Catalysts

About C&C Group

C&C Group is a branded drinks and wholesale distribution business focused on beer, cider and broader beverages across the U.K., Ireland and selected international markets.

What are the underlying business or industry changes driving this perspective?

- Revitalization of core brands such as Tennent's and Bulmers, supported by increased media investment, innovation in zero and light variants and milestone anniversaries, is expected to deepen brand equity and premium mix, supporting sustained revenue growth and higher net margins.

- Recovery and ongoing optimization of the Matthew Clark Bibendum distribution platform, including technology led efficiency gains, SKU rationalization and disciplined exit from low margin contracts, should structurally lift distribution margins and expand group operating profit.

- Rising consumer demand for moderation and lower calorie choices is being met by expanded low and no alcohol portfolios and new dealcoholization capability at Wellpark, positioning C&C to capture disproportionate share in faster growing segments and enhance earnings resilience.

- Strong execution on cost control through the Simply Better Growth program, modest input cost inflation and growing use of long dated financing facilities are expected to translate predictable cash generation into rising free cash flow and improving earnings per share.

- Accelerating momentum in premium and challenger brands such as Menabrea and Outsider, combined with C&C's market leading on trade reach, should increase exposure to higher value occasions like food led beer consumption, supporting mix improvement, revenue growth and expanding group EBITDA.

Assumptions

This narrative explores a more optimistic perspective on C&C Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

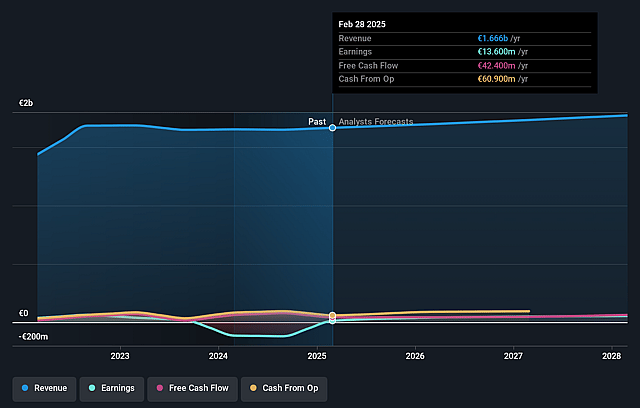

- The bullish analysts are assuming C&C Group's revenue will grow by 8.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 1.3% today to 3.3% in 3 years time.

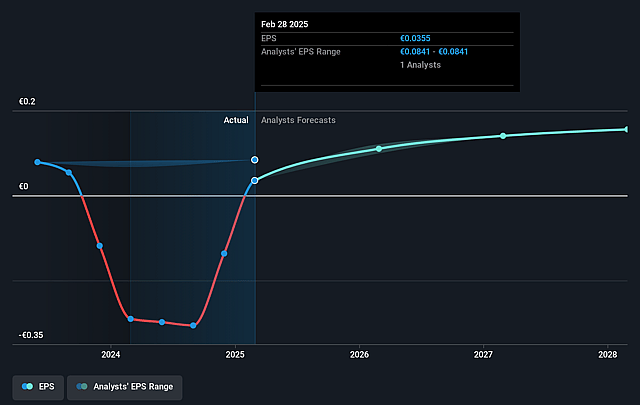

- The bullish analysts expect earnings to reach €67.1 million (and earnings per share of €0.19) by about December 2028, up from €20.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 22.8x on those 2028 earnings, down from 26.5x today. This future PE is greater than the current PE for the GB Beverage industry at 20.4x.

- The bullish analysts expect the number of shares outstanding to decline by 0.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.07%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Structural pressures on the hospitality sector, including rising operating costs for pubs and restaurants and consumers visiting less frequently or trading down for value, may limit long term on trade volumes for beer and cider, constraining revenue growth and reducing operating leverage across the group.

- Ongoing weakness in the U.K. on trade cider category, where Magners and Orchard Pig are already underperforming, could prove more secular than cyclical and slow or even reverse the recovery plans for Magners, depressing branded volumes and keeping group net margins below bullish expectations.

- The deliberate exit from low margin contracts, SKU rationalization and potential customer attrition in Matthew Clark Bibendum, while positive for mix, could result in a prolonged period of top line pressure if lost volumes are not replaced with more profitable business, leading to lower revenue and more modest EBITDA growth than forecast.

- Complexity from years of acquisitions, incomplete integration and the current position between a centralised and multi unit model may mean simplification, culture change and process redesign take longer and cost more than planned, delaying efficiency gains and limiting improvement in operating profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for C&C Group is £2.95, which represents up to two standard deviations above the consensus price target of £1.91. This valuation is based on what can be assumed as the expectations of C&C Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £3.02, and the most bearish reporting a price target of just £1.42.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be €2.1 billion, earnings will come to €67.1 million, and it would be trading on a PE ratio of 22.8x, assuming you use a discount rate of 7.1%.

- Given the current share price of £1.32, the analyst price target of £2.95 is 55.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on C&C Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.