Last Update25 Sep 25Fair value Increased 1.30%

Shell’s price target has edged up to £30.50 as analysts remain broadly supportive, citing strong growth prospects and a favorable refining outlook despite some concerns about near-term momentum.

Analyst Commentary

- Bullish analysts cited Shell's distinctive mix of growth, resource depth, and sustainable shareholder returns, with medium-term refining outlook becoming increasingly favorable.

- Recent integrated oil and refining sector updates led to upward adjustments in price targets for major stocks like Shell.

- Despite long-term strengths, some bearish analysts flagged expectations of weak momentum for Shell in the coming quarters.

- Minor price target reductions reflected near-term market sensitivities and modest adjustments to valuation models.

- Overall sentiment among major analysts remains supportive, with continued Overweight or Outperform ratings despite target tweaks.

What's in the News

- OPEC+ will increase oil output by 137,000 barrels/day in October 2025 amid concerns over a supply glut and softer prices, impacting major producers including Shell. (The Wall Street Journal, 2025-09-08)

- Shell lost a $1.7 billion arbitration case to Venture Global regarding LNG cargoes, with potential wider financial implications for the sector as similar claims total $7.4 billion. (The Wall Street Journal, 2025-08-13)

- Shell commenced a new share buyback program authorized for up to 10% of its issued share capital (602 million shares), with the repurchase authority expiring in August 2026 or at the next AGM. (Key Developments, 2025-07-31)

- As of July 2025, Shell completed a substantial tranche of its buyback program, repurchasing 101.6 million shares (1.69% of share capital) for $3.5 billion. (Key Developments, 2025-07-31)

- Shell entered a conditional agreement with Libya’s National Oil Corporation to assess and potentially develop the Al-Atshan field, supporting expansion of its upstream portfolio in Libya. (Key Developments, 2025-07-08)

Valuation Changes

Summary of Valuation Changes for Shell

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from £30.10 to £30.50.

- The Consensus Revenue Growth forecasts for Shell has significantly risen from 1.8% per annum to 3.3% per annum.

- The Net Profit Margin for Shell has fallen slightly from 6.93% to 6.76%.

Key Takeaways

- Shell's focus on LNG expansion, operational efficiency, and high-grading its portfolio positions it for resilient revenue growth and stronger returns.

- Strong shareholder rewards and strategic flexibility help ensure stability and investor appeal despite market volatility and global energy shifts.

- Continued weakness in chemicals, slow energy transition, and LNG market risks may undermine long-term profitability, while high shareholder payouts threaten future financial flexibility.

Catalysts

About Shell- Operates as an energy and petrochemical company Europe, Asia, Oceania, Africa, the United States, and other Americas.

- Shell's significant and growing investment in LNG, highlighted by the start-up and ramp-up of LNG Canada and new projects in Egypt and Trinidad & Tobago, positions the company to benefit from steadily rising global energy demand and LNG's role as a transition fuel. This is likely to drive long-term top-line revenue growth and support future earnings as Shell's LNG portfolio expands and gains more trading flexibility in key markets.

- Sustained operational efficiencies-demonstrated by nearly $4 billion in structural cost reductions since 2022, targeted at process transformation rather than portfolio trimming-should continue to drive margin expansion and improve net earnings, especially as further simplification and AI/digitalization are rolled out organization-wide.

- Shell's aggressive high-grading of its portfolio (divestment of non-core assets in Chemicals, Retail, and Renewables, and targeted upstream investments in deepwater and LNG) is redirecting capital to higher-return assets and geographies, underpinning higher operating leverage and future ROIC, and paving the way for more robust and resilient free cash flow.

- The company's strong shareholder returns policy-reflected in ongoing multi-billion-dollar buyback programs and a commitment to distributing 40–50% of cash flow from operations-combined with a solid balance sheet, is set to underpin EPS growth and maintain investor appeal, even in the face of cyclical price downturns.

- Shell is structurally positioned to benefit from long-term underinvestment in global oil and gas supply, which could result in tighter commodity markets and higher pricing, supporting profitability in the upstream segment and cushioning revenue as energy security becomes a renewed priority in Europe and Asia amid ongoing geopolitical risks.

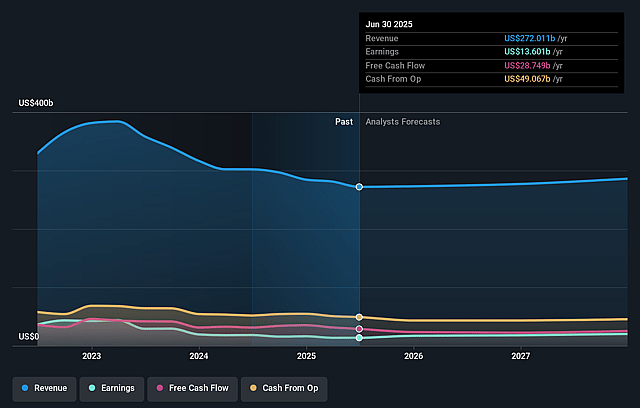

Shell Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Shell's revenue will grow by 1.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.0% today to 6.9% in 3 years time.

- Analysts expect earnings to reach $19.9 billion (and earnings per share of $3.88) by about September 2028, up from $13.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $27.3 billion in earnings, and the most bearish expecting $14.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.7x on those 2028 earnings, down from 15.6x today. This future PE is greater than the current PE for the GB Oil and Gas industry at 11.5x.

- Analysts expect the number of shares outstanding to decline by 5.01% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.43%, as per the Simply Wall St company report.

Shell Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged weak margins and sustained overcapacity in the Chemicals business, exacerbated by heavy supply from China and other regions, have resulted in negative free cash flow and required urgent cost and portfolio interventions, indicating a potential drag on segment profitability and group net margins over the long term.

- The company's continued reliance on oil and gas, with limited near-term detail on successful large-scale low-carbon or renewable energy transitions, exposes Shell to accelerating global decarbonization policies and shifts in energy demand, presenting long-term risks to revenue growth and asset value.

- Contract expiries and the loss of previously advantaged LNG supply contracts, paired with expectations for a more oversupplied LNG market, may limit price and margin upside, putting medium

- to long-term pressure on Integrated Gas revenues and net profit.

- Persistent underperformance or potential asset write-downs in loss-making assets such as Shell Polymers Monaca, divested (but not yet stabilized) sites, and non-core capital employed could result in lower returns on capital, further impacting group earnings and shareholder value.

- Heavy shareholder distributions via buybacks (~46% of cash flow from operations) sustained through balance sheet strength, may become less tenable if macro conditions worsen (e.g., falling oil prices, rising interest/lease costs), compromising funding flexibility and putting long-term dividend and buyback growth at risk.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £30.324 for Shell based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £39.36, and the most bearish reporting a price target of just £27.06.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $286.9 billion, earnings will come to $19.9 billion, and it would be trading on a PE ratio of 12.7x, assuming you use a discount rate of 7.4%.

- Given the current share price of £26.94, the analyst price target of £30.32 is 11.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.