Key Takeaways

- Strategic M&A and operational optimizations in the fuels division are projected to boost revenue, reduce costs, and improve margins.

- Expanding storage capacity in the Food division and launching new products in the Feed division aims to drive revenue growth and profitability.

- Reliance on traditional fuels and customer concentration risk threaten future revenues, with additional costs from warehouse delays and unresolved investigations impacting profit margins.

Catalysts

About NWF Group- Primarily engages in the sale and distribution of fuel oils in the United Kingdom.

- The strategic M&A pipeline in the fuels business presents significant growth opportunities, with expectations to integrate acquisitions for increased depot density and cost synergies, which could positively impact future revenues and reduce operational costs.

- Optimization of the commercial sales approach, including the separation of domestic and commercial sales teams and regional routing of fuel deliveries, is expected to improve operational efficiency and boost margins.

- Expansion in the Food division, particularly the successful fit-out and recruitment for the new Lymedale warehouse, positions the company to enhance its storage capacity and customer base, potentially driving higher revenues and improved net margins.

- Initiatives to enhance efficiency in the fuels business, such as reallocating tank fleets and implementing strict geographical delivery areas, are expected to reduce delivery distances and improve net margins through better cost management.

- Introduction of new products like 'moist feed' in the Feed division is positioned to leverage existing customer relationships, providing incremental profit and strengthening earnings growth.

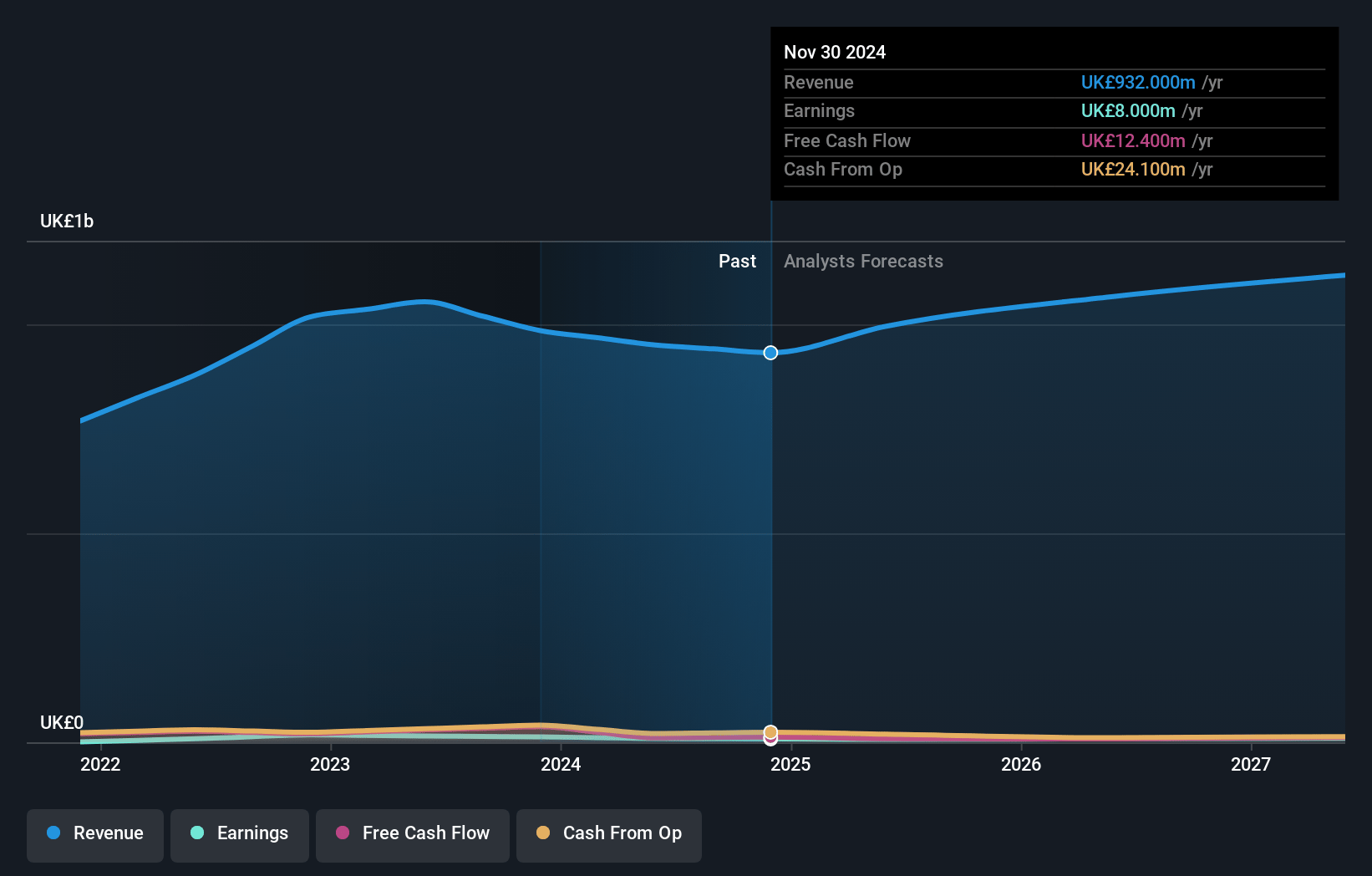

NWF Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NWF Group's revenue will grow by 7.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 0.9% today to 0.8% in 3 years time.

