Key Takeaways

- Strategic global expansion, innovation in premium and convenience products, and operational automation are set to drive sustained revenue growth and improved margins.

- Enhanced sustainability efforts and diversification across categories and markets strengthen retailer partnerships, reduce risk, and support stable long-term earnings.

- Heavy dependence on traditional meat, slow diversification, and concentration among a few partners increase long-term risks from market, regulatory, and sustainability shifts.

Catalysts

About Hilton Food Group- Engages in the food packing business.

- Strong expansion into new high-growth international markets, including the launch of operations in Saudi Arabia (2026) and Canada (2027) with major retail partners, is set to significantly grow Hilton's addressable market, driving topline revenue increases and long-term volume growth.

- Ongoing investment in automation and advanced food processing technologies is improving operational efficiency and reducing reliance on labor, which should protect and gradually enhance net margins even in the face of rising global employment costs.

- Capitalizing on the rising consumer demand for convenience and premiumization, Hilton's innovation in ready-to-cook, value-added, and premium-tier products (e.g. skin-packaged meats and upmarket ranges) enables margin-accretive revenue growth and resilience against retail sector shifts.

- Strengthened supply chain transparency and sustainability initiatives, including progress on emissions and packaging reduction, position Hilton as a preferred supplier for major retailers facing increasing regulatory and consumer scrutiny-likely supporting sustained retailer partnerships and stable earnings.

- A multi-category and multi-geography approach, including successful ventures in seafood and emerging plant-based lines, increases customer "stickiness," diversifies risk, and broadens Hilton's earnings base, fortifying both revenue stability and future profit growth.

Hilton Food Group Future Earnings and Revenue Growth

Assumptions

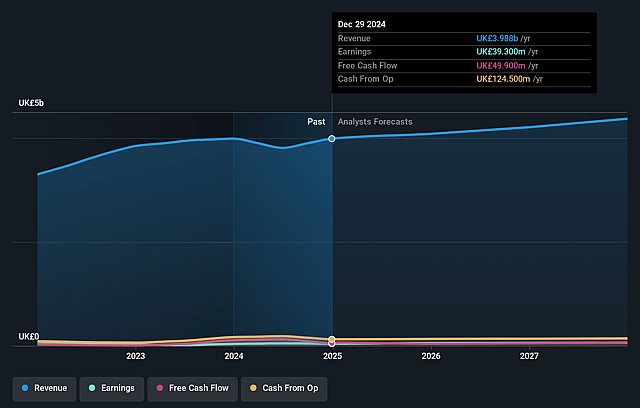

How have these above catalysts been quantified?- Analysts are assuming Hilton Food Group's revenue will grow by 3.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.0% today to 1.4% in 3 years time.

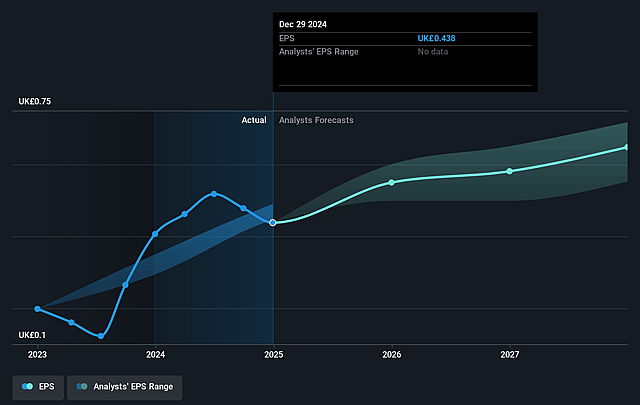

- Analysts expect earnings to reach £60.0 million (and earnings per share of £0.65) by about August 2028, up from £39.3 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting £68 million in earnings, and the most bearish expecting £50.9 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.2x on those 2028 earnings, down from 19.4x today. This future PE is about the same as the current PE for the GB Food industry at 19.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.82%, as per the Simply Wall St company report.

Hilton Food Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's continued core reliance on traditional meat (80% of sales) exposes it to the long-term secular trend of consumers shifting toward plant-based and alternative proteins, as highlighted by ongoing challenges and impairment in its vegan/vegetarian segment; this could erode future revenue and growth as the protein market evolves.

- While automation and operational efficiencies have improved margins and countered labor and cost pressures, any future lag in innovation regarding sustainable packaging or further diversification into alternative proteins could leave Hilton Food Group vulnerable to more nimble, sustainability-focused competitors, risking margin compression and future earnings potential.

- Expansion into new geographies (e.g., Canada, Saudi Arabia) entails execution risk, and initial contributions from these projects are expected to be small for several years; if anticipated volume build or partner scale-up is slower than expected, near

- and mid-term topline and earnings growth may fall short of market expectations.

- Heightened regulatory and environmental pressures-such as rising UK tax rates, increased scrutiny on food safety, animal welfare, and emissions reduction-could increase compliance and operational costs, impacting net margins over the long term.

- The business remains concentrated on a select group of large retail partners in key markets (e.g., Tesco, Walmart, Woolworths, Ahold Delhaize); if any major contract is lost, renegotiated unfavorably, or if retailers increase private-label vertical integration, Hilton's revenues and earnings could be materially pressured, especially given limited exposure in high-growth markets like North America and Asia-Pacific.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £10.608 for Hilton Food Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £11.2, and the most bearish reporting a price target of just £9.4.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £4.4 billion, earnings will come to £60.0 million, and it would be trading on a PE ratio of 19.2x, assuming you use a discount rate of 6.8%.

- Given the current share price of £8.48, the analyst price target of £10.61 is 20.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.