Last Update 07 Dec 25

WG.: Sidara Cash Offer And Leadership Shift Will Drive Future Upside

Analysts have raised their price target for John Wood Group, citing a modest improvement in expected long term earnings multiples, which lifts fair value by approximately $0.10 per share.

What's in the News

- Shareholders approved changes to John Wood Group's Articles at court and general meetings on November 17, 2025, clearing the way for implementation of a scheme of arrangement and revised company bylaws (Key Developments).

- The Board has urged investors to accept a 30p per share cash offer from Sidara, valuing the company at about £207 million and including a planned £333 million capital injection, with delisting from the London Stock Exchange expected if the deal completes in the first half of 2026 (Key Developments).

- CEO Ken Gilmartin plans to step down following the shareholder vote on the Sidara transaction, with interim CFO Iain Torrens set to become CEO to oversee the next phase of the company strategy (Key Developments).

- Jade Moore has been appointed Group Chief Financial Officer and will join the Executive Leadership Team from December 1, 2025, bringing extensive experience in restructurings and M&A across multiple sectors (Key Developments).

- A series of special shareholder meetings, scheduled between October and December 2025 in Aberdeen, is being used to secure investor approval for the Sidara transaction and related structural changes (Key Developments).

Valuation Changes

- Fair Value: unchanged at £0.52 per share, reflecting a stable assessment of long term intrinsic value.

- Discount Rate: held steady at 13.19 percent, indicating no change in the risk or required return assumptions.

- Revenue Growth: effectively flat at around 2.67 percent, with only a negligible downward adjustment in the modelled rate.

- Net Profit Margin: broadly unchanged at about 2.28 percent, with only a very small upward refinement to the underlying estimate.

- Future P/E: increased slightly from 5.75x to 5.85x, indicating a modest rise in the multiple applied to projected earnings.

Key Takeaways

- Growth in Operations and Consulting segments, driven by strategic initiatives, is likely to bolster revenue and improve net margins.

- Focus on sustainable solutions and significant contracts, particularly with Aramco, expected to drive long-term revenue growth and profitability.

- Issues in project contracts and accounting might lead to financial restatements, while market weaknesses and regulatory challenges could affect revenue and liquidity.

Catalysts

About John Wood Group- Engages in the provision of consulting, project management, and engineering solutions to energy and built environment worldwide.

- The Operations segment is experiencing strong growth, driven by increased activity across Europe and the Middle East, which is contributing to both revenue and margin expansion. This growth trajectory in Operations is likely to bolster overall revenue and improve net margins.

- Consulting has shown the ability to grow EBITDA despite a weaker top line, thanks to higher pricing and a shift to higher-margin work. This indicates potential for enhanced net margins and earnings through strategic business mix adjustments.

- The company is focused on expanding its sustainable solutions, which now represent a larger portion of the pipeline (46% of the pipeline). As these solutions are in high demand, they are likely to drive future revenue growth and improve margins due to higher value projects.

- The company has secured significant engineering contracts, most notably with Aramco, which will provide a range of engineering services. This major win in a strategic growth region is expected to boost future revenue streams and enhance long-term profitability.

- Simplification programs and other operational efficiencies are on track to deliver significant cost savings, and completed asset disposals are expected to generate substantial cash proceeds, improving cash flow management and potentially enhancing earnings stability.

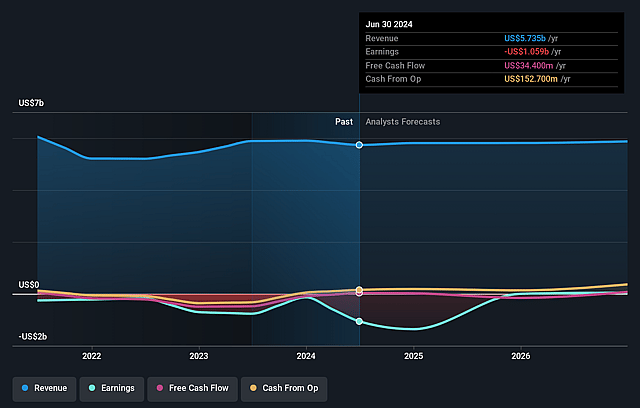

John Wood Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming John Wood Group's revenue will decrease by 0.9% annually over the next 3 years.

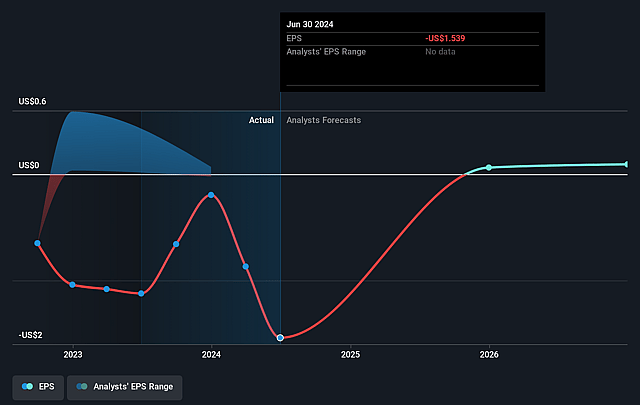

- Analysts assume that profit margins will increase from -18.5% today to 0.7% in 3 years time.

- Analysts expect earnings to reach $41.8 million (and earnings per share of $0.09) by about July 2028, up from $-1.1 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $68 million in earnings, and the most bearish expecting $26 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.5x on those 2028 earnings, up from -0.2x today. This future PE is greater than the current PE for the GB Energy Services industry at 8.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.8%, as per the Simply Wall St company report.

John Wood Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The independent review commissioned by the board, focusing on project contracts, accounting, governance, and controls, could reveal issues that might require financial restatements, impacting earnings and investor confidence.

- The group's EBITDA was down in Q3, particularly due to disappointing performance in Projects, which could affect overall profitability if not resolved.

- A decrease in the group order book by 8% over the year reflects external market weaknesses and the timing of large awards, potentially impacting future revenue streams.

- Potential regulatory delays concerning the sale of EthosEnergy could affect the anticipated cash proceeds and net debt levels, which might strain liquidity and future cash flow projections.

- The hesitancy of clients around regulatory changes in the Consulting division reflects uncertainty in the market, which might impact future top-line growth and revenue stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £0.58 for John Wood Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £0.65, and the most bearish reporting a price target of just £0.49.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $5.9 billion, earnings will come to $41.8 million, and it would be trading on a PE ratio of 18.5x, assuming you use a discount rate of 12.8%.

- Given the current share price of £0.18, the analyst price target of £0.58 is 68.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on John Wood Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.