Key Takeaways

- Expansion of local manufacturing, supply chain upgrades, and ERP-driven efficiencies are set to boost margins and diversify growth across emerging and established markets.

- Health-focused innovation and sustainability initiatives position Nichols for increased market share, regulatory alignment, and long-term margin resilience.

- Heavy reliance on core brands, regulatory pressures, and intensified competition threaten Nichols' growth prospects and profitability despite efforts in innovation and international expansion.

Catalysts

About Nichols- Engages in supply of soft drinks to the retail, wholesale, catering, licensed, and leisure industries in the United Kingdom, the Middle East, Africa, and internationally.

- Nichols' rapid rollout of the concentrate production model in West Africa and imminent local manufacturing in Ivory Coast and the U.S.A. are designed to reduce supply chain risk, improve pricing competitiveness, and expand margin-key as per-capita soft drink consumption rises in emerging markets. This supports both future revenue growth and higher operating margins.

- The company's ongoing innovation in low-sugar, functional, and zero-sugar beverages-highlighted by new Wonderfuel functional squashes and Vimto Zero in the Middle East-directly addresses the rising global health consciousness and regulatory shifts, positioning Nichols to capture market share and sustain pricing power, ultimately benefiting revenue and net margins.

- Nichols' focused international expansion (notably in Malaysia and anticipation of Southeast Asian growth) leverages increasing middle-class consumption and e-commerce penetration in emerging markets, laying the groundwork for diversified and robust top-line growth over the medium to long term.

- The successful deployment of a new SAP ERP system initiates a business transformation program aimed at significant cost efficiencies in procurement and supply chain, which are expected to be realized and reinvested over the next 5 years, positively impacting operating margins and long-term earnings.

- Ongoing sustainability initiatives-such as local production reducing transport emissions and double concentrate packaging lowering plastic use-align Nichols with intensifying consumer and regulatory preferences for environmentally responsible products, providing differentiated long-term sales and margin advantages as industry sustainability scrutiny increases.

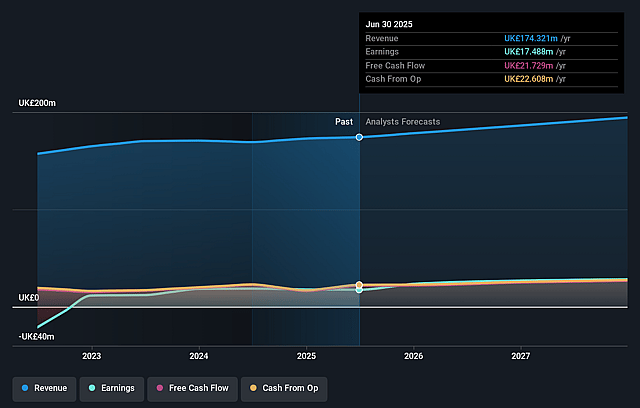

Nichols Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Nichols's revenue will grow by 4.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.0% today to 16.1% in 3 years time.

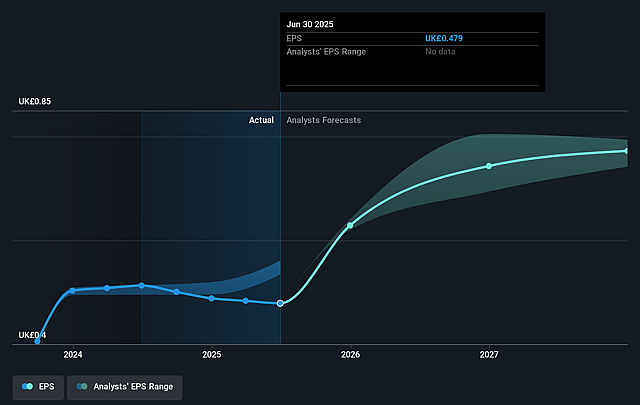

- Analysts expect earnings to reach £32.1 million (and earnings per share of £0.77) by about September 2028, up from £17.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.7x on those 2028 earnings, down from 24.3x today. This future PE is lower than the current PE for the GB Beverage industry at 24.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.82%, as per the Simply Wall St company report.

Nichols Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Nichols remains heavily reliant on the Vimto brand and a handful of core products, exposing the company to risks from changing consumer tastes, increased competition, or potential brand fatigue, which could stagnate or reduce long-term revenues and earnings.

- The company's international expansion strategy, particularly in emerging markets like West Africa, faces risks from supply chain complexity, partner dependency, foreign currency volatility, and political or regulatory changes, all of which can disrupt operations and negatively impact revenue consistency and profit margins.

- There is intensifying competitive pressure in the soft drinks sector from both large-scale players (such as Coca-Cola and Carlsberg Britvic) and health-focused smaller brands, particularly in the flavored carbonate and functional beverage segments, potentially curbing Nichols' market share gains and putting downward pressure on earnings and margins.

- Regulatory and tax pressures (such as sugar taxes and sustainability requirements) are growing globally and in key Nichols markets; while the company is innovating with low/no-sugar products, the success of these initiatives is uncertain, and regulatory compliance and related costs could erode profitability and net margins over time.

- Profit growth has slowed to single-digit levels compared to previous double-digit growth, and revenue reporting is now complicated by lower-value concentrate sales in Africa, which, while potentially margin-neutral, may mask underlying pedestrian growth and fail to meet future investor expectations for robust top-line and bottom-line expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £14.425 for Nichols based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £18.2, and the most bearish reporting a price target of just £12.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £198.6 million, earnings will come to £32.1 million, and it would be trading on a PE ratio of 19.7x, assuming you use a discount rate of 6.8%.

- Given the current share price of £11.6, the analyst price target of £14.42 is 19.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.