effects and the need for significant pricing corrections in high-inflation regions.

- The growth of direct-to-consumer and digital-native brands, as well as consolidation among global retail and ecommerce platforms, threatens Unilever's pricing power and brand loyalty, potentially leading to increased trade and marketing spend, lower pricing flexibility, and ultimately pressure on both revenue and profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Unilever is £59.48, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Unilever's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £59.48, and the most bearish reporting a price target of just £38.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €68.5 billion, earnings will come to €8.6 billion, and it would be trading on a PE ratio of 24.7x, assuming you use a discount rate of 8.2%.

- Given the current share price of £44.45, the bullish analyst price target of £59.48 is 25.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.