Key Takeaways

- Investment in brand innovation, premium products, and digital customer engagement is positioning C&C for sustainable revenue and margin growth as consumer preferences evolve.

- Expansion into low and no-alcohol options, along with operational efficiencies and a recovering distribution business, diversifies revenue streams and strengthens competitive positioning.

- Neglected legacy brands, digital transformation delays, market overconcentration, lack of portfolio diversification, and rising costs threaten future growth, earnings resilience, and brand relevance.

Catalysts

About C&C Group- Manufactures, markets, and distributes beer, cider, wine, spirits, and soft drinks in the United Kingdom, the Republic of Ireland, Great Britain, and internationally.

- C&C is beginning to meaningfully invest in brand innovation, premium product development, and packaging-especially for its core brands (Tennent's, Bulmers, Magners) and premium portfolio-after years of underinvestment; this positions the group to capture higher average selling prices and share as consumer preferences shift toward quality and premium options, supporting medium/long-term revenue and margin growth.

- The group's focus on developing a digital-first, enhanced CRM and e-commerce customer journey-coupled with investments in data analytics and technology-will expand its direct market access and improve customer engagement, enabling increased volumes and more effective revenue growth management, positively impacting revenue and net margin resilience.

- Dedicated expansion of the low

- and no-alcohol segment across core brands (notably with launches and redevelopment of 0.0% variants for Tennent's and Bulmers) allows C&C to address the rapid growth in this category and align with consumer health trends, providing access to new customer bases and mitigating potential declines in traditional alcohol consumption, thereby diversifying and supporting future revenue streams.

- Ongoing supply chain simplification, operational efficiency measures (Simply Better Growth program), and SKU rationalization are expected to drive sustainable cost reductions and operational leverage, increasing operating margins and supporting the group's ability to reinvest in growth and deliver predictable free cash flow.

- Stabilization and recovery in C&C's Distribution business (Matthew Clark Bibendum), enhanced by improvements in service, customer proposition, and digital capabilities, are rebuilding customer confidence, which should translate into customer wins, volume growth, and improved operating margins in a consolidating on-trade sector-bolstering both revenue and earnings growth prospects.

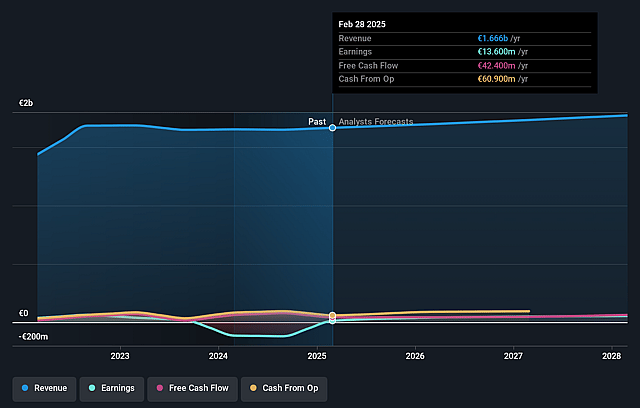

C&C Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming C&C Group's revenue will grow by 2.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.8% today to 3.1% in 3 years time.

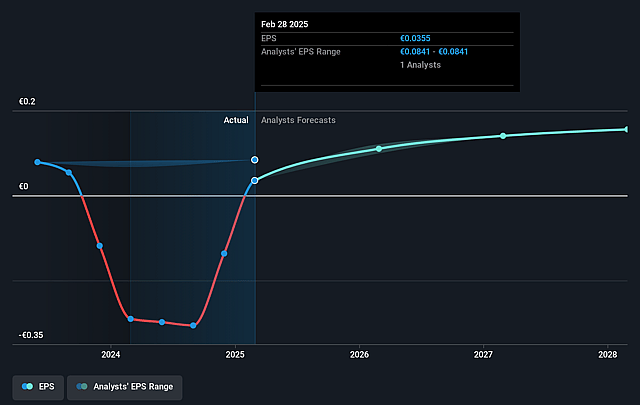

- Analysts expect earnings to reach €54.6 million (and earnings per share of €0.16) by about September 2028, up from €13.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.2x on those 2028 earnings, down from 53.0x today. This future PE is lower than the current PE for the GB Beverage industry at 24.0x.

- Analysts expect the number of shares outstanding to decline by 3.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.82%, as per the Simply Wall St company report.

C&C Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company acknowledges that many of its legacy brands such as Bulmers and Magners have been neglected in terms of innovation and development, and revitalizing them will be a multi-year, investment-heavy effort with uncertain outcomes; failure to reconnect with younger or evolving consumer groups risks long-term brand equity and revenue deterioration.

- Despite efforts to strengthen digital and direct-to-consumer capabilities, management admits being at "ground zero" with digital transformation, which suggests C&C is lagging industry peers in adapting to secular e-commerce and digital distribution trends-potentially weakening their route-to-market strengths and stifling future sales or efficiency gains.

- The company remains highly concentrated in UK and Irish markets, so it remains exposed to region-specific economic headwinds, demographic shifts (e.g., aging population), and the risk of declining alcohol consumption per capita-all potentially contributing to ongoing revenue and volume pressures.

- There is limited evidence of meaningful diversification into high-growth non-alcoholic, low-alcohol, craft, or functional beverage segments; this leaves earnings vulnerable to the secular decline in mainstream alcohol consumption driven by health and wellness trends as well as regulatory tightening, threatening the company's long-term revenue base.

- While recent profit growth has been driven by exiting low-margin businesses and short-term cost efficiencies, management highlights persistent input and labor cost inflation; if C&C cannot pass costs onto customers or drive significant volume growth, net margins could be compressed in the medium to long term, eroding earnings resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £1.884 for C&C Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £3.08, and the most bearish reporting a price target of just £1.43.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €1.8 billion, earnings will come to €54.6 million, and it would be trading on a PE ratio of 16.2x, assuming you use a discount rate of 6.8%.

- Given the current share price of £1.7, the analyst price target of £1.88 is 9.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.