Key Takeaways

- Operational reliability issues and asset maturity threaten production stability, increasing operating costs and pressuring future margins.

- Regulatory uncertainties and shifting government policies risk stifling reserve growth and destabilizing long-term profitability.

- Operational inefficiencies, regulatory risks, dwindling reserves, fiscal pressures, and decarbonization trends threaten Serica's future profitability, asset valuations, and growth prospects.

Catalysts

About Serica Energy- Serica Energy plc, together with its subsidiaries, identifies, acquires, and exploits oil and gas reserves oil in the United Kingdom.

- While Serica Energy stands to benefit from sustained global demand for transitional fuels and a structural need for domestic energy security in the UK, persistent operational reliability issues-particularly at the Triton FPSO-have highlighted weaknesses in maintenance and uptime, creating uncertainty over consistent production delivery and thereby putting pressure on top-line revenue growth.

- Although the company's diverse portfolio and drilling success with short-cycle projects provide a platform for production growth, the inherent maturity of North Sea assets, ongoing natural decline rates of around 15 percent per year, and recurring maintenance backlogs threaten to erode volumes and increase per-barrel operating costs, which could restrict future net margins.

- Despite investments in emissions reduction and advancements in asset optimization, Serica's pivot to new reserve replacement remains at risk from policy-related and regulatory uncertainties, particularly regarding licensing constraints and fiscal regime changes in the UK, which could stifle both organic and inorganic growth opportunities and undermine long-term earnings stability.

- While the strong balance sheet and material tax loss balances offer near-term resilience, elevated headline tax rates, periodic windfall taxes, and potential delays in implementing a more favorable tax regime mean that free cash flow will continue to be vulnerable to sudden changes in government policy-limiting the ability to return capital to shareholders consistently.

- Even as Serica's robust position in decommissioning intensity and technical success with new wells suggest potential for longer asset lives, the company faces the industry-wide challenge of capital reallocation away from hydrocarbons, alongside the risk that contingent resources do not mature into booked reserves quickly enough to offset declines, leaving earnings growth exposed to future reserve write-downs and declining investor appetite for traditional E&P assets.

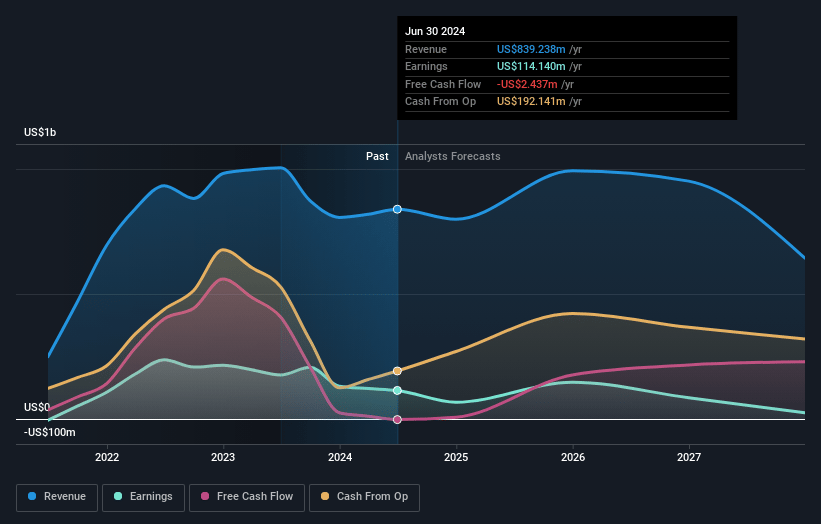

Serica Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Serica Energy compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Serica Energy's revenue will decrease by 4.1% annually over the next 3 years.

- The bearish analysts are not forecasting that Serica Energy will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Serica Energy's profit margin will increase from 12.7% to the average GB Oil and Gas industry of 8.8% in 3 years.

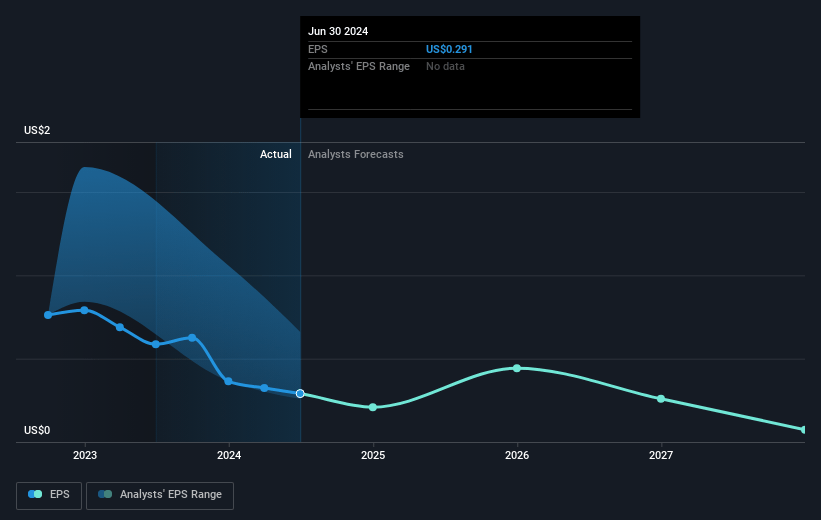

- If Serica Energy's profit margin were to converge on the industry average, you could expect earnings to reach $56.4 million (and earnings per share of $0.15) by about July 2028, down from $92.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 20.8x on those 2028 earnings, up from 9.3x today. This future PE is greater than the current PE for the GB Oil and Gas industry at 10.3x.

- Analysts expect the number of shares outstanding to decline by 1.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.91%, as per the Simply Wall St company report.

Serica Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Serica's asset base in the UK North Sea faces a natural decline rate of about 15% per year and recent performance has been hampered by erratic production and poor operational efficiency, which could lead to ongoing revenue and cash flow contraction if sustained improvements and sufficient new reserves are not delivered.

- The company's inability in 2024 and early 2025 to meet production guidance due to persistent maintenance and equipment issues at the Triton FPSO, as well as past maintenance backlogs, highlights operational risks that could further undermine net margins if uptime is not restored reliably.

- A structural shift in the fiscal environment with headline tax rates now at 78% and the possibility of further windfall taxes or regulatory changes in the UK materially affects profitability, as seen by reduced dividends and management's acknowledgement of a structural shift in profitability, potentially limiting future earnings growth.

- There has been a notable fall in Serica's 2P reserves for the first time in recent years, and although there is a substantial hopper of contingent (2C) resources, their conversion to reserves is uncertain and dependent on both technical and regulatory developments; continued inability to replace reserves fully may lead to reduced asset valuations and diminished long-term earning power.

- Longer-term, macro trends toward decarbonization and the government's proposal to halt new licensing rounds, combined with potential competition for capital and possible delays or barriers to developing assets such as Buchan Horst or Kyle, could constrain Serica's growth and investment returns, negatively impacting revenues and the share price outlook.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Serica Energy is £1.9, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Serica Energy's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £2.85, and the most bearish reporting a price target of just £1.9.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $640.4 million, earnings will come to $56.4 million, and it would be trading on a PE ratio of 20.8x, assuming you use a discount rate of 6.9%.

- Given the current share price of £1.63, the bearish analyst price target of £1.9 is 13.9% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.