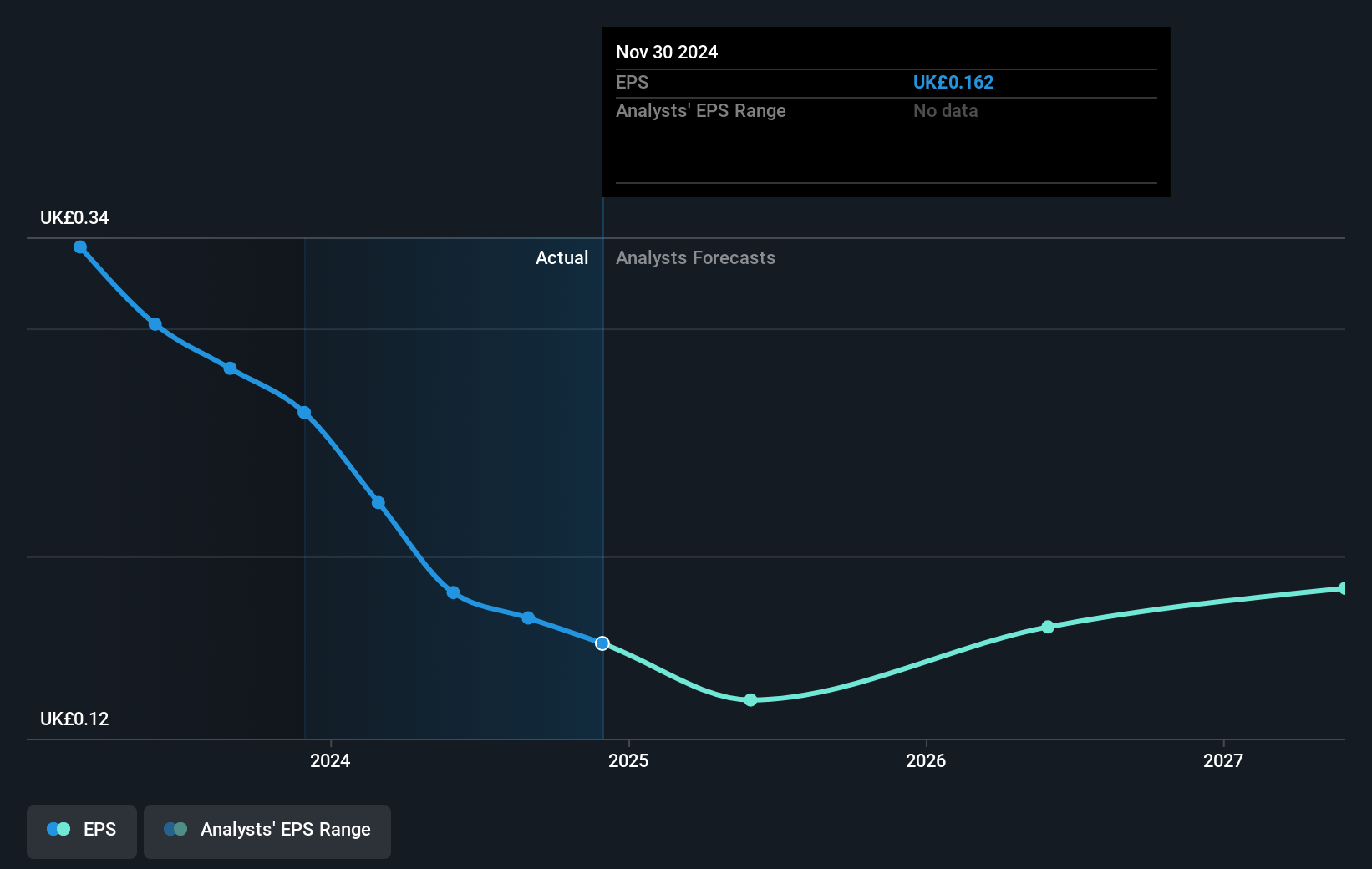

- Analysts expect earnings to reach £9.6 million (and earnings per share of £0.19) by about July 2028, up from £8.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.8x on those 2028 earnings, up from 10.5x today. This future PE is greater than the current PE for the GB Oil and Gas industry at 10.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.56%, as per the Simply Wall St company report.

NWF Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's reliance on the traditional fuels market could pose a risk if the energy transition accelerates, as there is still minimal movement towards biofuels and electric vehicles, potentially impacting future revenues.

- Delays in customer onboarding at the new Lymedale warehouse resulted in unexpected costs, which could affect operating margins if future customer engagements experience similar issues.

- The food division's dependency on a few large customers (albeit below 10% of sales) still poses a concentration risk, which could impact revenue if significant clients are lost.

- The acquisition of family-owned businesses in the fuels sector often encounters unexpected issues, potentially stalling growth plans and affecting expected earnings improvements.

- Currently unresolved investigations related to conflicts of interest in the food business may incur additional costs and affect the overall profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £2.665 for NWF Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £1.2 billion, earnings will come to £9.6 million, and it would be trading on a PE ratio of 16.8x, assuming you use a discount rate of 7.6%.

- Given the current share price of £1.69, the analyst price target of £2.66 is 36.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.