Catalysts

About Nichols

Nichols is a branded soft drinks business focused on asset-light, partnership-led growth across U.K. Packaged, International Packaged and Out of Home channels.

What are the underlying business or industry changes driving this perspective?

- Rapid expansion of the concentrate model and local manufacturing in West Africa and the U.S.A. is set to unlock structurally higher volumes, lower supply chain risk and better pricing competitiveness, supporting revenue growth and more resilient earnings.

- Growing demand for affordable, branded soft drinks in emerging Muslim-majority markets such as West Africa, the Middle East and Malaysia, combined with Nichols long-standing Vimto brand equity, positions the group to grow international revenues at attractive margins.

- Increasing consumer focus on health and wellness, including rising diabetes incidence in the Middle East, is accelerating the shift toward Zero sugar and functional products like Wonderfuel. This can support mix improvement, higher net margins and enhanced earnings quality.

- The successful implementation of SAP S4 HANA and a broader business transformation agenda is expected to deliver procurement, logistics and working capital efficiencies over the next 5 to 6 years, supporting operating margins and free cash flow generation.

- Diversified growth levers, including innovation in higher-margin U.K. Packaged, the rollout of value formats and kids ranges internationally and disciplined Out of Home optimisation, create multiple routes to pursue the targeted PBT margin of 20%, with potential implications for earnings and dividend capacity.

Assumptions

This narrative explores a more optimistic perspective on Nichols compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

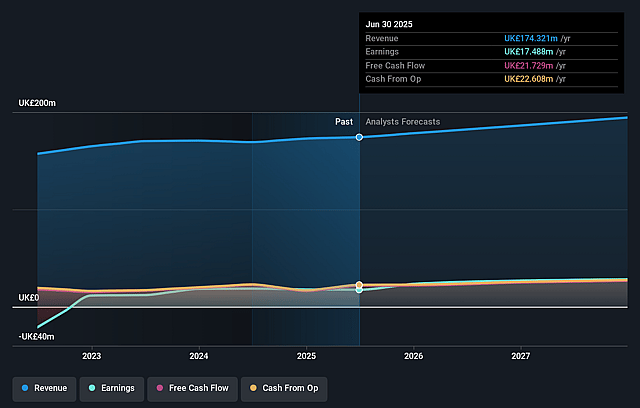

- The bullish analysts are assuming Nichols's revenue will grow by 6.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 10.0% today to 16.0% in 3 years time.

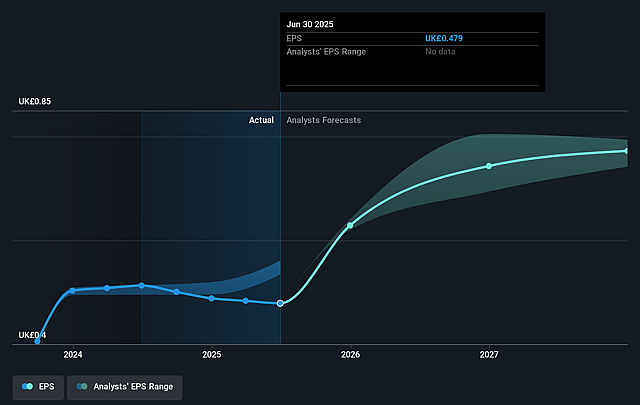

- The bullish analysts expect earnings to reach £33.4 million (and earnings per share of £0.91) by about December 2028, up from £17.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 24.5x on those 2028 earnings, up from 20.1x today. This future PE is greater than the current PE for the GB Beverage industry at 20.4x.

- The bullish analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.07%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Heavy reliance on Ramadan linked consumption in the Middle East and the natural maturation of that market mean long term growth may slow to low single digits. This could make Nichols vulnerable to any disruption in seasonal demand or geopolitical volatility in the region, which would constrain revenue and earnings growth.

- The shift to local concentrate production in West Africa and the planned move of manufacturing back into the U.S.A. increase exposure to partner execution risk, local regulatory change, tariffs and currency availability. Any of these factors could disrupt volumes or delay collections, pressuring revenue and net margins.

- Ambitious expansion into new geographies such as Malaysia and potential future entries like South Africa or deeper moves into Southeast Asia require sustained marketing investment and careful partner selection. If brand traction is slower than expected or partners underperform, the payback period could lengthen, diluting earnings and return on capital.

- Intensifying competition from global beverage majors and large regional players in energy, flavored carbonates and kids ranges can drive higher promotional intensity and limit price increases. Over the long term this may cap pricing power and compress net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Nichols is £18.2, which represents up to two standard deviations above the consensus price target of £14.63. This valuation is based on what can be assumed as the expectations of Nichols's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £18.2, and the most bearish reporting a price target of just £12.5.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be £208.2 million, earnings will come to £33.4 million, and it would be trading on a PE ratio of 24.5x, assuming you use a discount rate of 7.1%.

- Given the current share price of £9.62, the analyst price target of £18.2 is 47.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Nichols?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.